About Us

EXPERIENCED LEADERSHIP

RIGHTSIZE & STABILIZE

CULTURE DRIVEN EXECUTION

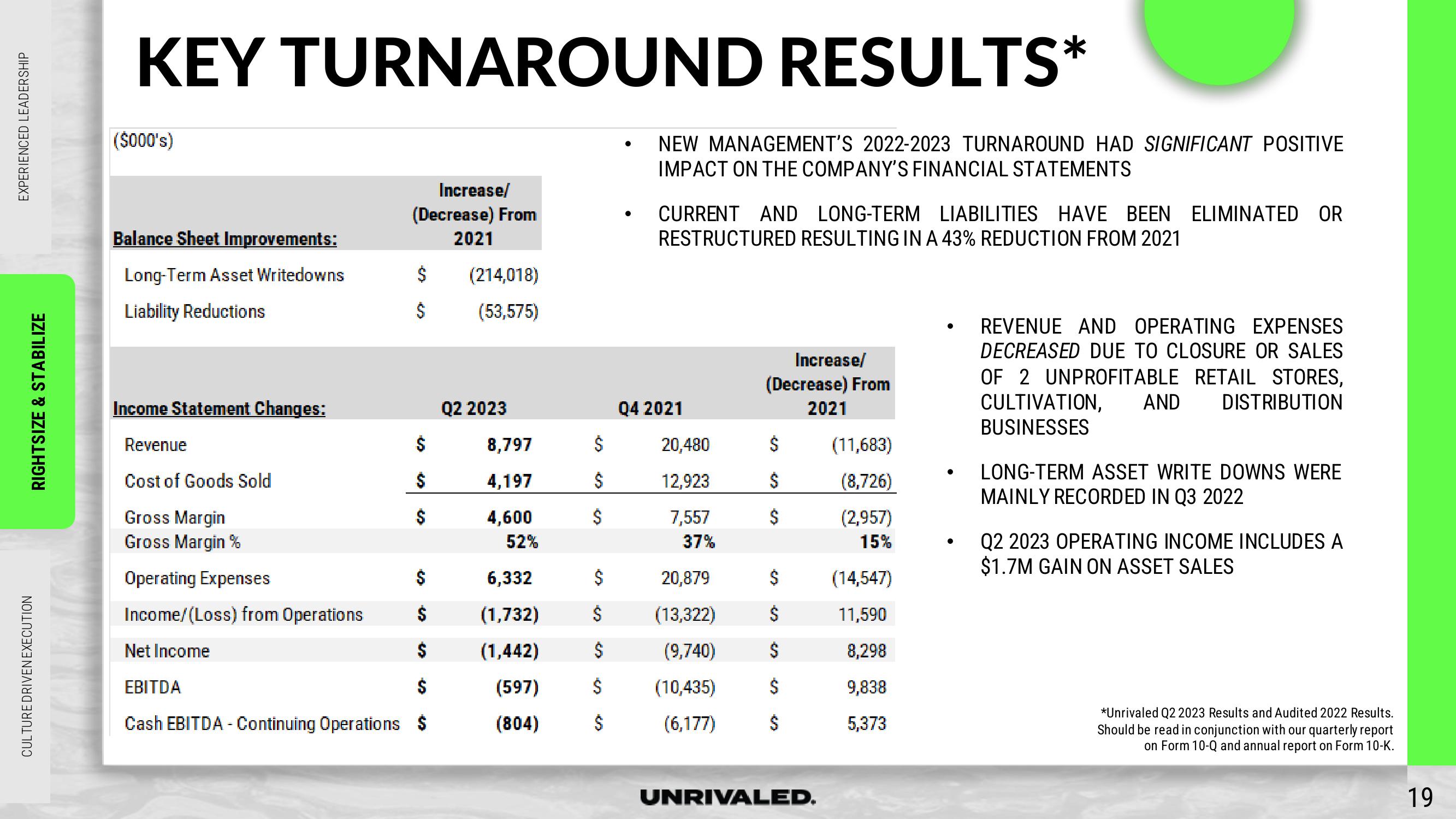

KEY TURNAROUND RESULTS*

($000's)

Balance Sheet Improvements:

Long-Term Asset Writedowns

Liability Reductions

Income Statement Changes:

Revenue

Cost of Goods Sold

Gross Margin

Gross Margin %

Operating Expenses

Income/(Loss) from Operations

Net Income

Increase/

(Decrease) From

2021

to

20

55

$

EBITDA

Cash EBITDA - Continuing Operations $

(214,018)

(53,575)

Q2 2023

8,797

4,197

4,600

52%

6,332

(1,732)

(1,442)

(597)

(804)

Ś

$

$

$

$

Ś

●

●

NEW MANAGEMENT'S 2022-2023 TURNAROUND HAD SIGNIFICANT POSITIVE

IMPACT ON THE COMPANY'S FINANCIAL STATEMENTS

CURRENT AND LONG-TERM LIABILITIES HAVE BEEN ELIMINATED OR

RESTRUCTURED RESULTING IN A 43% REDUCTION FROM 2021

Q4 2021

20,480

12,923

7,557

37%

20,879

(13,322)

(9,740)

(10,435)

(6,177)

Increase/

(Decrease) From

2021

$

$

UNRIVALED.

(11,683)

(8,726)

(2,957)

15%

(14,547)

11,590

8,298

9,838

5,373

●

REVENUE AND OPERATING EXPENSES

DECREASED DUE TO CLOSURE OR SALES

OF 2 UNPROFITABLE RETAIL STORES,

CULTIVATION, AND DISTRIBUTION

BUSINESSES

LONG-TERM ASSET WRITE DOWNS WERE

MAINLY RECORDED IN Q3 2022

Q2 2023 OPERATING INCOME INCLUDES A

$1.7M GAIN ON ASSET SALES

*Unrivaled Q2 2023 Results and Audited 2022 Results.

Should be read in conjunction with our quarterly report

on Form 10-Q and annual report on Form 10-K.

19View entire presentation