Debunking the Retail Apocalypse

Into the Data - Some Definitions

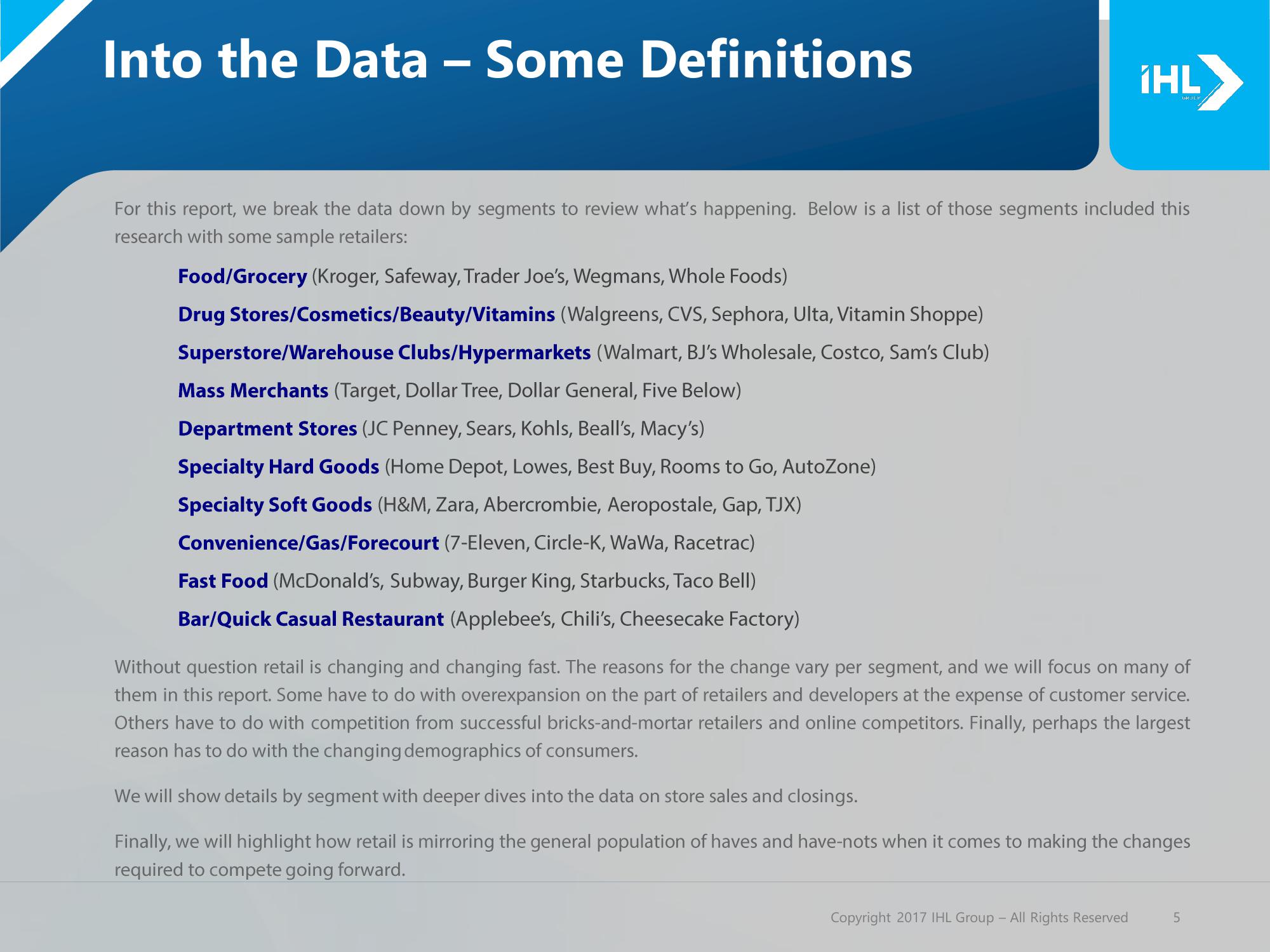

For this report, we break the data down by segments to review what's happening. Below is a list of those segments included this

research with some sample retailers:

Food/Grocery (Kroger, Safeway, Trader Joe's, Wegmans, Whole Foods)

Drug Stores/Cosmetics/Beauty/Vitamins (Walgreens, CVS, Sephora, Ulta, Vitamin Shoppe)

Superstore/Warehouse Clubs/Hypermarkets (Walmart, BJ's Wholesale, Costco, Sam's Club)

Mass Merchants (Target, Dollar Tree, Dollar General, Five Below)

Department Stores (JC Penney, Sears, Kohls, Beall's, Macy's)

Specialty Hard Goods (Home Depot, Lowes, Best Buy, Rooms to Go, AutoZone)

Specialty Soft Goods (H&M, Zara, Abercrombie, Aeropostale, Gap, TJX)

Convenience/Gas/Forecourt (7-Eleven, Circle-K, WaWa, Racetrac)

Fast Food (McDonald's, Subway, Burger King, Starbucks, Taco Bell)

Bar/Quick Casual Restaurant (Applebee's, Chili's, Cheesecake Factory)

¡HL

Without question retail is changing and changing fast. The reasons for the change vary per segment, and we will focus on many of

them in this report. Some have to do with overexpansion on the part of retailers and developers at the expense of customer service.

Others have to do with competition from successful bricks-and-mortar retailers and online competitors. Finally, perhaps the largest

reason has to do with the changing demographics of consumers.

We will show details by segment with deeper dives into the data on store sales and closings.

Finally, we will highlight how retail is mirroring the general population of haves and have-nots when it comes to making the changes

required to compete going forward.

Copyright 2017 IHL Group - All Rights Reserved

5View entire presentation