OpenText Investor Presentation Deck

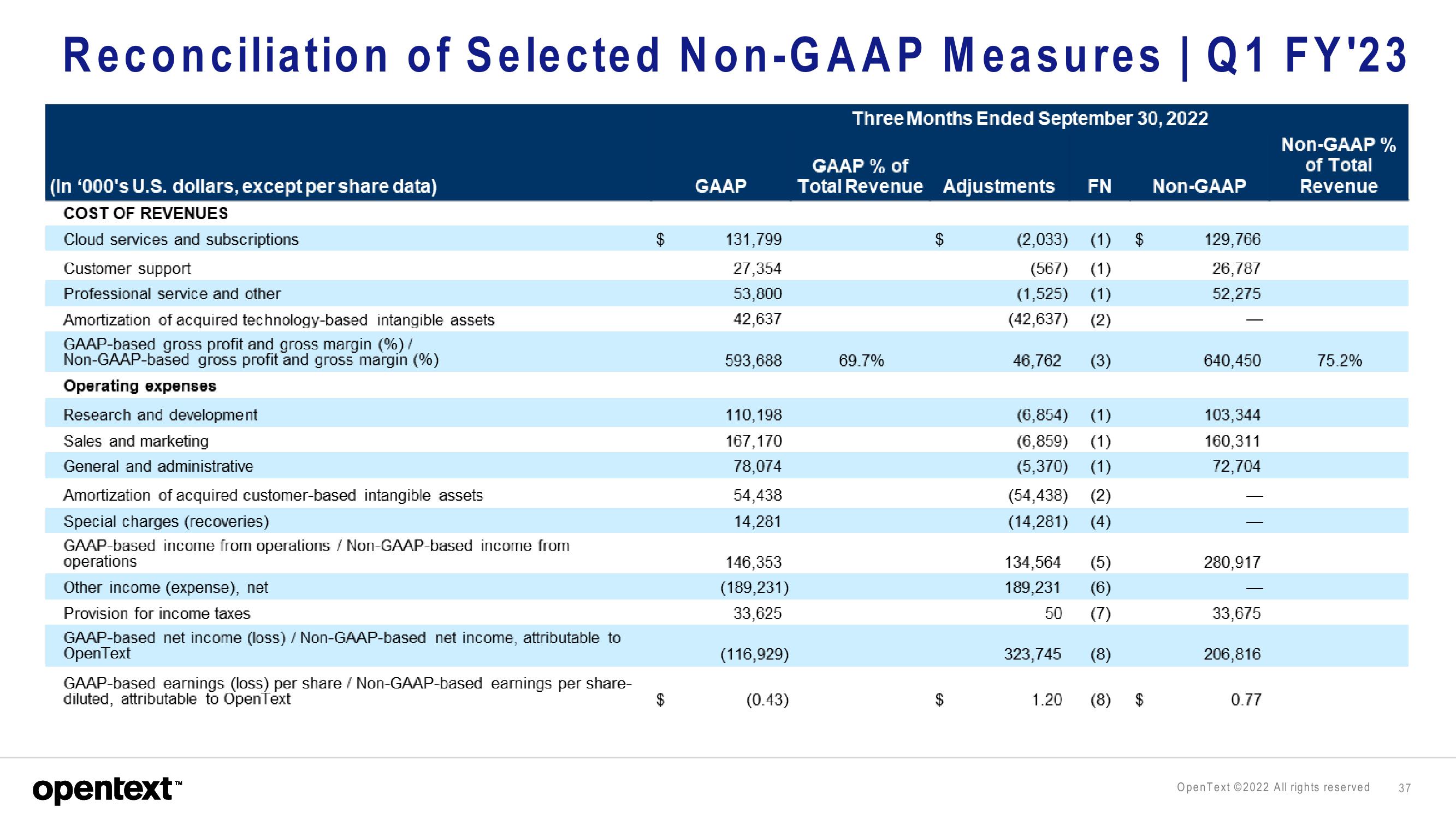

Reconciliation of Selected Non-GAAP Measures | Q1 FY'23

(In '000's U.S. dollars, except per share data)

COST OF REVENUES

Cloud services and subscriptions

Customer support

Professional service and other

Amortization of acquired technology-based intangible assets

GAAP-based gross profit and gross margin (%)/

Non-GAAP-based gross profit and gross margin (%)

Operating expenses

Research and development

Sales and marketing

General and administrative

Amortization of acquired customer-based intangible assets

Special charges (recoveries)

GAAP-based income from operations / Non-GAAP-based income from

operations

Other income (expense), net

Provision for income taxes

GAAP-based net income (loss) / Non-GAAP-based net income, attributable to

OpenText

GAAP-based earnings (loss) per share / Non-GAAP-based earnings per share-

diluted, attributable to OpenText

opentext™

$

GAAP

131,799

27,354

53,800

42,637

593,688

110,198

167,170

78,074

54,438

14,281

146,353

(189,231)

33,625

(116,929)

(0.43)

Three Months Ended September 30, 2022

GAAP % of

Total Revenue Adjustments FN Non-GAAP

69.7%

(2,033) (1) $

(567) (1)

(1,525) (1)

(42,637) (2)

46,762 (3)

(6,854) (1)

(6,859) (1)

(5,370) (1)

(54,438) (2)

(14,281) (4)

134,564 (5)

189,231 (6)

50

(7)

323,745 (8)

1.20 (8)

129,766

26,787

52,275

640,450

103,344

160,311

72,704

280,917

33,675

206,816

0.77

Non-GAAP %

of Total

Revenue

75.2%

OpenText ©2022 All rights reserved

37View entire presentation