First Quarter 2023 Earnings Conference Call

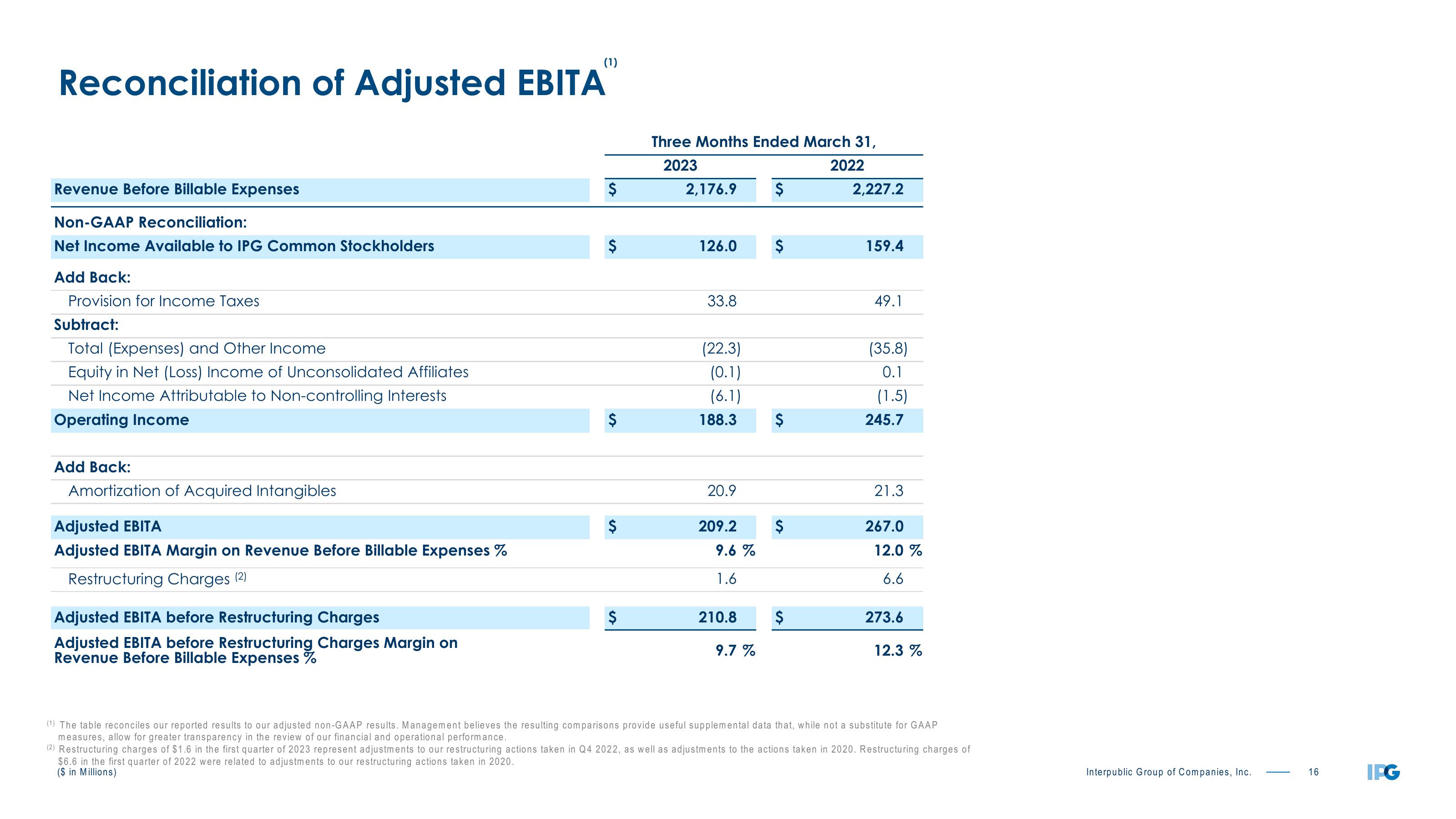

Reconciliation of Adjusted EBITA

Revenue Before Billable Expenses

Non-GAAP Reconciliation:

Net Income Available to IPG Common Stockholders

Add Back:

Provision for Income Taxes

Subtract:

Total (Expenses) and Other Income

Equity in Net (Loss) Income of Unconsolidated Affiliates

Net Income Attributable to Non-controlling Interests

Operating Income

Add Back:

Amortization of Acquired Intangibles

Adjusted EBITA

Adjusted EBITA Margin on Revenue Before Billable Expenses %

Restructuring Charges (2)

(1)

Adjusted EBITA before Restructuring Charges

Adjusted EBITA before Restructuring Charges Margin on

Revenue Before Billable Expenses %

$

$

$

$

$

Three Months Ended March 31,

2023

2022

2,176.9 $

126.0

33.8

(22.3)

(0.1)

(6.1)

188.3

20.9

209.2

9.6 %

1.6

210.8

9.7 %

$

$

$

2,227.2

159.4

49.1

(35.8)

0.1

(1.5)

245.7

21.3

267.0

12.0 %

6.6

273.6

12.3 %

(1) The table reconciles our reported results to our adjusted non-GAAP results. Management believes the resulting comparisons provide useful supplemental data that, while not a substitute for GAAP

measures, allow for greater transparency in the review of our financial and operational performance.

(2) Restructuring charges of $1.6 in the first quarter of 2023 represent adjustments to our restructuring actions taken in Q4 2022, as well as adjustments to the actions taken in 2020. Restructuring charges of

$6.6 in the first quarter of 2022 were related to adjustments to our restructuring actions taken in 2020.

($ in Millions)

Interpublic Group of Companies, Inc.

16

IFGView entire presentation