Melrose Mergers and Acquisitions Presentation Deck

Aerospace: overview

Melrose

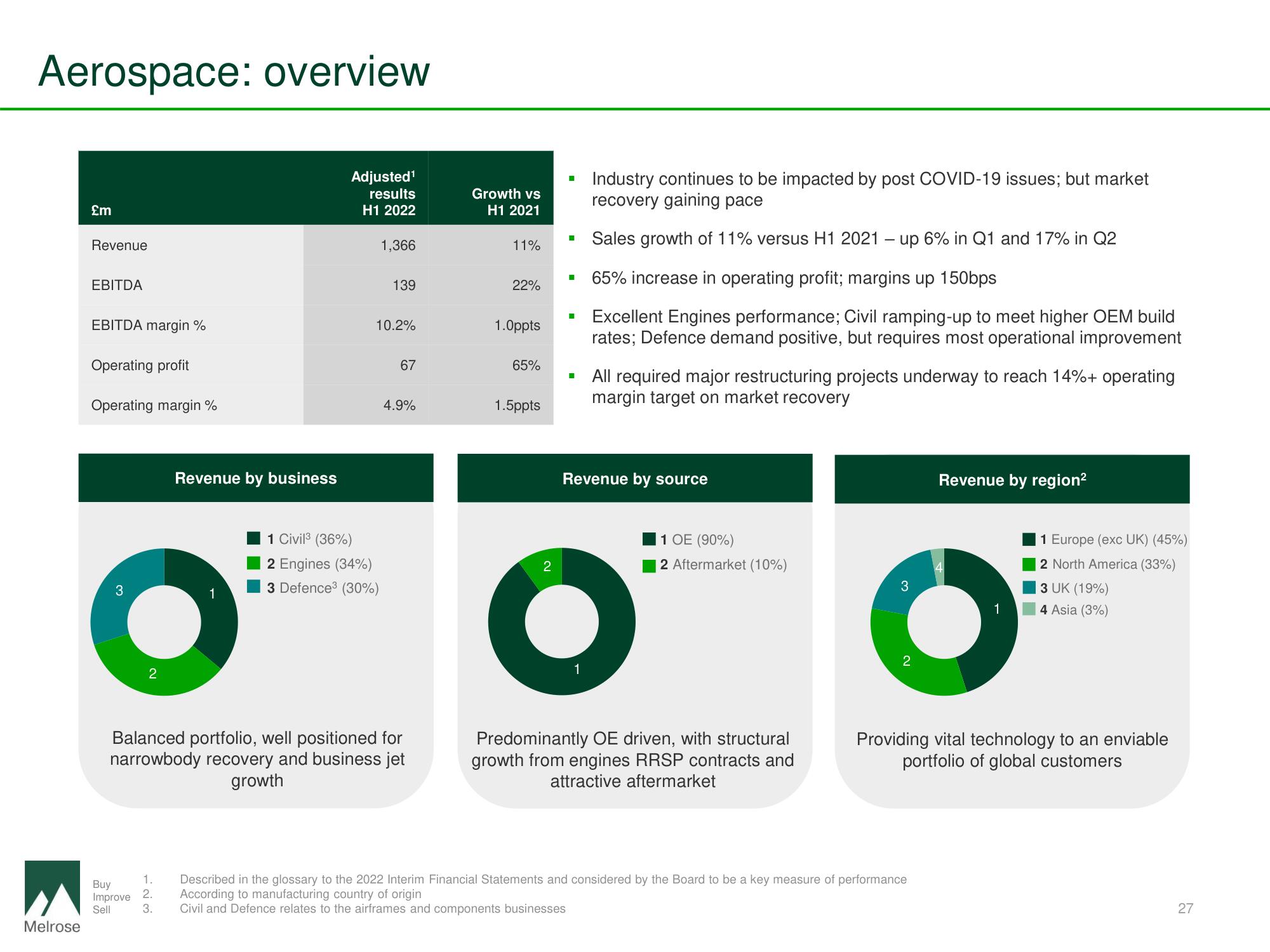

£m

Revenue

EBITDA

EBITDA margin %

Operating profit

Operating margin %

3

2

Buy

Improve

Sell

Revenue by business

1

123

Adjusted¹

results

H1 2022

1,366

1 Civil³ (36%)

2 Engines (34%)

3 Defence³ (30%)

139

10.2%

67

Balanced portfolio, well positioned for

narrowbody recovery and business jet

growth

4.9%

Growth vs

H1 2021

11%

22%

1.0ppts

65%

1.5ppts

■

2

■

Industry continues to be impacted by post COVID-19 issues; but market

recovery gaining pace

Sales growth of 11% versus H1 2021 - up 6% in Q1 and 17% in Q2

65% increase in operating profit; margins up 150bps

Excellent Engines performance; Civil ramping-up to meet higher OEM build

rates; Defence demand positive, but requires most operational improvement

All required major restructuring projects underway to reach 14%+ operating

margin target on market recovery

Revenue by source

●

1

1 OE (90%)

2 Aftermarket (10%)

Predominantly OE driven, with structural

growth from engines RRSP contracts and

attractive aftermarket

3

2

1. Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

According to manufacturing country of origin

3. Civil and Defence relates to the airframes and components businesses

Revenue by region²

1 Europe (exc UK) (45%)

2 North America (33%)

3 UK (19%)

4 Asia (3%)

Providing vital technology to an enviable

portfolio of global customers

27View entire presentation