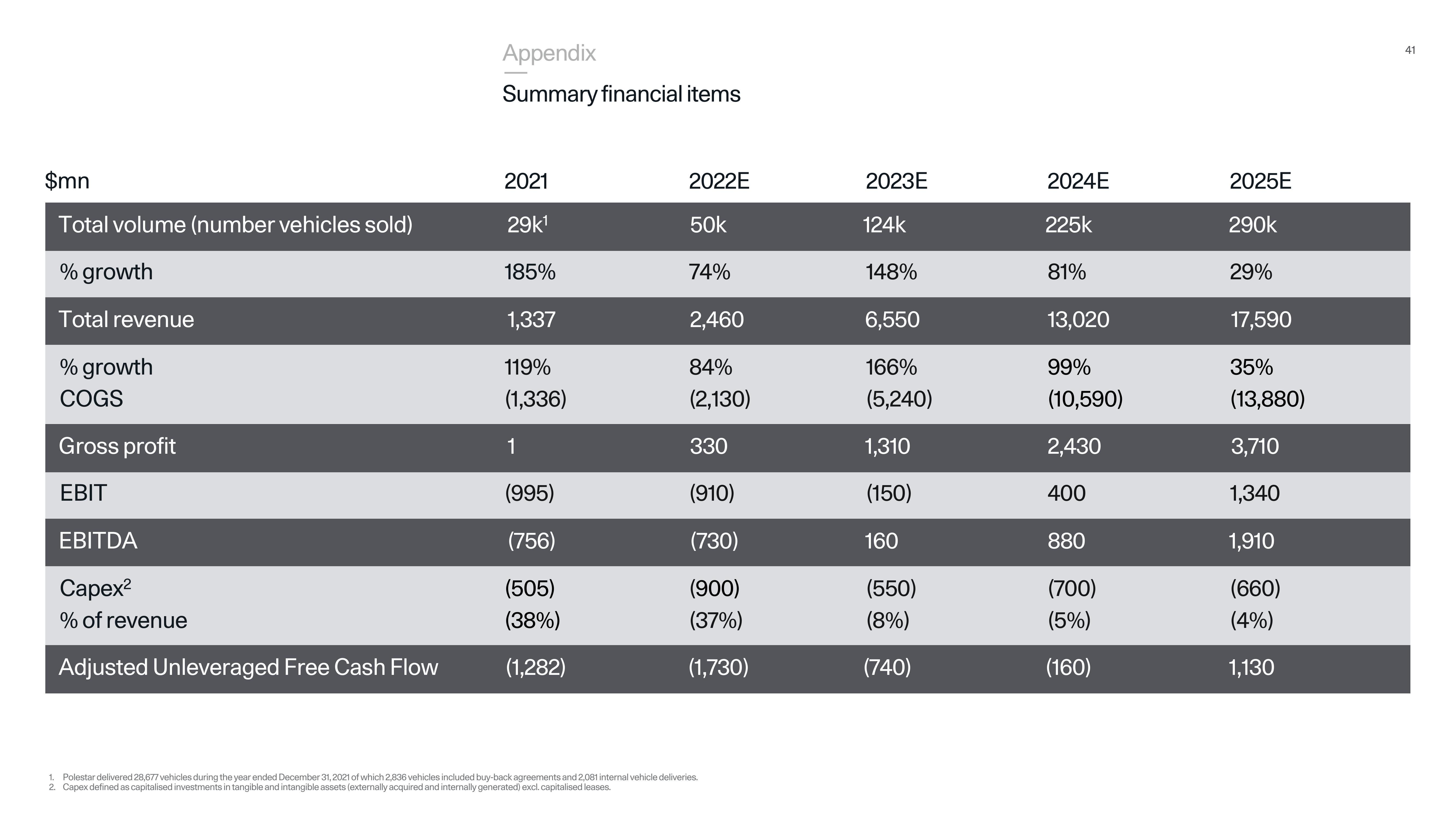

Polestar Investor Presentation Deck

$mn

Total volume (number vehicles sold)

% growth

Total revenue

% growth

COGS

Gross profit

EBIT

EBITDA

Capex2

% of revenue

Adjusted Unleveraged Free Cash Flow

Appendix

Summary financial items

2021

29k¹

185%

1,337

119%

(1,336)

1

(995)

(756)

(505)

(38%)

(1,282)

2022E

50k

74%

2,460

84%

(2,130)

330

(910)

(730)

(900)

(37%)

(1,730)

1. Polestar delivered 28,677 vehicles during the year ended December 31, 2021 of which 2,836 vehicles included buy-back agreements and 2,081 internal vehicle deliveries.

2. Capex defined as capitalised investments in tangible and intangible assets (externally acquired and internally generated) excl. capitalised leases.

2023E

124k

148%

6,550

166%

(5,240)

1,310

(150)

160

(550)

(8%)

(740)

2024E

225k

81%

13,020

99%

(10,590)

2,430

400

880

(700)

(5%)

(160)

2025E

290k

29%

17,590

35%

(13,880)

3,710

1,340

1,910

(660)

(4%)

1,130

41View entire presentation