Hanmi Financial Results Presentation Deck

Residential Real Estate Portfolio

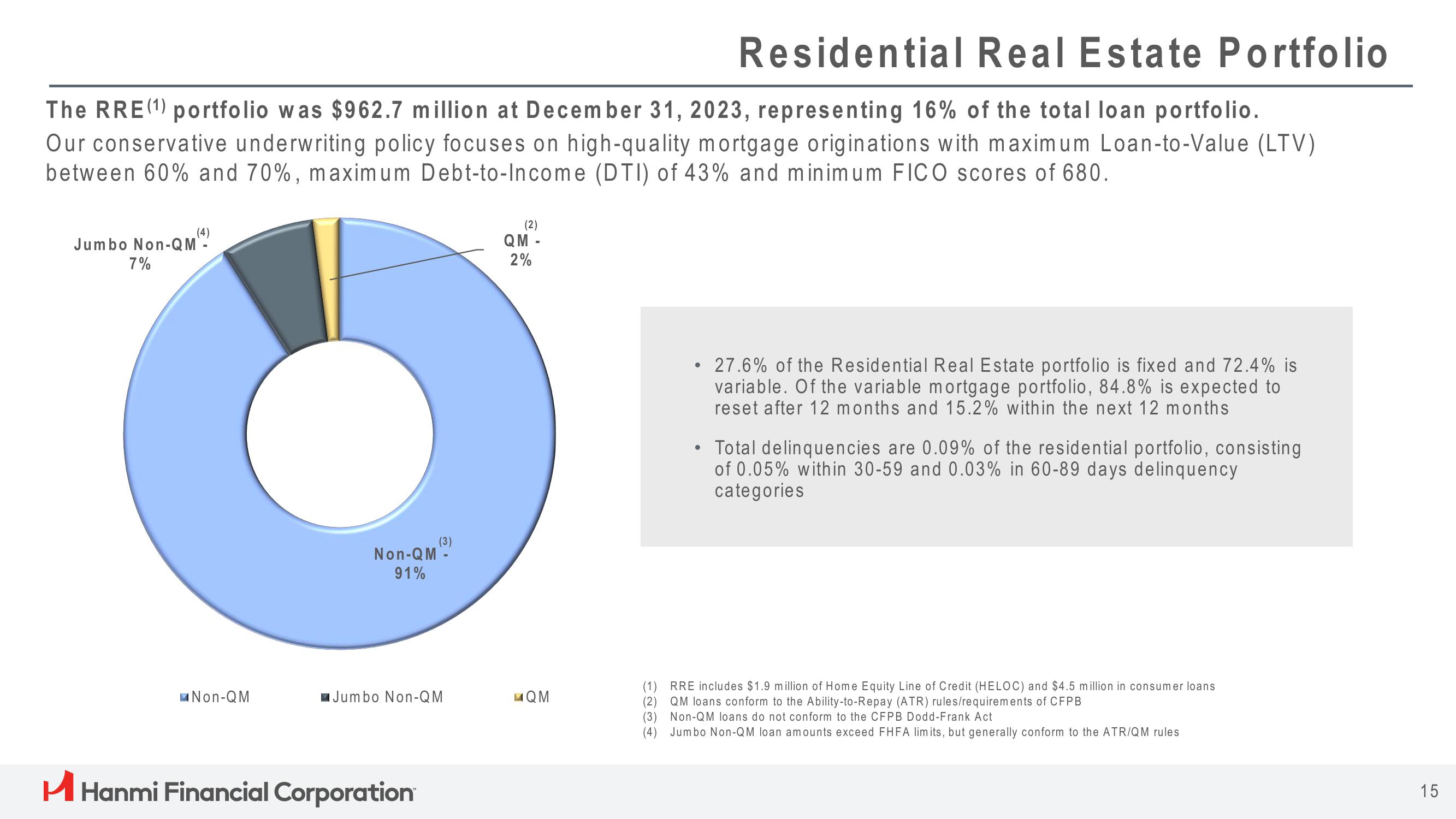

The RRE(¹) portfolio was $962.7 million at December 31, 2023, representing 16% of the total loan portfolio.

Our conservative underwriting policy focuses on high-quality mortgage originations with maximum Loan-to-Value (LTV)

between 60% and 70%, maximum Debt-to-Income (DTI) of 43% and minimum FICO scores of 680.

Jumbo Non-QM¹

7%

Non-QM

Non-QM-

91%

Jumbo Non-QM

H Hanmi Financial Corporation

(2)

QM -

2%

QM

27.6% of the Residential Real Estate portfolio is fixed and 72.4% is

variable. Of the variable mortgage portfolio, 84.8% is expected to

reset after 12 months and 15.2% within the next 12 months

Total delinquencies are 0.09% of the residential portfolio, consisting

of 0.05% within 30-59 and 0.03% in 60-89 days delinquency

categories

(1) RRE includes $1.9 million of Home Equity Line of Credit (HELOC) and $4.5 million in consumer loans

(2) QM loans conform to the Abili to-Repay (ATR) rules/requirements of CFPB

(3) Non-QM loans do not conform to the CFPB Dodd-Frank Act

(4) Jumbo Non-QM loan amounts exceed FHFA limits, but generally conform to the ATR/QM rules

15View entire presentation