Affirm Investor Day Presentation Deck

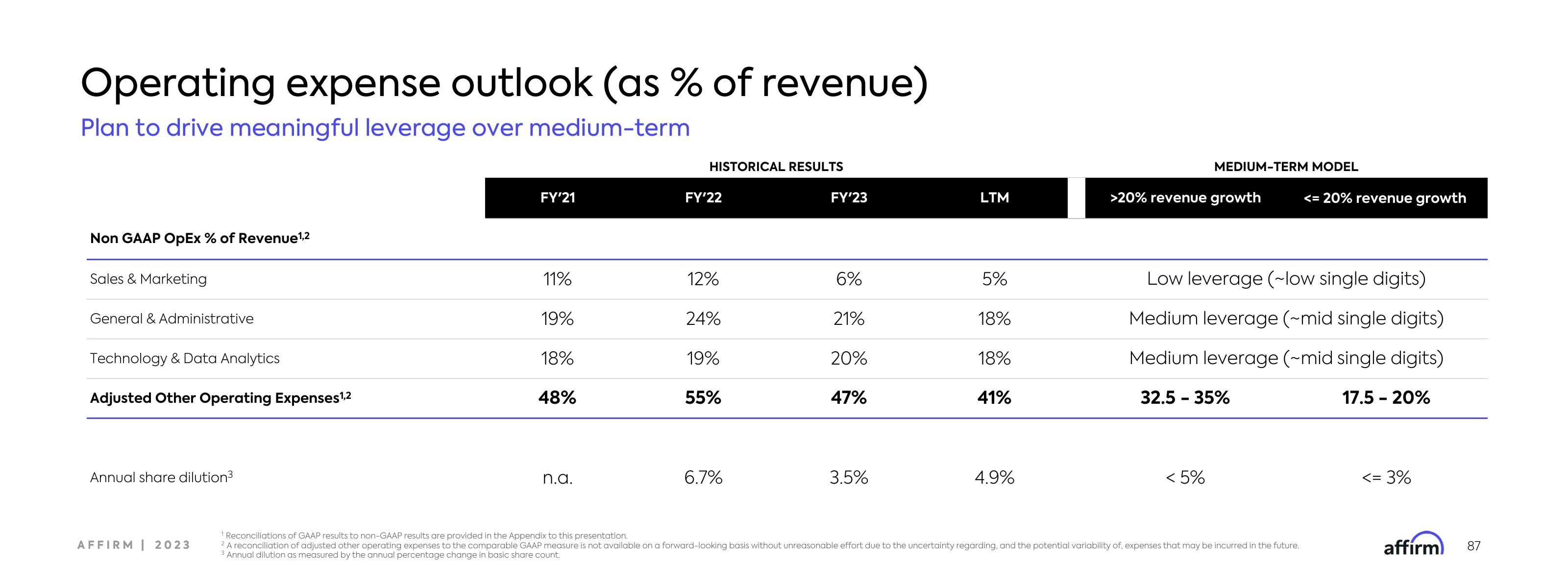

Operating expense outlook (as % of revenue)

Plan to drive meaningful leverage over medium-term

Non GAAP OPEx % of Revenue ¹,2

Sales & Marketing

General & Administrative

Technology & Data Analytics

Adjusted Other Operating Expenses ¹,2

Annual share dilution³

AFFIRM | 2023

FY'21

11%

19%

18%

48%

n.a.

HISTORICAL RESULTS

FY'22

12%

24%

19%

55%

6.7%

FY'23

6%

21%

20%

47%

3.5%

LTM

5%

18%

18%

41%

4.9%

MEDIUM-TERM MODEL

>20% revenue growth

Low leverage (~low single digits)

Medium leverage (~mid single digits)

Medium leverage (~mid single digits)

32.5-35%

< 5%

<= 20% revenue growth

1 Reconciliations of GAAP results to non-GAAP results are provided in the Appendix to this presentation.

2 A reconciliation of adjusted other operating expenses to the comparable GAAP measure is not available on a forward-looking basis without unreasonable effort due to the uncertainty regarding, and the potential variability of, expenses that may be incurred in the future.

3 Annual dilution as measured by the annual percentage change in basic share count.

17.5-20%

<= 3%

affirm

87View entire presentation