Recommendation Report

Hamilton Lane

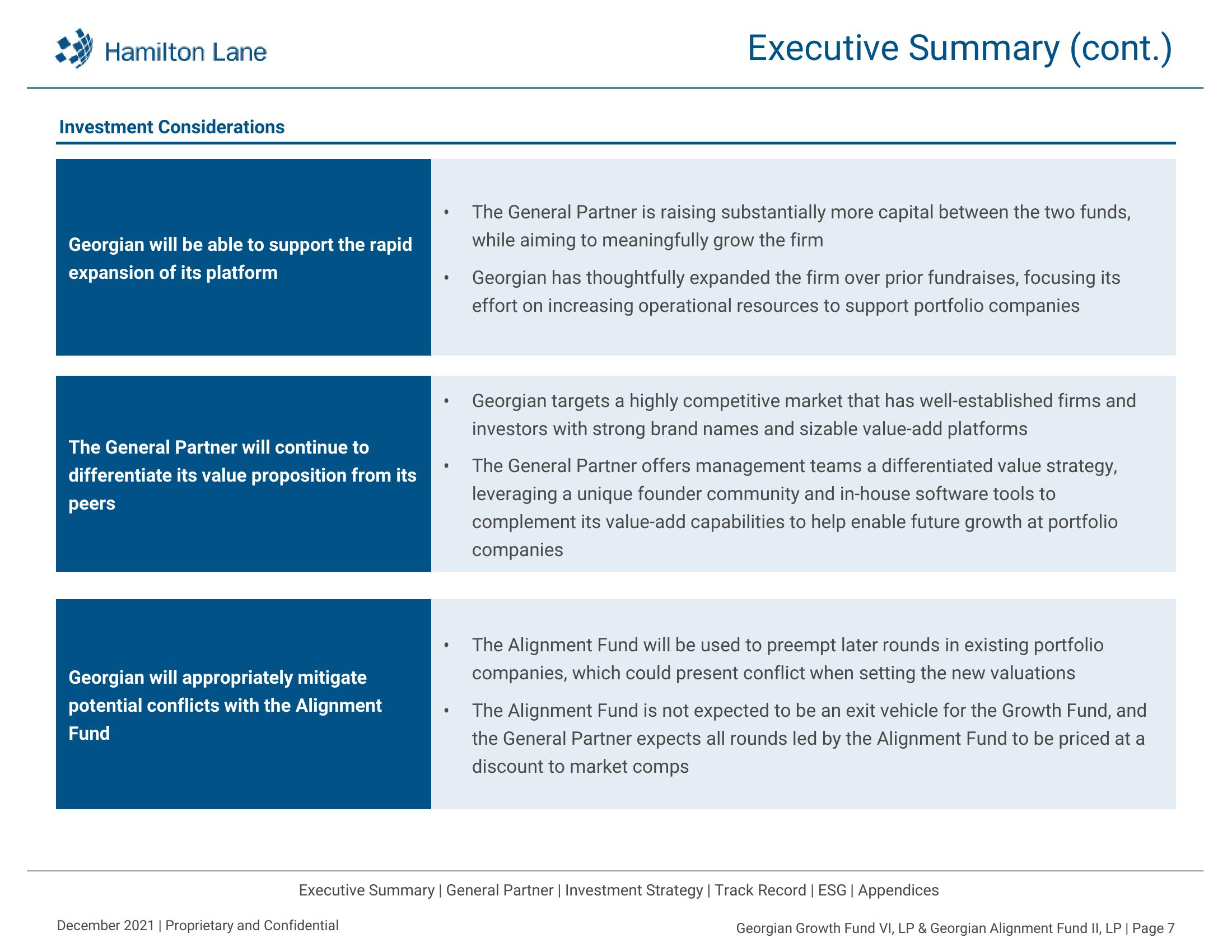

Investment Considerations

Georgian will be able to support the rapid

expansion of its platform

The General Partner will continue to

differentiate its value proposition from its

peers

Georgian will appropriately mitigate

potential conflicts with the Alignment

Fund

●

December 2021 | Proprietary and Confidential

●

Executive Summary (cont.)

The General Partner is raising substantially more capital between the two funds,

while aiming to meaningfully grow the firm

Georgian has thoughtfully expanded the firm over prior fundraises, focusing its

effort on increasing operational resources to support portfolio companies

Georgian targets a highly competitive market that has well-established firms and

investors with strong brand names and sizable value-add platforms

The General Partner offers management teams a differentiated value strategy,

leveraging a unique founder community and in-house software tools to

complement its value-add capabilities to help enable future growth at portfolio

companies

The Alignment Fund will be used to preempt later rounds in existing portfolio

companies, which could present conflict when setting the new valuations

The Alignment Fund is not expected to be an exit vehicle for the Growth Fund, and

the General Partner expects all rounds led by the Alignment Fund to be priced at a

discount to market comps

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

Georgian Growth Fund VI, LP & Georgian Alignment Fund II, LP | Page 7View entire presentation