Despegar Mergers and Acquisitions Presentation Deck

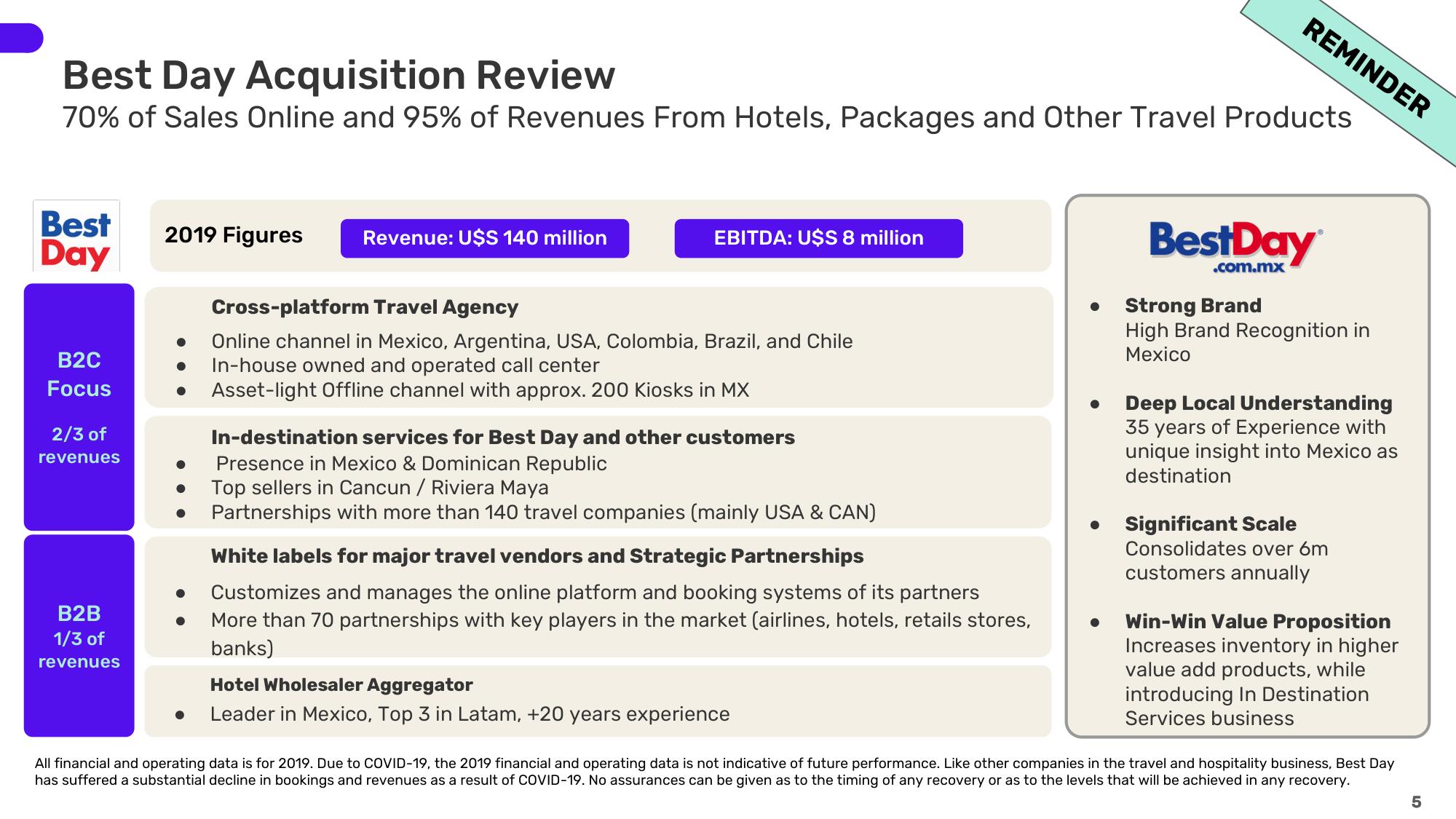

Best Day Acquisition Review

70% of Sales Online and 95% of Revenues From Hotels, Packages and Other Travel Products

Best 2019 Figures

Day

B2C

Focus

2/3 of

revenues

B2B

1/3 of

revenues

Revenue: U$S 140 million

EBITDA: U$S 8 million

Cross-platform Travel Agency

Online channel in Mexico, Argentina, USA, Colombia, Brazil, and Chile

In-house owned and operated call center

Asset-light Offline channel with approx. 200 Kiosks in MX

In-destination services for Best Day and other customers

Presence in Mexico & Dominican Republic

Top sellers in Cancun / Riviera Maya

Partnerships with more than 140 travel companies (mainly USA & CAN)

White labels for major travel vendors and Strategic Partnerships

Customizes and manages the online platform and booking systems of its partners

More than 70 partnerships with key players in the market (airlines, hotels, retails stores,

banks)

Hotel Wholesaler Aggregator

Leader in Mexico, Top 3 in Latam, +20 years experience

REMINDER

●

BestDay

Strong Brand

High Brand Recognition in

Mexico

Deep Local Understanding

35 years of Experience with

unique insight into Mexico as

destination

Significant Scale

Consolidates over 6m

customers annually

Win-Win Value Proposition

Increases inventory in higher

value add products, while

introducing In Destination

Services business

All financial and operating data is for 2019. Due to COVID-19, the 2019 financial and operating data is not indicative of future performance. Like other companies in the travel and hospitality business, Best Day

has suffered a substantial decline in bookings and revenues as a result of COVID-19. No assurances can be given as to the timing of any recovery or as to the levels that will be achieved in any recovery.

01

5View entire presentation