Credit Suisse Results Presentation Deck

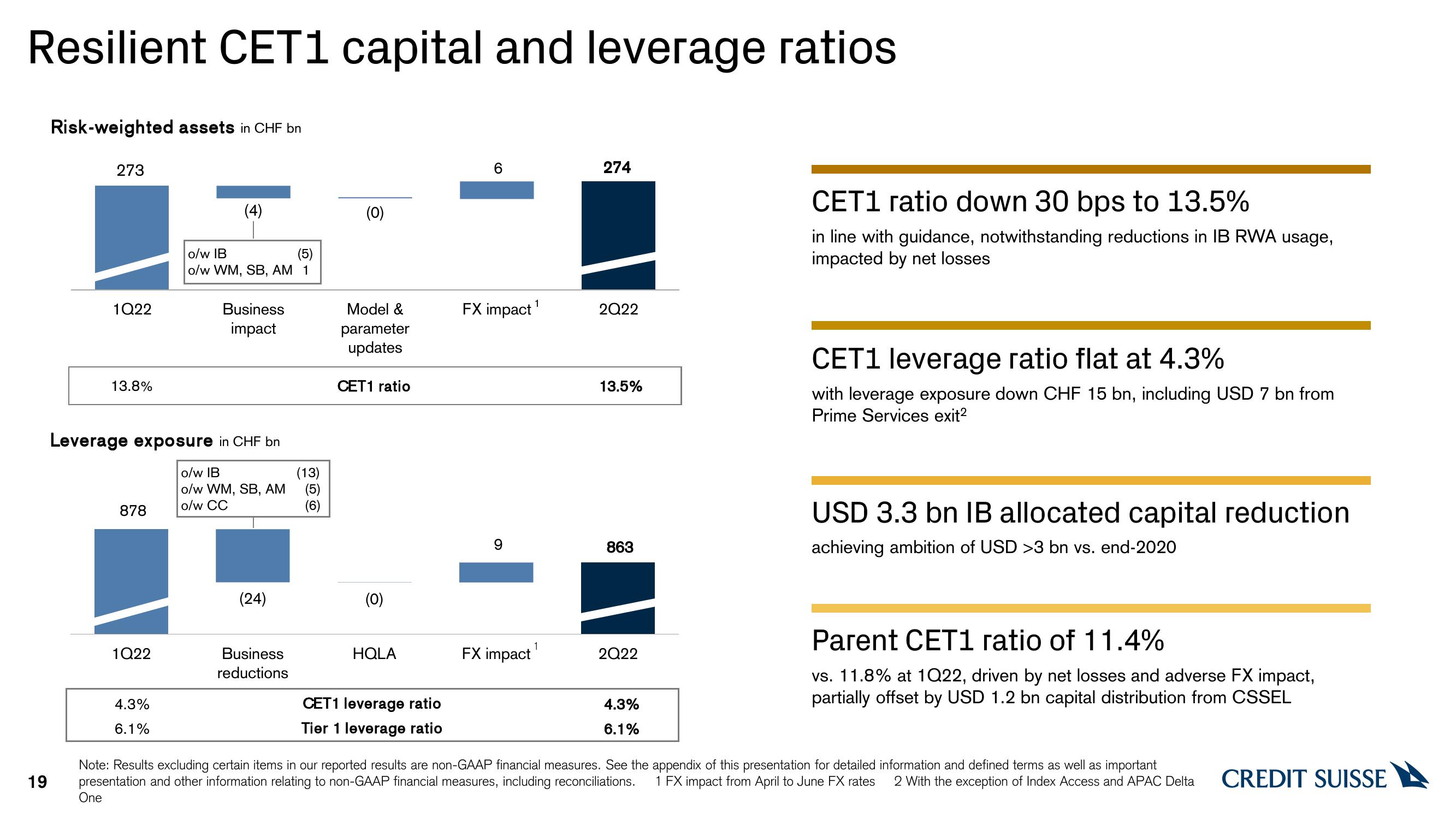

Resilient CET1 capital and leverage ratios

19

Risk-weighted assets in CHF bn

273

1Q22

13.8%

878

1Q22

(4)

Leverage exposure in CHF bn

4.3%

6.1%

o/w IB

(5)

o/w WM, SB, AM 1

Business

impact

o/w IB

o/w WM, SB, AM

o/w CC

(24)

Business

reductions

(13)

(5)

(6)

(0)

Model &

parameter

updates

CET1 ratio

(0)

HQLA

CET1 leverage ratio

Tier 1 leverage ratio

FX impact

9

FX impact

1

1

274

2Q22

13.5%

863

2Q22

4.3%

6.1%

CET1 ratio down 30 bps to 13.5%

in line with guidance, notwithstanding reductions in IB RWA usage,

impacted by net losses

CET1 leverage ratio flat at 4.3%

with leverage exposure down CHF 15 bn, including USD 7 bn from

Prime Services exit²

USD 3.3 bn IB allocated capital reduction

achieving ambition of USD >3 bn vs. end-2020

Parent CET1 ratio of 11.4%

vs. 11.8% at 1Q22, driven by net losses and adverse FX impact,

partially offset by USD 1.2 bn capital distribution from CSSEL

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 FX impact from April to June FX rates 2 With the exception of Index Access and APAC Delta CREDIT SUISSE

OneView entire presentation