Frontier IPO Presentation Deck

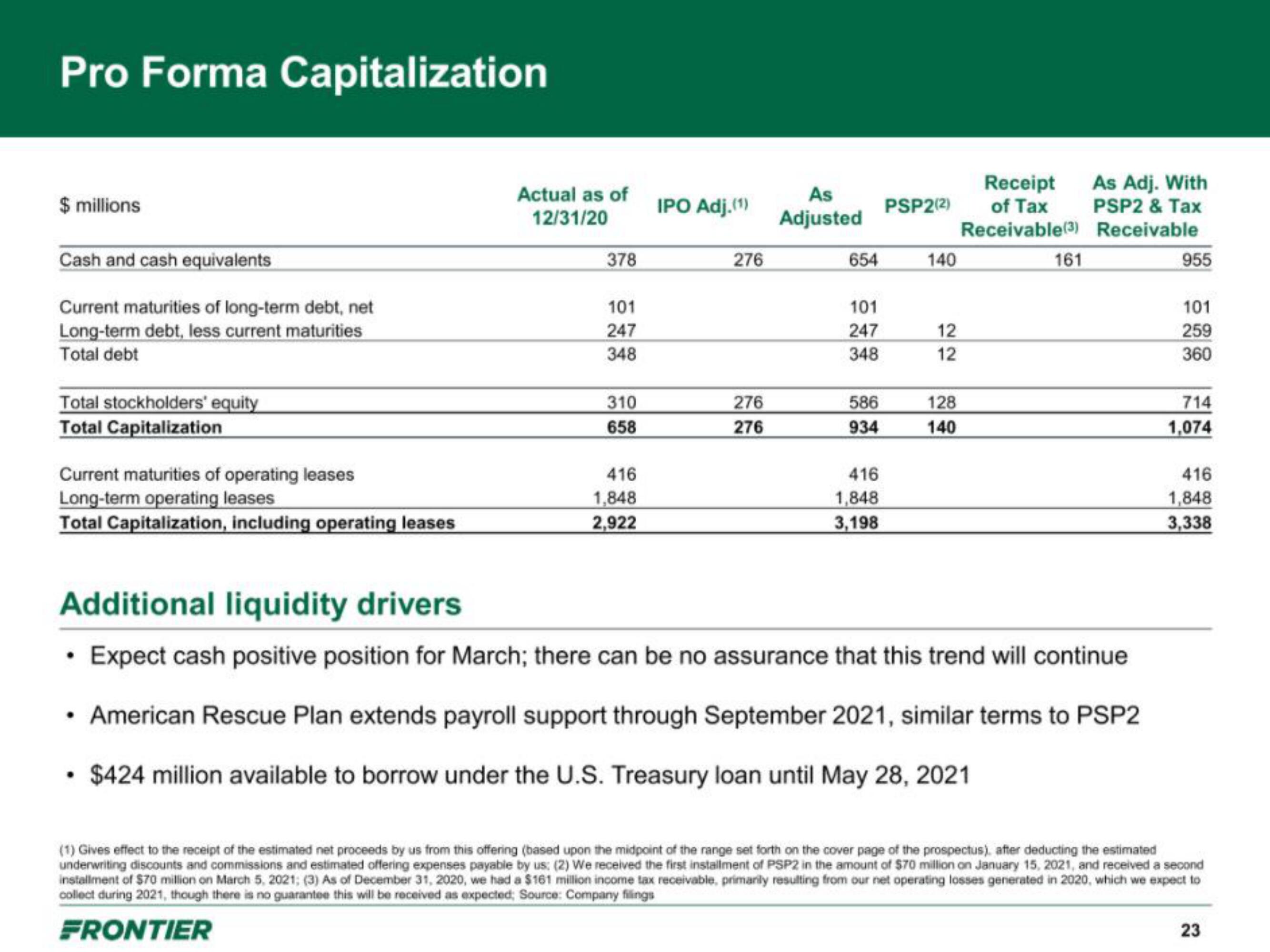

Pro Forma Capitalization

$ millions

Cash and cash equivalents

Current maturities of long-term debt, net

Long-term debt, less current maturities

Total debt

Total stockholders' equity

Total Capitalization

Current maturities of operating leases

Long-term operating leases

Total Capitalization, including operating leases

Actual as of

12/31/20

●

378

101

247

348

310

658

416

1,848

2,922

IPO Adj. (1)

276

276

276

As

Adjusted

654

101

247

348

586

934

416

1,848

3,198

PSP2(2)

140

12

12

128

140

Receipt As Adj. With

of Tax PSP2 & Tax

Receivable (3) Receivable

161

Additional liquidity drivers

Expect cash positive position for March; there can be no assurance that this trend will continue

American Rescue Plan extends payroll support through September 2021, similar terms to PSP2

$424 million available to borrow under the U.S. Treasury loan until May 28, 2021

955

101

259

360

714

1,074

416

1,848

3,338

(1) Gives effect to the receipt of the estimated net proceeds by us from this offering (based upon the midpoint of the range set forth on the cover page of the prospectus), after deducting the estimated

underwriting discounts and commissions and estimated offering expenses payable by us: (2) We received the first installment of PSP2 in the amount of $70 million on January 15, 2021, and received a second

installment of $70 million on March 5, 2021; (3) As of December 31, 2020, we had a $161 million income tax receivable, primarily resulting from our net operating losses generated in 2020, which we expect to

collect during 2021, though there is no guarantee this will be received as expected; Source: Company filings

FRONTIER

23View entire presentation