Main Street Capital Investor Presentation Deck

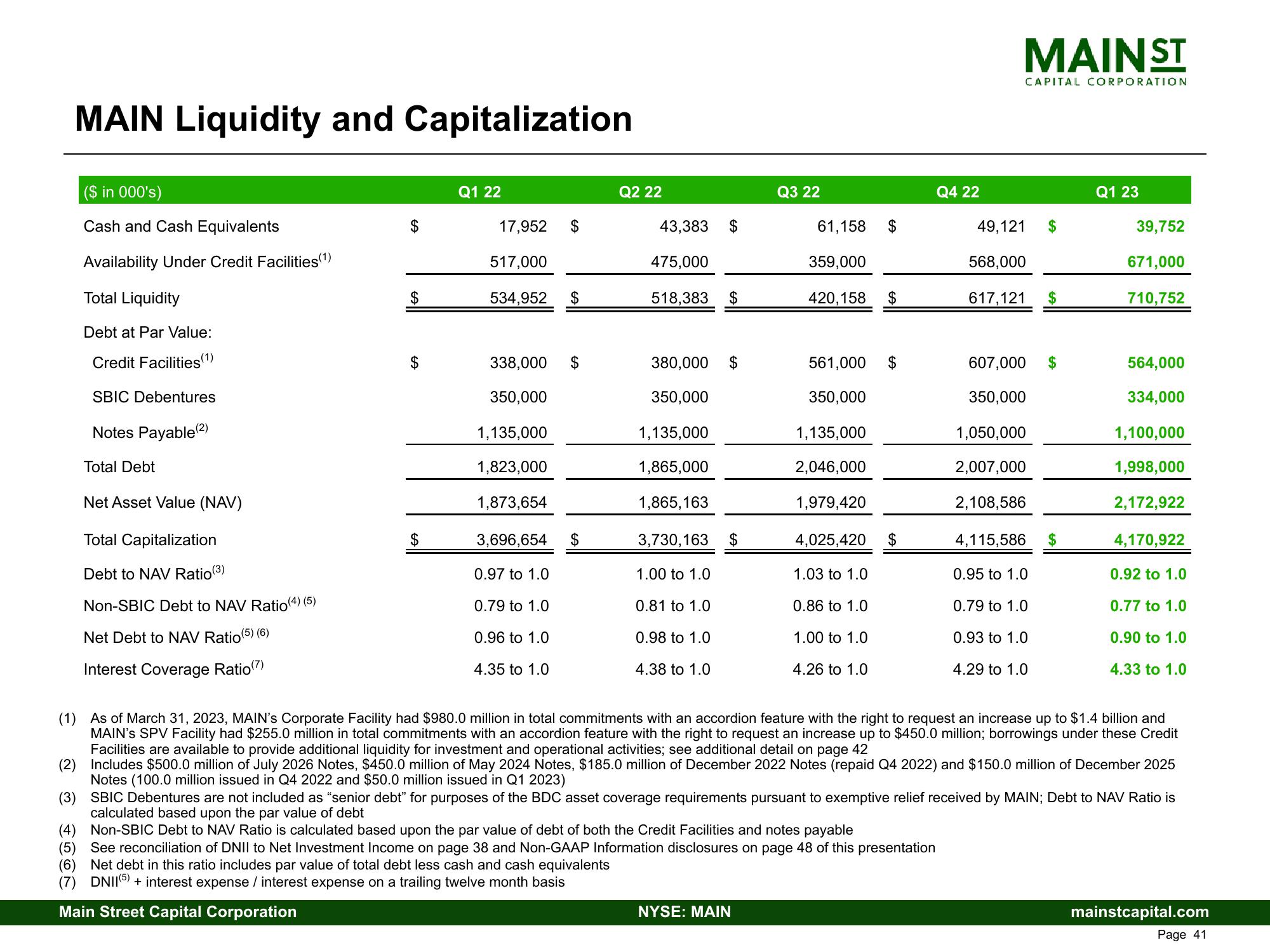

MAIN Liquidity and Capitalization

($ in 000's)

Cash and Cash Equivalents

Availability Under Credit Facilities (1)

Total Liquidity

Debt at Par Value:

Credit Facilities (1)

SBIC Debentures

Notes Payable (2)

Total Debt

Net Asset Value (NAV)

Total Capitalization

Debt to NAV Ratio (3)

Non-SBIC Debt to NAV Ratio (4) (5)

Net Debt to NAV Ratio (5) (6)

Interest Coverage Ratio (7)

$

$

$

Q1 22

17,952

517,000

534,952 $

338,000 $

350,000

1,135,000

1,823,000

1,873,654

3,696,654

0.97 to 1.0

0.79 to 1.0

0.96 to 1.0

4.35 to 1.0

Q2 22

43,383

475,000

518,383

$

380,000 $

350,000

1,135,000

1,865,000

1,865,163

3,730,163

1.00 to 1.0

0.81 to 1.0

0.98 to 1.0

4.38 to 1.0

$

Q3 22

61,158

359,000

420,158 $

NYSE: MAIN

$

561,000 $

350,000

1,135,000

2,046,000

1,979,420

4,025,420

1.03 to 1.0

0.86 to 1.0

1.00 to 1.0

4.26 to 1.0

Q4 22

(5) See reconciliation of DNII to Net Investment Income on page 38 and Non-GAAP Information disclosures on page 48 of this presentation

(6) Net debt in this ratio includes par value of total debt less cash and cash equivalents

(7) DNII(5) + interest expense / interest expense on a trailing twelve month basis

Main Street Capital Corporation

MAIN ST

CAPITAL CORPORATION

49,121

568,000

617,121

607,000

350,000

1,050,000

2,007,000

2,108,586

4,115,586

0.95 to 1.0

0.79 to 1.0

0.93 to 1.0

4.29 to 1.0

$

$

Q1 23

39,752

671,000

710,752

564,000

334,000

1,100,000

1,998,000

2,172,922

4,170,922

0.92 to 1.0

0.77 to 1.0

0.90 to 1.0

(1) As of March 31, 2023, MAIN's Corporate Facility had $980.0 million in total commitments with an accordion feature with the right to request an increase up to $1.4 billion and

MAIN's SPV Facility had $255.0 million in total commitments with an accordion feature with the right to request an increase up to $450.0 million; borrowings under these Credit

Facilities are available to provide additional liquidity for investment and operational activities; see additional detail on page 42

(2) Includes $500.0 million of July 2026 Notes, $450.0 million of May 2024 Notes, $185.0 million of December 2022 Notes (repaid Q4 2022) and $150.0 million of December 2025

Notes (100.0 million issued in Q4 2022 and $50.0 million issued in Q1 2023)

4.33 to 1.0

(3) SBIC Debentures are not included as "senior debt" for purposes of the BDC asset coverage requirements pursuant to exemptive relief received by MAIN; Debt to NAV Ratio is

calculated based upon the par value of debt

(4) Non-SBIC Debt to NAV Ratio is calculated based upon the par value of debt of both the Credit Facilities and notes payable

mainstcapital.com

Page 41View entire presentation