Verint SPAC Presentation Deck

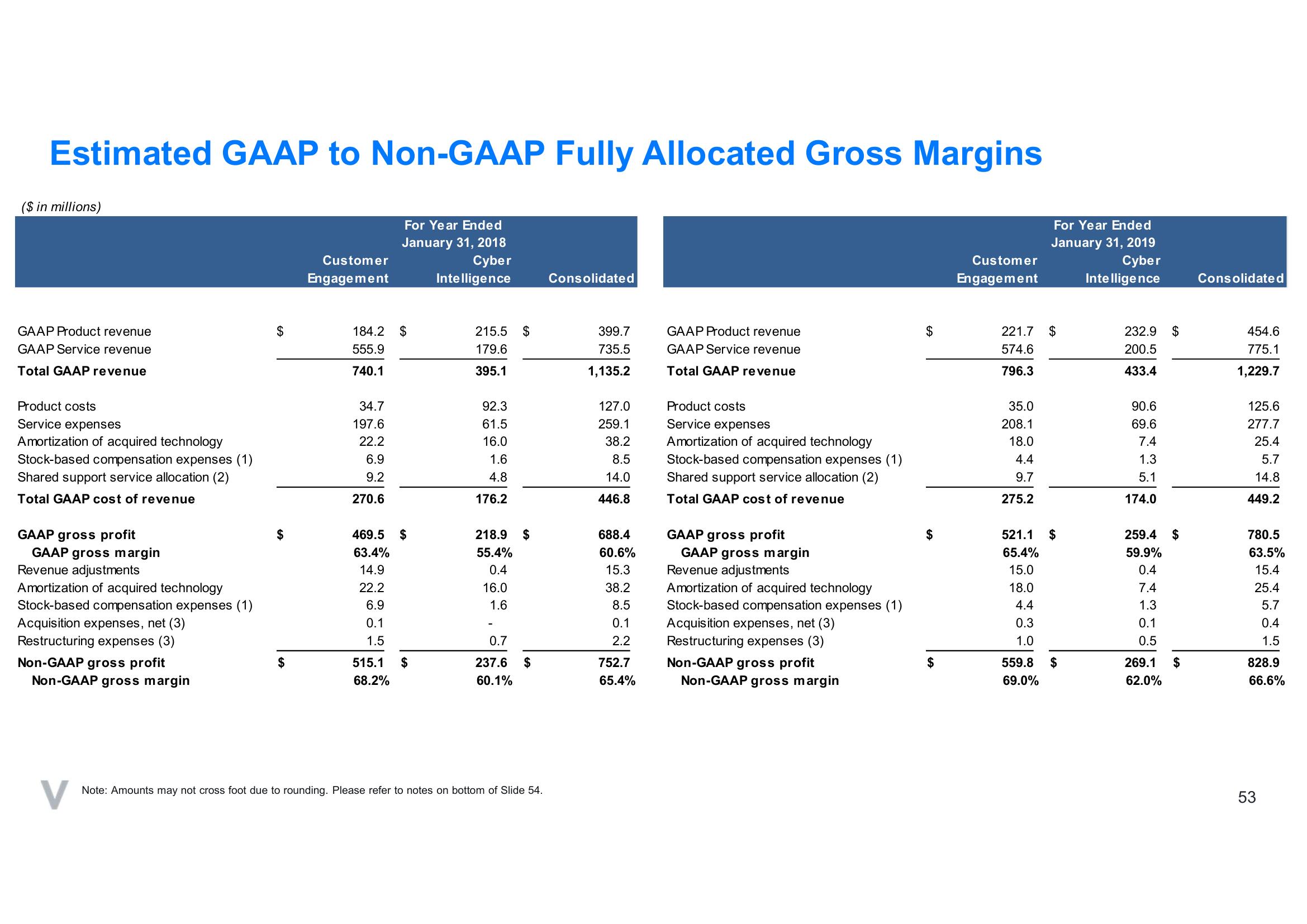

Estimated GAAP to Non-GAAP Fully Allocated Gross Margins

For Year Ended

January 31, 2018

Cyber

Intelligence

($ in millions)

GAAP Product revenue

GAAP Service revenue

Total GAAP revenue

Product costs

Service expenses

Amortization of acquired technology

Stock-based compensation expenses (1)

Shared support service allocation (2)

Total GAAP cost of revenue

GAAP gross profit

GAAP gross margin

Revenue adjustments

Amortization of acquired technology

Stock-based compensation expenses (1)

Acquisition expenses, net (3)

Restructuring expenses (3)

Non-GAAP gross profit

Non-GAAP gross margin

$

$

Customer

Engagement

184.2 $

555.9

740.1

34.7

197.6

22.2

6.9

9.2

270.6

469.5 $

63.4%

14.9

22.2

6.9

0.1

1.5

515.1

68.2%

$

215.5 $

179.6

395.1

92.3

61.5

16.0

1.6

4.8

176.2

218.9

55.4%

0.4

16.0

1.6

-

0.7

237.6

60.1%

$

$

Note: Amounts may not cross foot due to rounding. Please refer to notes on bottom of Slide 54.

Consolidated

399.7

735.5

1,135.2

127.0

259.1

38.2

8.5

14.0

446.8

688.4

60.6%

15.3

38.2

8.5

0.1

2.2

752.7

65.4%

GAAP Product revenue

GAAP Service revenue

Total GAAP revenue

Product costs

Service expenses

Amortization of acquired technology

Stock-based compensation expenses (1)

Shared support service allocation (2)

Total GAAP cost of revenue

GAAP gross profit

GAAP gross margin

Revenue adjustments

Amortization of acquired technology

Stock-based compensation expenses (1)

Acquisition expenses, net (3)

Restructuring expenses (3)

Non-GAAP gross profit

Non-GAAP gross margin

$

$

$

Customer

Engagement

221.7 $

574.6

796.3

35.0

208.1

18.0

4.4

9.7

275.2

For Year Ended

January 31, 2019

Cyber

Intelligence

521.1

65.4%

15.0

18.0

4.4

0.3

1.0

559.8

69.0%

$

$

232.9 $

200.5

433.4

90.6

69.6

7.4

1.3

5.1

174.0

259.4 $

59.9%

0.4

7.4

1.3

0.1

0.5

269.1

62.0%

$

Consolidated

454.6

775.1

1,229.7

125.6

277.7

25.4

5.7

14.8

449.2

780.5

63.5%

15.4

25.4

5.7

0.4

1.5

828.9

66.6%

53View entire presentation