Inovalon Results Presentation Deck

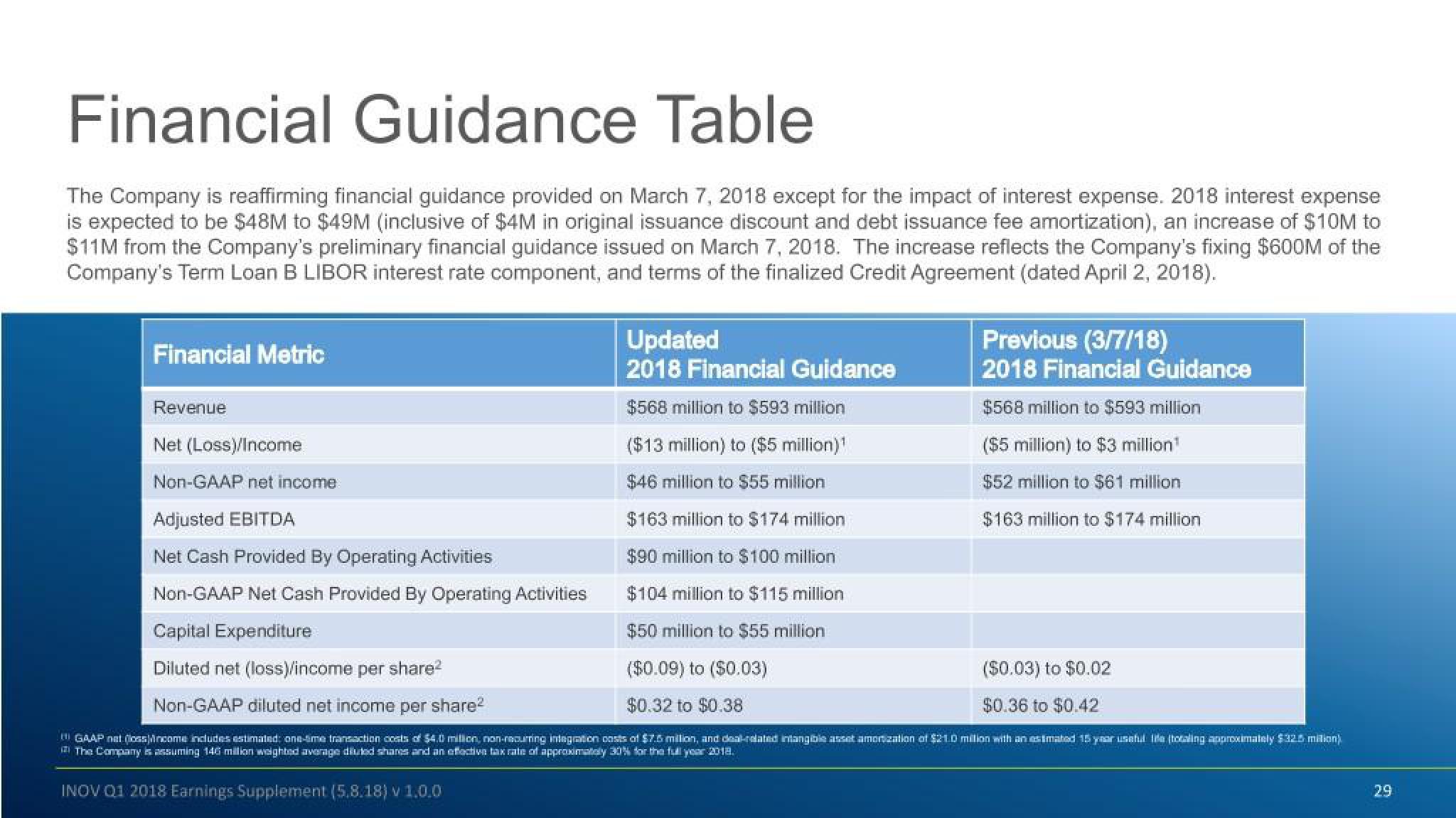

Financial Guidance Table

The Company is reaffirming financial guidance provided on March 7, 2018 except for the impact of interest expense. 2018 interest expense

is expected to be $48M to $49M (inclusive of $4M in original issuance discount and debt issuance fee amortization), an increase of $10M to

$11M from the Company's preliminary financial guidance issued on March 7, 2018. The increase reflects the Company's fixing $600M of the

Company's Term Loan B LIBOR interest rate component, and terms of the finalized Credit Agreement (dated April 2, 2018).

Financial Metric

Updated

2018 Financial Guidance

$568 million to $593 million

($13 million) to ($5 million)¹

$46 million to $55 million

$163 million to $174 million

DAST

$90 million to $100 million

$104 million to $115 million

$50 million to $55 million

Previous (3/7/18)

2018 Financial Guidance

$568 million to $593 million

($5 million) to $3 million¹

$52 million to $61 million

$163 million to $174 million

JUDANDESAM

Revenue

Net (Loss)/Income

Non-GAAP net income

Adjusted EBITDA

Net Cash Provided By Operating Activities

Non-GAAP Net Cash Provided By Operating Activities

Capital Expenditure

Diluted net (loss)/income per share²

($0.03) to $0.02

($0.09) to ($0.03)

$0.32 to $0.38

Non-GAAP diluted net income per share²

$0.36 to $0.42

GAAP net (lossincome includes estimated: one-time transaction costs of $4.0 million, non-neurring integration costs of $7.5 million, and deal-related intangible asset amortization of $21.0 million with an astmated 15 year useful life (totaling approximately $32.5 milion)

The Company is assuming 146 million weighted average diluted shares and an effective tax rate of approximately 30% for the full year 2018.

INOV Q1 2018 Earnings Supplement (5.8.18) v 1.0.0

29View entire presentation