Atalaya Risk Management Overview

Case Study: Consumer Installment Loans

Senior secured revolving credit facility to a Canadian

consumer finance company that originates consumer

installment loans at point of sale

Asset Class

Initial Investment

Date

Size

Investment Type

Highlights

Atalaya Edge

Gross IRR

Financial Assets: Consumer Installment Loan

Rediscount Facility

Status

January 2017 (subsequently upsized five times)

CAD 250 million

Senior Secured Rediscount Loan

■ Demonstrated ability to scale without sacrificing

asset performance

Financial sponsor who has demonstrated ability and

desire to fund platform growth

■

✓ Atalaya was able to secure an off-market transaction

via a ROFR provision in the initial deal

✓ Significant experience in point-of-sale installment

lending

Projected -13% Gross IRR¹

Cumulative Charge-Offs (% of Original Loan Balance)

40%

30%

20%

10%

0%

0

18%

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

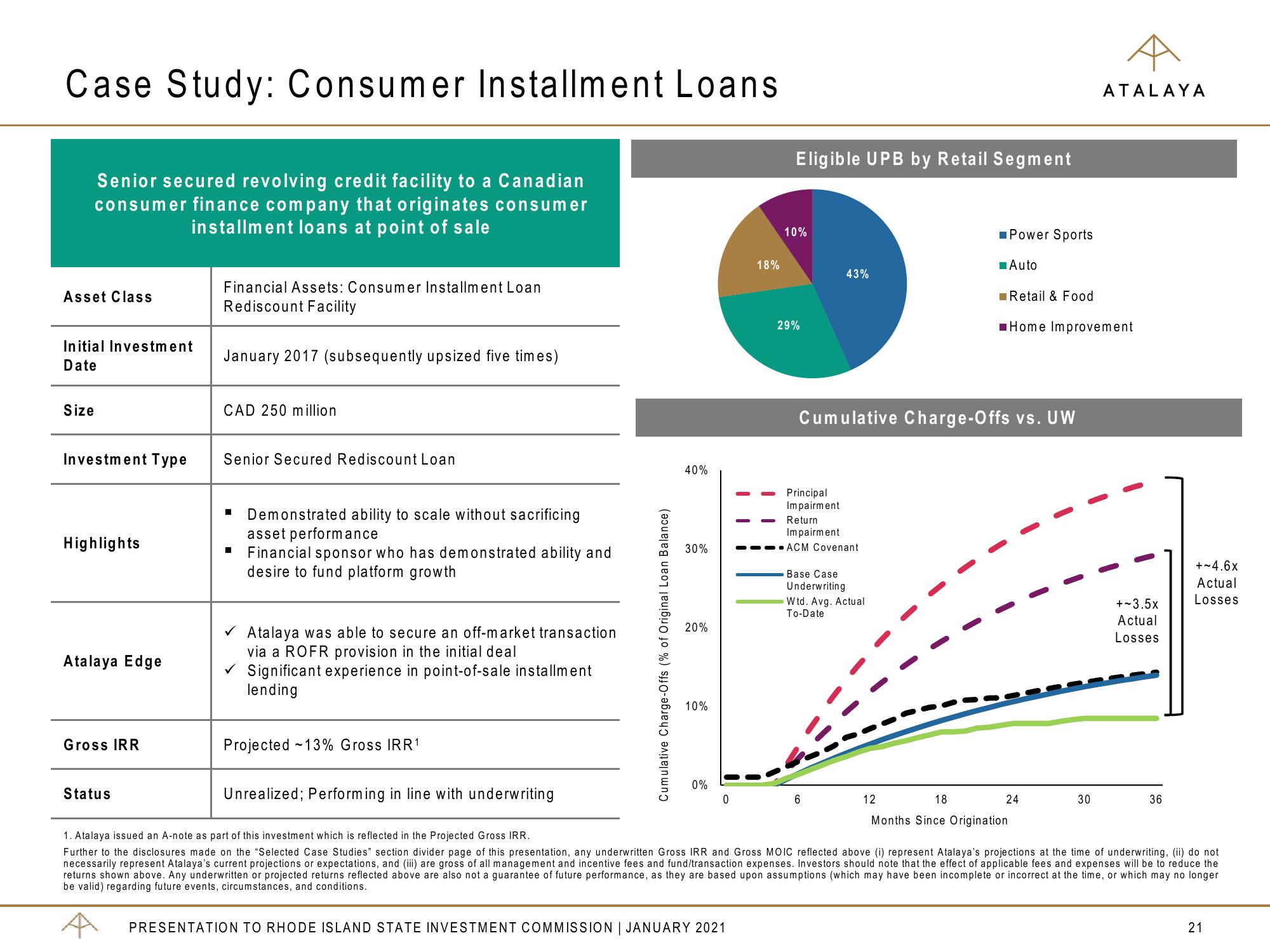

Eligible UPB by Retail Segment

10%

29%

43%

Principal

Impairment

Return

Impairment

ACM Covenant

Cumulative Charge-Offs vs. UW

Base Case

Underwriting

Wtd. Avg. Actual

To-Date

6

■Power Sports

■Auto

Unrealized; Performing in line with underwriting

1. Atalaya issued an A-note as part of this investment which is reflected in the Projected Gross IRR.

Further to the disclosures made on the "Selected Case Studies section divider page of this presentation, any underwritten Gross IRR and Gross MOIC reflected above (i) represent Atalaya's projections at the time of underwriting, (ii) do not

necessarily represent Atalaya's current projections or expectations, and (iii) are gross of all management and incentive fees and fund/transaction expenses. Investors should note that the effect of applicable fees and expenses will be to reduce the

returns shown above. Any underwritten or projected returns reflected above are also not a guarantee of future performance, as they are based upon assumptions (which may have been incomplete or incorrect at the time, or which may no longer

be valid) regarding future events, circumstances, and conditions.

12

18

Months Since Origination

Retail & Food

Home Improvement

ATALAYA

24

30

+-3.5x

Actual

Losses

+~4.6x

Actual

Losses

36

21View entire presentation