Credit Suisse Investment Banking Pitch Book

CONFIDENTIAL

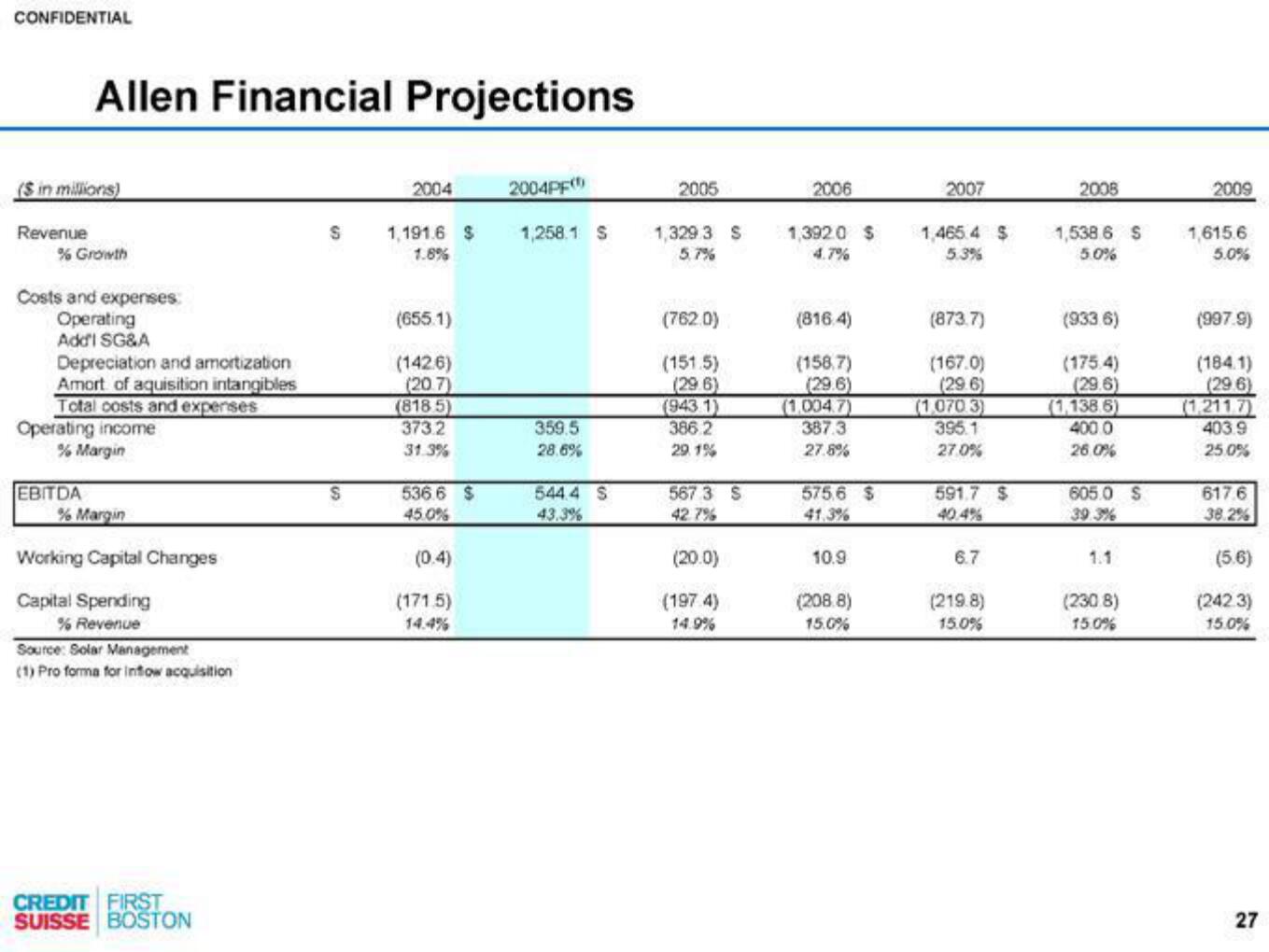

Allen Financial Projections

($ in millions)

Revenue

% Growth

Costs and expenses:

Operating

Add'l SG&A

Depreciation and amortization

Amort of aquisition intangibles

Total costs and expenses

Operating income

% Margin

EBITDA

% Margin

Working Capital Changes

Capital Spending

% Revenue

Source: Solar Management

(1) Pro forma for inflow acquisition

CREDIT FIRST

SUISSE BOSTON

2004

S 1,191.6 S

1.8%

S

(655.1)

(1426)

(20.7)

(818 5)

373.2

31.3%

536.6 $

45.0%

(0.4)

(171.5)

14.4%

2004PF

1,258.1 S

359.5

28.6%

544.4 S

43.3%

2005

1,329 3 S

5.7%

(762.0)

(151.5)

(29.6)

(943 1)

386.2

29.1%

567 3 S

42.7%

(20.0)

(197.4)

14.9%

2006

1,392.0 $

4.7%

(816.4)

(158.7)

(29.6)

(1.004.7)

387.3

27.8%

575.6 $

41.3%

10.9

(208.8)

15.0%

2007

1,465 4 S

5.3%

(873.7)

(167.0)

(29.6)

(1.070.3)

395.1

27.0%

591.7 $

40.4%

6.7

(219.8)

15.0%

2008

1,538 6 S

5.0%

(933 6)

(175.4)

(29.6)

(1,138.6)

400.0

26.0%

605.0 S

39.3%

1.1

(2308)

15.0%

2009

1,615.6

5.0%

(997.9)

(184.1)

(29.6)

(1.211.7)

403.9

25.0%

617.6

38.2%

(5.6)

(242.3)

15.0%

27View entire presentation