Acquisition of ECM Industries

Transaction Summary

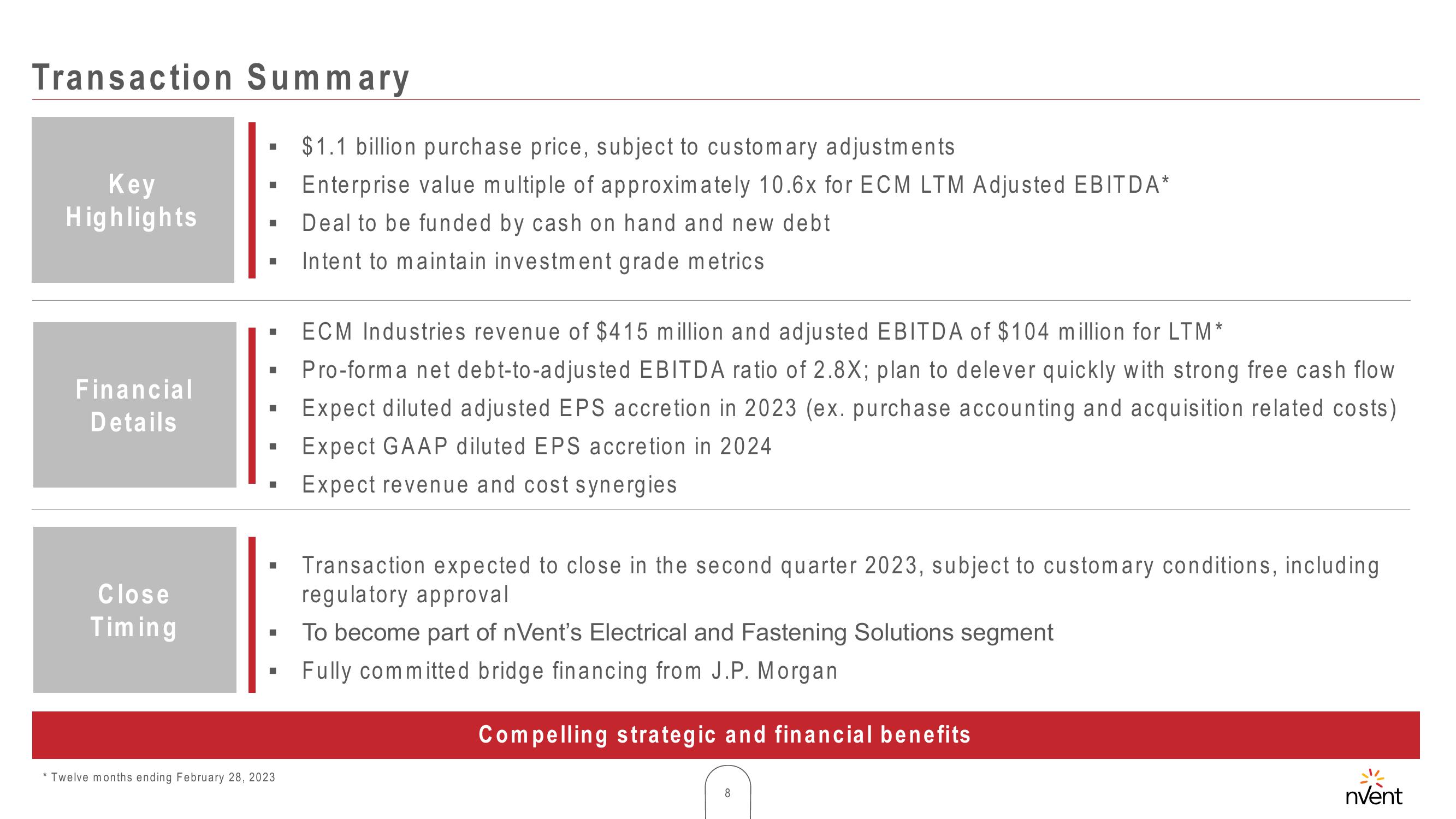

Key

Highlights

Financial

Details

Close

Timing

■

■

■

■

■

* Twelve months ending February 28, 2023

$1.1 billion purchase price, subject to customary adjustments

Enterprise value multiple of approximately 10.6x for ECM LTM Adjusted EBITDA*

Deal to be funded by cash on hand and new debt

Intent to maintain investment grade metrics

ECM Industries revenue of $415 million and adjusted EBITDA of $104 million for LTM*

Pro-forma net debt-to-adjusted EBITDA ratio of 2.8X; plan to delever quickly with strong free cash flow

Expect diluted adjusted EPS accretion in 2023 (ex. purchase accounting and acquisition related costs)

Expect GAAP diluted EPS accretion in 2024

Expect revenue and cost synergies

Transaction expected to close in the second quarter 2023, subject to customary conditions, including

regulatory approval

To become part of nVent's Electrical and Fastening Solutions segment

Fully committed bridge financing from J.P. Morgan

Compelling strategic and financial benefits

nventView entire presentation