KKR Real Estate Finance Trust Investor Presentation Deck

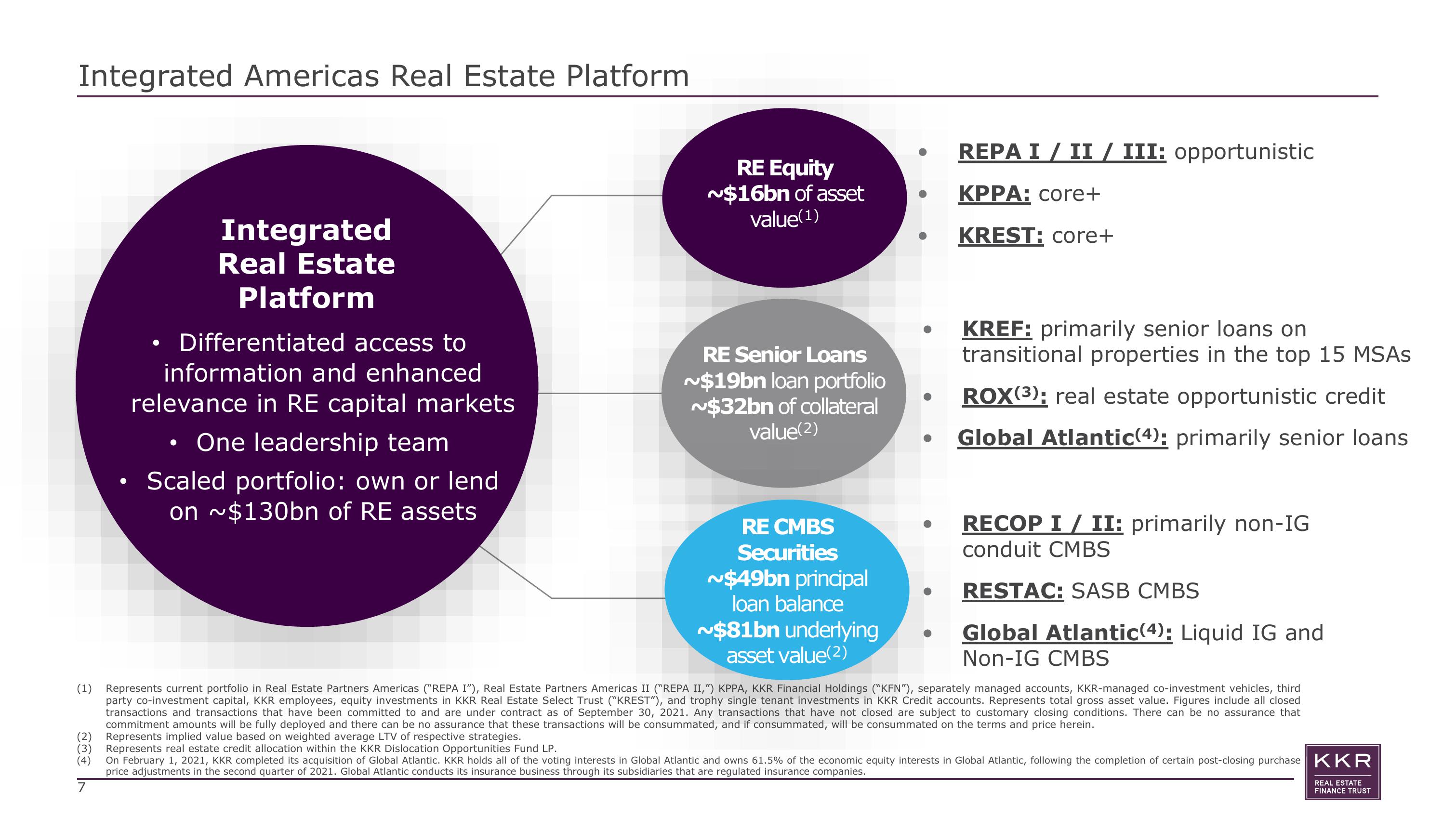

Integrated Americas Real Estate Platform

(2)

(3)

(4)

7

Integrated

Real Estate

Platform

●

Differentiated access to

information and enhanced

relevance in RE capital markets

One leadership team

Scaled portfolio: own or lend

on ~$130bn of RE assets

RE Equity

~$16bn of asset

value(¹)

RE Senior Loans

~$19bn loan portfolio

~$32bn of collateral

value(2)

RE CMBS

Securities

~$49bn principal

loan balance

~$81bn underlying

asset value(2)

REPA I / II / III: opportunistic

KPPA: core+

KREST: core+

KREF: primarily senior loans on

transitional properties in the top 15 MSAS

ROX(3): real estate opportunistic credit

Global Atlantic(4): primarily senior loans

RECOP I / II: primarily non-IG

conduit CMBS

RESTAC: SASB CMBS

Global Atlantic(4): Liquid IG and

Non-IG CMBS

(1) Represents current portfolio in Real Estate Partners Americas ("REPA I"), Real Estate Partners Americas II ("REPA II,") KPPA, KKR Financial Holdings ("KFN"), separately managed accounts, KKR-managed co-investment vehicles, third

party co-investment capital, KKR employees, equity investments in KKR Real Estate Select Trust ("KREST"), and trophy single tenant investments in KKR Credit accounts. Represents total gross asset value. Figures include all closed

transactions and transactions that have been committed to and are under contract as of September 30, 2021. Any transactions that have not closed are subject to customary closing conditions. There can be no assurance that

commitment amounts will be fully deployed and there can be no assurance that these transactions will be consummated, and if consummated, will be consummated on the terms and price herein.

Represents implied value based on weighted average LTV of respective strategies.

Represents real estate credit allocation within the KKR Dislocation Opportunities Fund LP.

On February 1, 2021, KKR completed its acquisition of Global Atlantic. KKR holds all of the voting interests in Global Atlantic and owns 61.5% of the economic equity interests in Global Atlantic, following the completion of certain post-closing purchase KKR

price adjustments in the second quarter of 2021. Global Atlantic conducts its insurance business through its subsidiaries that are regulated insurance companies.

REAL ESTATE

FINANCE TRUSTView entire presentation