Antofagasta Results Presentation Deck

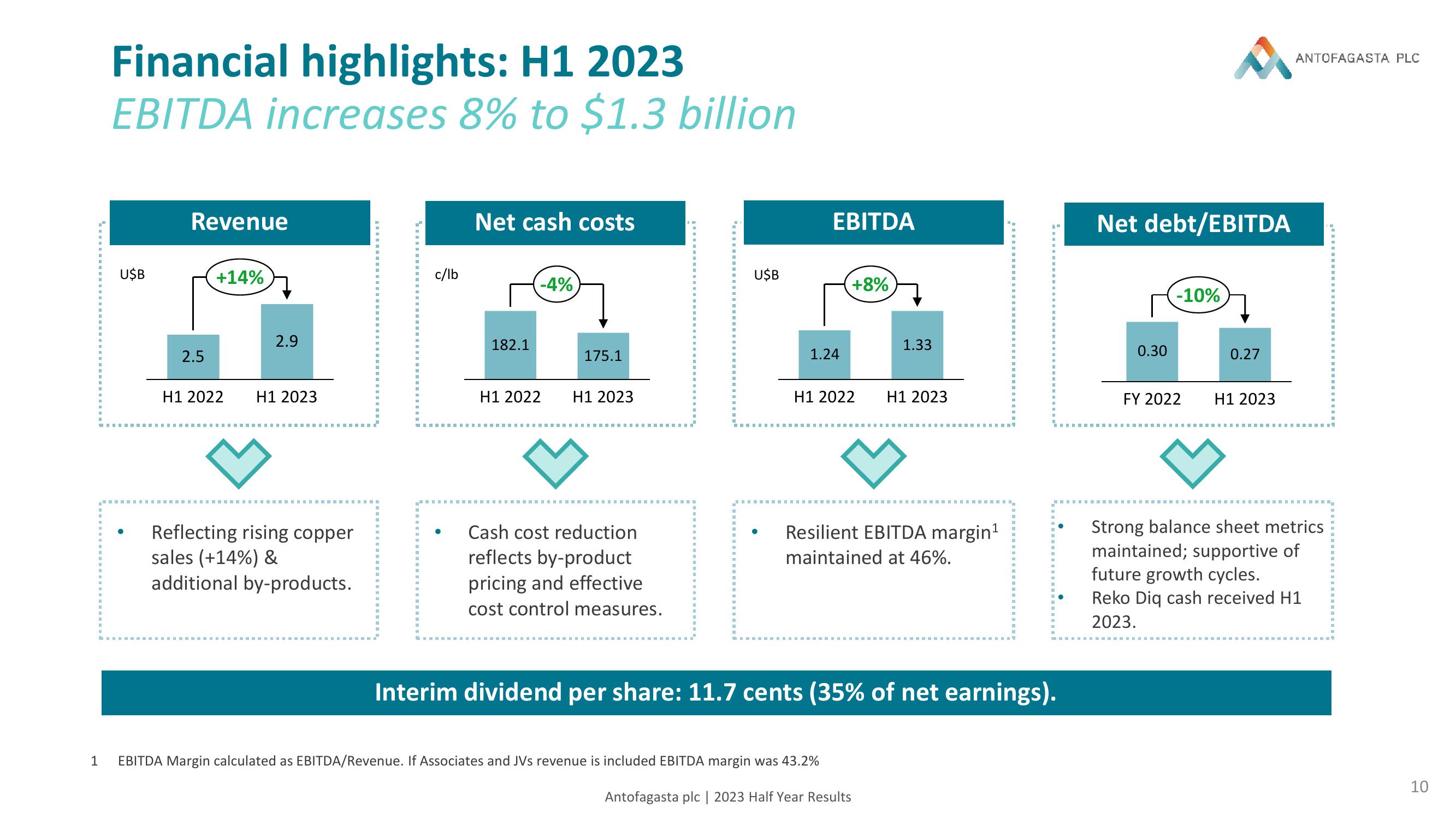

Financial highlights: H1 2023

EBITDA increases 8% to $1.3 billion

U$B

Revenue

2.5

+14%

H1 2022

2.9

H1 2023

‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒

Reflecting rising copper

sales (+14%) &

additional by-products.

c/lb

Net cash costs

‒‒‒‒‒‒‒‒‒‒

●

‒‒‒‒‒‒‒‒‒

182.1

-4%

H1 2022

175.1

H1 2023

‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒

‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒

Cash cost reduction

reflects by-product

pricing and effective

cost control measures.

U$B

EBITDA

1.24

+8%

1.33

H1 2022 H1 2023

‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒

Resilient EBITDA margin¹

maintained at 46%.

1 EBITDA Margin calculated as EBITDA/Revenue. If Associates and JVS revenue is included EBITDA margin was 43.2%

Antofagasta plc | 2023 Half Year Results

Interim dividend per share: 11.7 cents (35% of net earnings).

Net debt/EBITDA

0.30

-10%

FY 2022

‒‒‒‒‒‒‒‒‒

0.27

H1 2023

ANTOFAGASTA PLC

‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒

Strong balance sheet metrics

maintained; supportive of

future growth cycles.

Reko Diq cash received H1

2023.

10View entire presentation