Imara M&A

Merger of Enliven and Imara

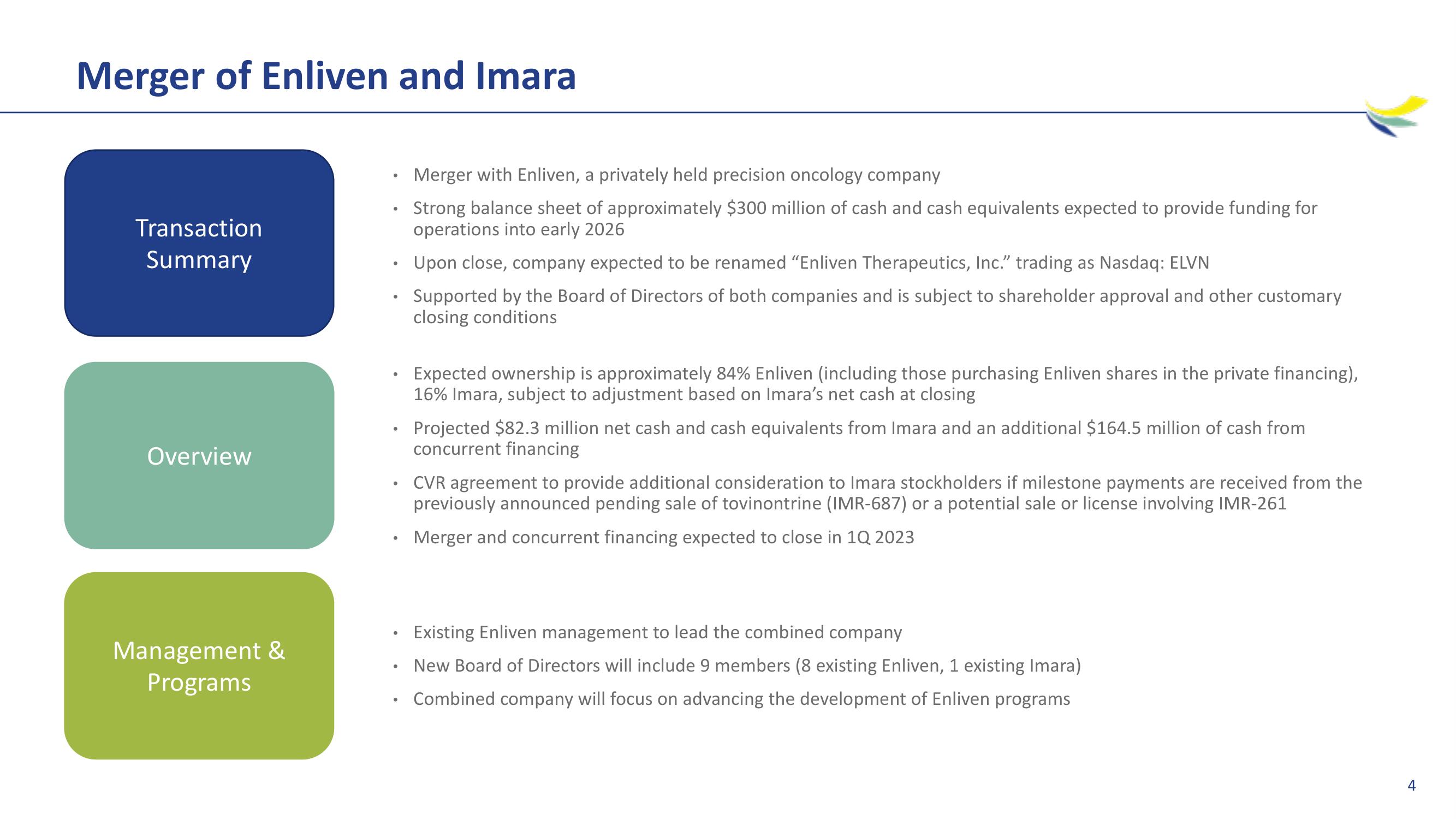

Transaction

Summary

Overview

Management &

Programs

.

●

●

Merger with Enliven, a privately held precision oncology company

Strong balance sheet of approximately $300 million of cash and cash equivalents expected to provide funding for

operations into early 2026

Upon close, company expected to be renamed "Enliven Therapeutics, Inc." trading as Nasdaq: ELVN

Supported by the Board of Directors of both companies and is subject to shareholder approval and other customary

closing conditions

Expected ownership is approximately 84% Enliven (including those purchasing Enliven shares in the private financing),

16% Imara, subject to adjustment based on Imara's net cash at closing

Projected $82.3 million net cash and cash equivalents from Imara and an additional $164.5 million of cash from

concurrent financing

CVR agreement to provide additional consideration to Imara stockholders if milestone payments are received from the

previously announced pending sale of tovinontrine (IMR-687) or a potential sale or license involving IMR-261

Merger and concurrent financing expected to close in 1Q 2023

Existing Enliven management to lead the combined company

New Board of Directors will include 9 members (8 existing Enliven, 1 existing Imara)

Combined company will focus on advancing the development of Enliven programs

4View entire presentation