Spring 2023 Solar Industry Update

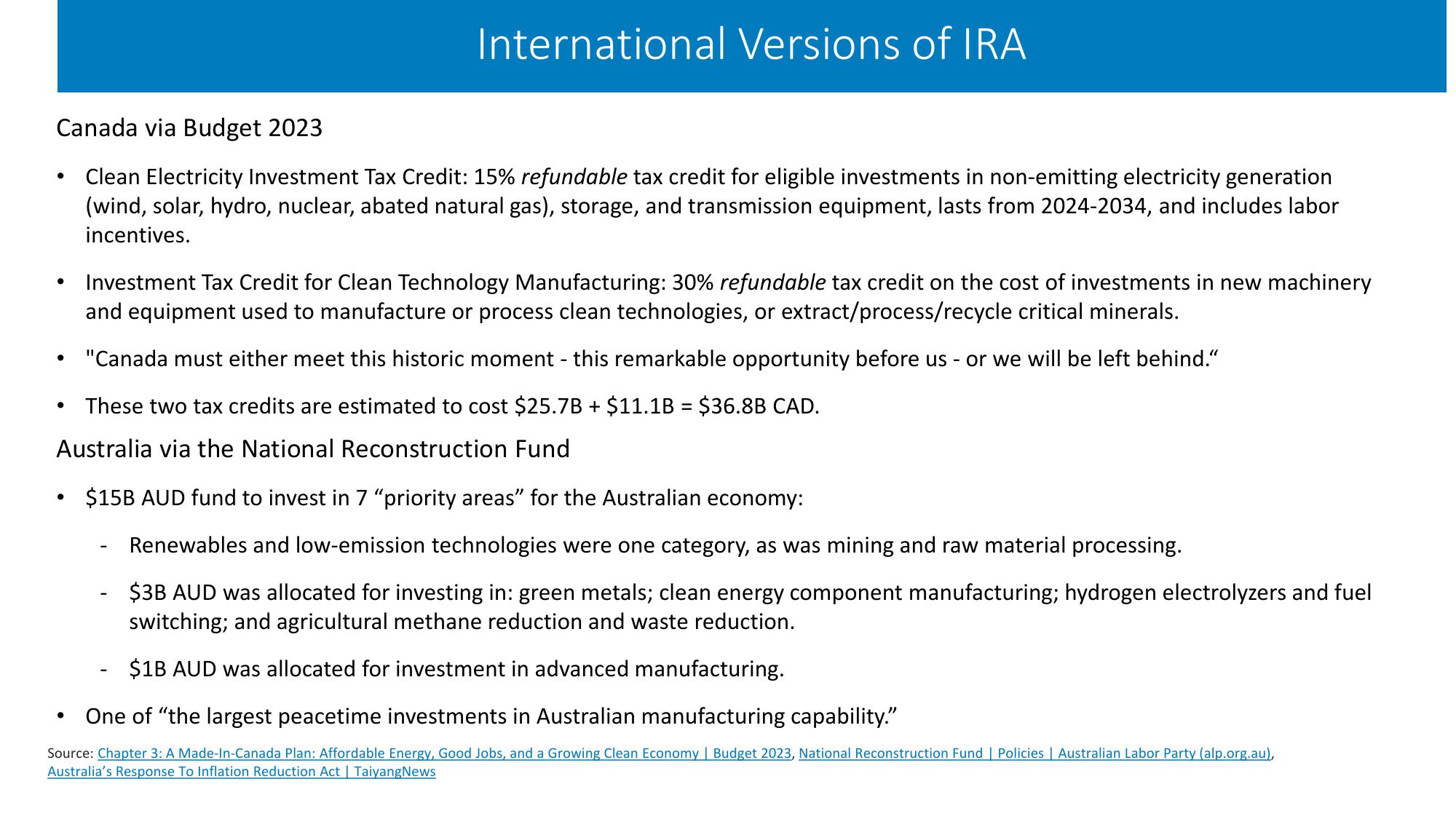

International Versions of IRA

Canada via Budget 2023

•

.

•

Clean Electricity Investment Tax Credit: 15% refundable tax credit for eligible investments in non-emitting electricity generation

(wind, solar, hydro, nuclear, abated natural gas), storage, and transmission equipment, lasts from 2024-2034, and includes labor

incentives.

Investment Tax Credit for Clean Technology Manufacturing: 30% refundable tax credit on the cost of investments in new machinery

and equipment used to manufacture or process clean technologies, or extract/process/recycle critical minerals.

"Canada must either meet this historic moment - this remarkable opportunity before us - or we will be left behind."

•

These two tax credits are estimated to cost $25.7B + $11.1B = $36.8B CAD.

Australia via the National Reconstruction Fund

•

$15B AUD fund to invest in 7 "priority areas" for the Australian economy:

•

Renewables and low-emission technologies were one category, as was mining and raw material processing.

$3B AUD was allocated for investing in: green metals; clean energy component manufacturing; hydrogen electrolyzers and fuel

switching; and agricultural methane reduction and waste reduction.

$1B AUD was allocated for investment in advanced manufacturing.

One of "the largest peacetime investments in Australian manufacturing capability."

Source: Chapter 3: A Made-In-Canada Plan: Affordable Energy, Good Jobs, and a Growing Clean Economy | Budget 2023, National Reconstruction Fund | Policies | Australian Labor Party (alp.org.au),

Australia's Response To Inflation Reduction Act | TaiyangNewsView entire presentation