Pershing Square Activist Presentation Deck

D

A Revised Proposal for Creating Value

at McDonald's

Estimated 4-Wall EBITDA Margins

16%

Estimated 4-Wall EBITDA Margin %

12%

8%

4%

0%

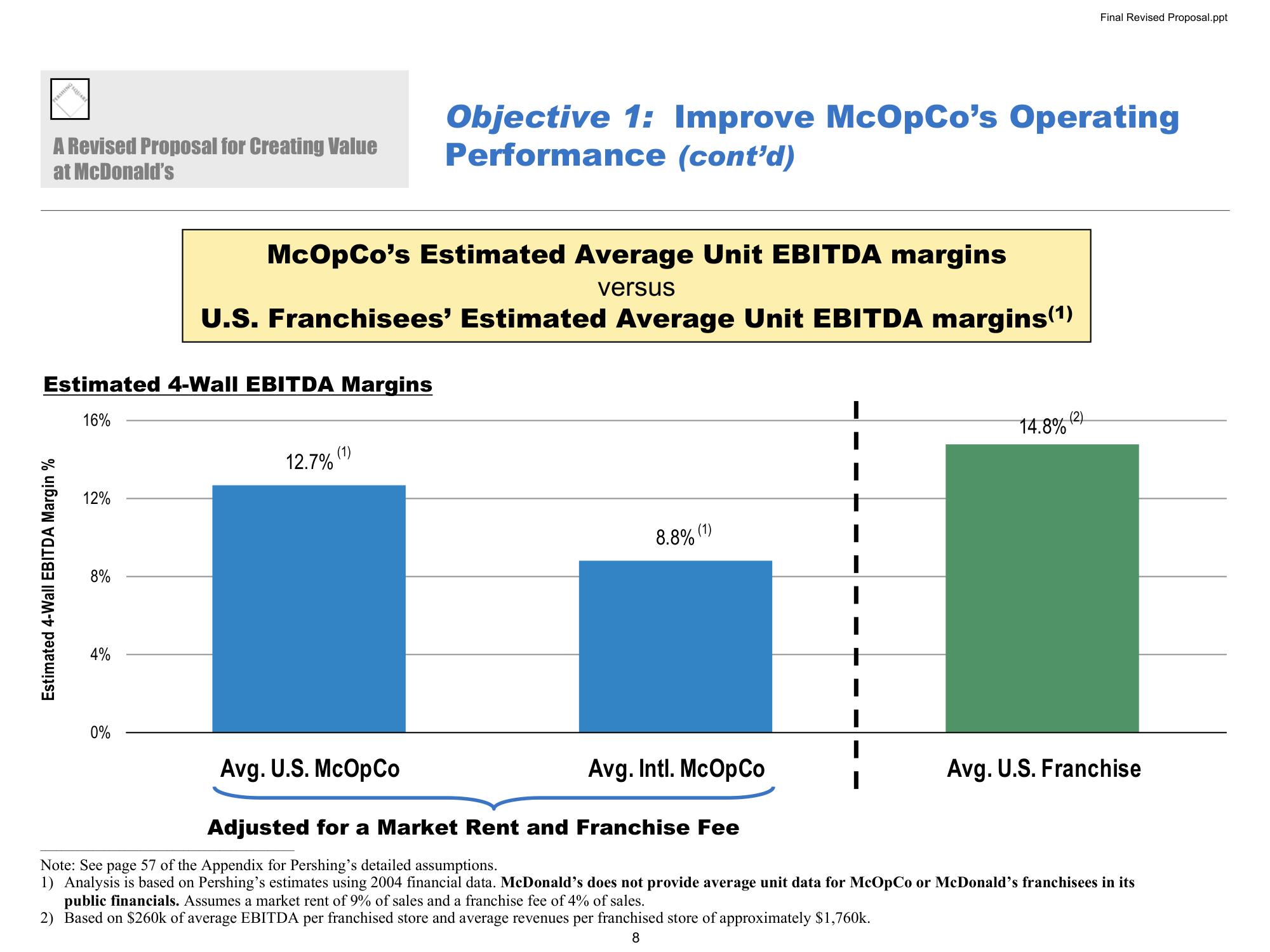

McOpCo's Estimated Average Unit EBITDA margins

versus

U.S. Franchisees' Estimated Average Unit EBITDA margins(¹)

12.7%

(1)

Avg. U.S. McOpCo

Objective 1: Improve McOpCo's Operating

Performance (cont'd)

8.8% (1)

Avg. Intl. McOpCo

Adjusted for a Market Rent and Franchise Fee

I

I

Final Revised Proposal.ppt

14.8% (2)

Avg. U.S. Franchise

Note: See page 57 of the Appendix for Pershing's detailed assumptions.

1) Analysis is based on Pershing's estimates using 2004 financial data. McDonald's does not provide average unit data for McOpCo or McDonald's franchisees in its

public financials. Assumes a market rent of 9% of sales and a franchise fee of 4% of sales.

2) Based on $260k of average EBITDA per franchised store and average revenues per franchised store of approximately $1,760k.

8View entire presentation