Kinnevik Results Presentation Deck

WE HOLD A SIGNIFICANT CASH POSITION, HAVE REDUCED OUR 2020

MATURITIES, AND CONTINUE TO EXECUTE ON OUR CAPITAL ALLOCATION PLAN

■

■

■

■

I

■

Our Financial Position

Capital Structure and Financial Capabilities

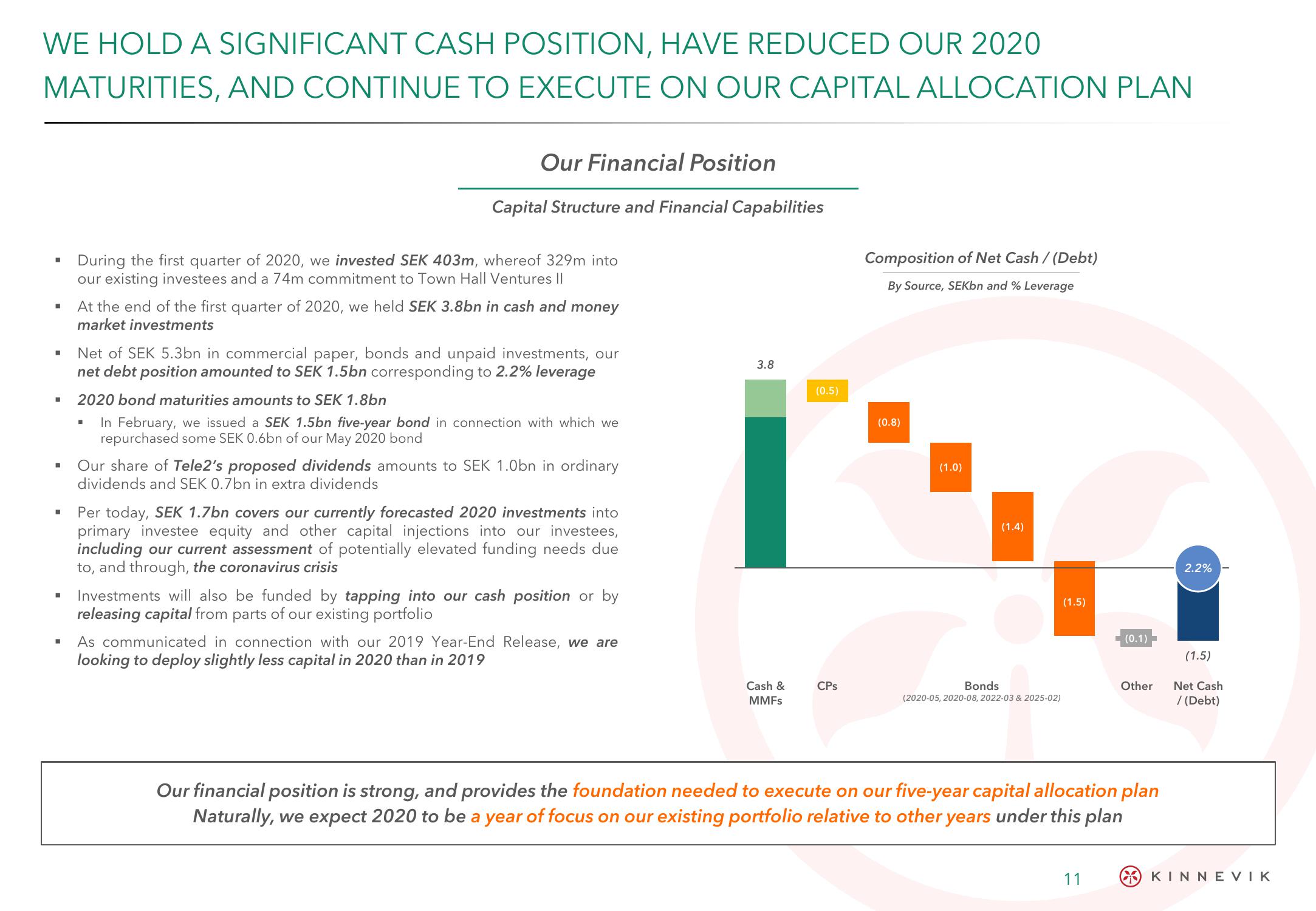

During the first quarter of 2020, we invested SEK 403m, whereof 329m into

our existing investees and a 74m commitment to Town Hall Ventures II

At the end of the first quarter of 2020, we held SEK 3.8bn in cash and money

market investments

Net of SEK 5.3bn in commercial paper, bonds and unpaid investments, our

net debt position amounted to SEK 1.5bn corresponding to 2.2% leverage

2020 bond maturities amounts to SEK 1.8bn

In February, we issued a SEK 1.5bn five-year bond in connection with which we

repurchased some SEK 0.6bn of our May 2020 bond

Our share of Tele2's proposed dividends amounts to SEK 1.0bn in ordinary

dividends and SEK 0.7bn in extra dividends

Per today, SEK 1.7bn covers our currently forecasted 2020 investments into

primary investee equity and other capital injections into our investees,

including our current assessment of potentially elevated funding needs due

to, and through, the coronavirus crisis

Investments will also be funded by tapping into our cash position or by

releasing capital from parts of our existing portfolio

As communicated in connection with our 2019 Year-End Release, we are

looking to deploy slightly less capital in 2020 than in 2019

3.8

Cash &

MMFs

(0.5)

CPs

Composition of Net Cash / (Debt)

By Source, SEKbn and % Leverage

(0.8)

(1.0)

(1.4)

Bonds

(2020-05, 2020-08, 2022-03 & 2025-02)

(1.5)

(0.1)

11

Other

Our financial position is strong, and provides the foundation needed to execute on our five-year capital allocation plan

Naturally, we expect 2020 to be a year of focus on our existing portfolio relative to other years under this plan

2.2%

(1.5)

Net Cash

/ (Debt)

KINNEVIKView entire presentation