Topps SPAC Presentation Deck

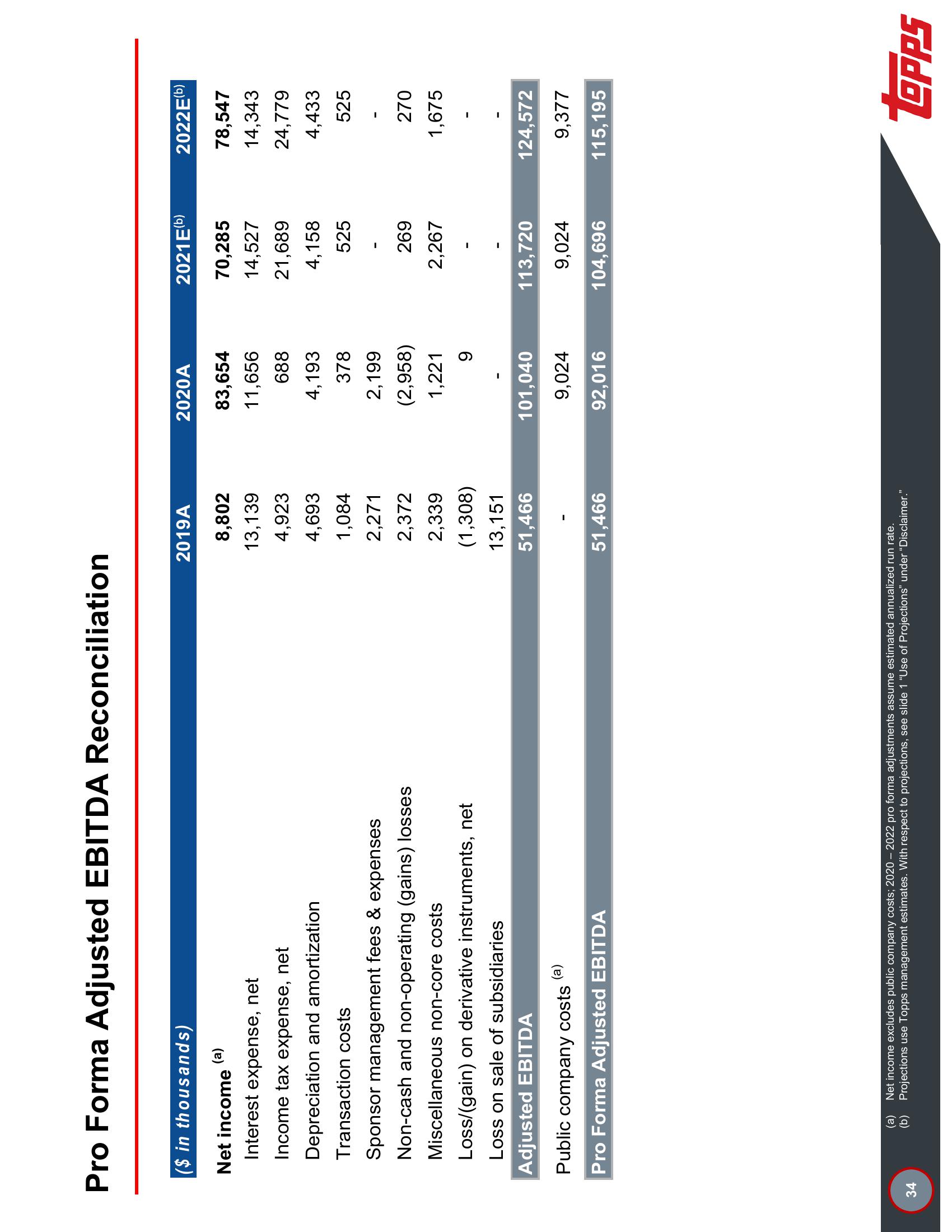

Pro Forma Adjusted EBITDA Reconciliation

34

($ in thousands)

(a)

Net income

Interest expense, net

Income tax expense, net

Depreciation and amortization

Transaction costs

Sponsor management fees & expenses

Non-cash and non-operating (gains) losses

Miscellaneous non-core costs

Loss/(gain) on derivative instruments, net

Loss on sale of subsidiaries

Adjusted EBITDA

(a)

Public company costs

Pro Forma Adjusted EBITDA

2019A

8,802

13,139

4,923

4,693

1,084

2,271

2,372

2,339

(1,308)

13,151

51,466

51,466

(a) Net income excludes public company costs; 2020-2022 pro forma adjustments assume estimated annualized run rate.

(b) Projections use Topps management estimates. With respect to projections, see slide 1 "Use of Projections" under "Disclaimer."

2020A

83,654

11,656

688

4,193

378

2,199

(2,958)

1,221

9

101,040

9,024

92,016

2021E(b)

70,285

14,527

21,689

4,158

525

269

2,267

113,720

9,024

104,696

2022E(b)

78,547

14,343

24,779

4,433

525

270

1,675

124,572

9,377

115,195

LOPPSView entire presentation