Mondi Mergers and Acquisitions Presentation Deck

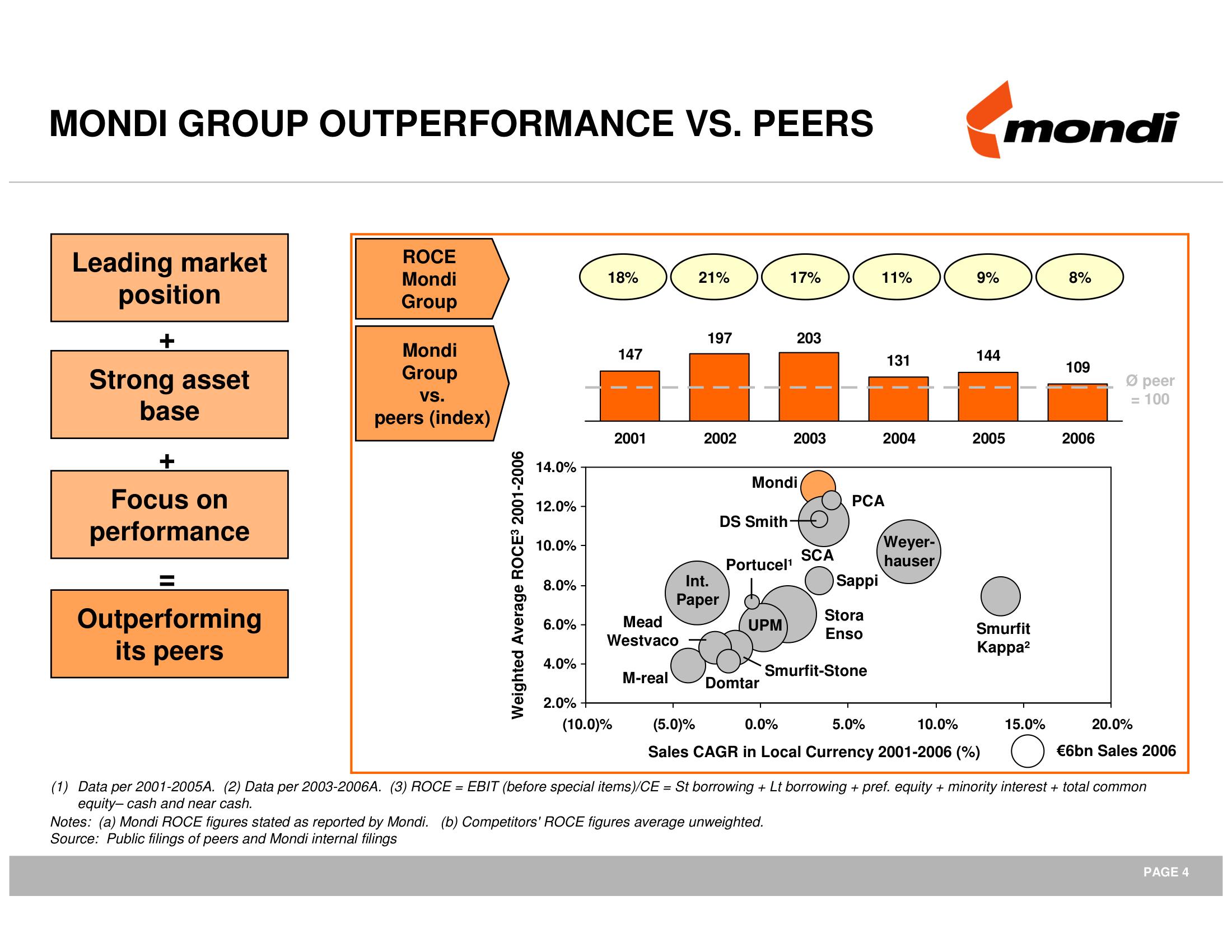

MONDI GROUP OUTPERFORMANCE VS. PEERS

Leading market

position

+

Strong asset

base

Focus on

performance

Outperforming

its peers

ROCE

Mondi

Group

Mondi

Group

VS.

peers (index)

Weighted Average ROCE³ 2001-2006

14.0%

12.0%

10.0%

8.0%

6.0%

4.0%

2.0%

18%

147

(10.0)%

2001

Mead

Westvaco

M-real

21%

197

2002

Int.

Paper

DS Smith-

17%

Mondi

Portucel¹

UPM

Domtar

203

2003

Notes: (a) Mondi ROCE figures stated as reported by Mondi. (b) Competitors' ROCE figures average unweighted.

Source: Public filings of peers and Mondi internal filings

SCA

Sappi

PCA

Stora

Enso

11%

Smurfit-Stone

131

2004

Weyer-

hauser

9%

10.0%

144

5.0%

(5.0)%

0.0%

Sales CAGR in Local Currency 2001-2006 (%)

mondi

2005

Smurfit

Kappa²

15.0%

8%

109

2006

Ø peer

100

20.0%

€6bn Sales 2006

(1) Data per 2001-2005A. (2) Data per 2003-2006A. (3) ROCE = EBIT (before special items)/CE = St borrowing + Lt borrowing + pref. equity + minority interest + total common

equity-cash and near cash.

PAGE 4View entire presentation