Metals Company SPAC

BETTER METALS FOR EVs

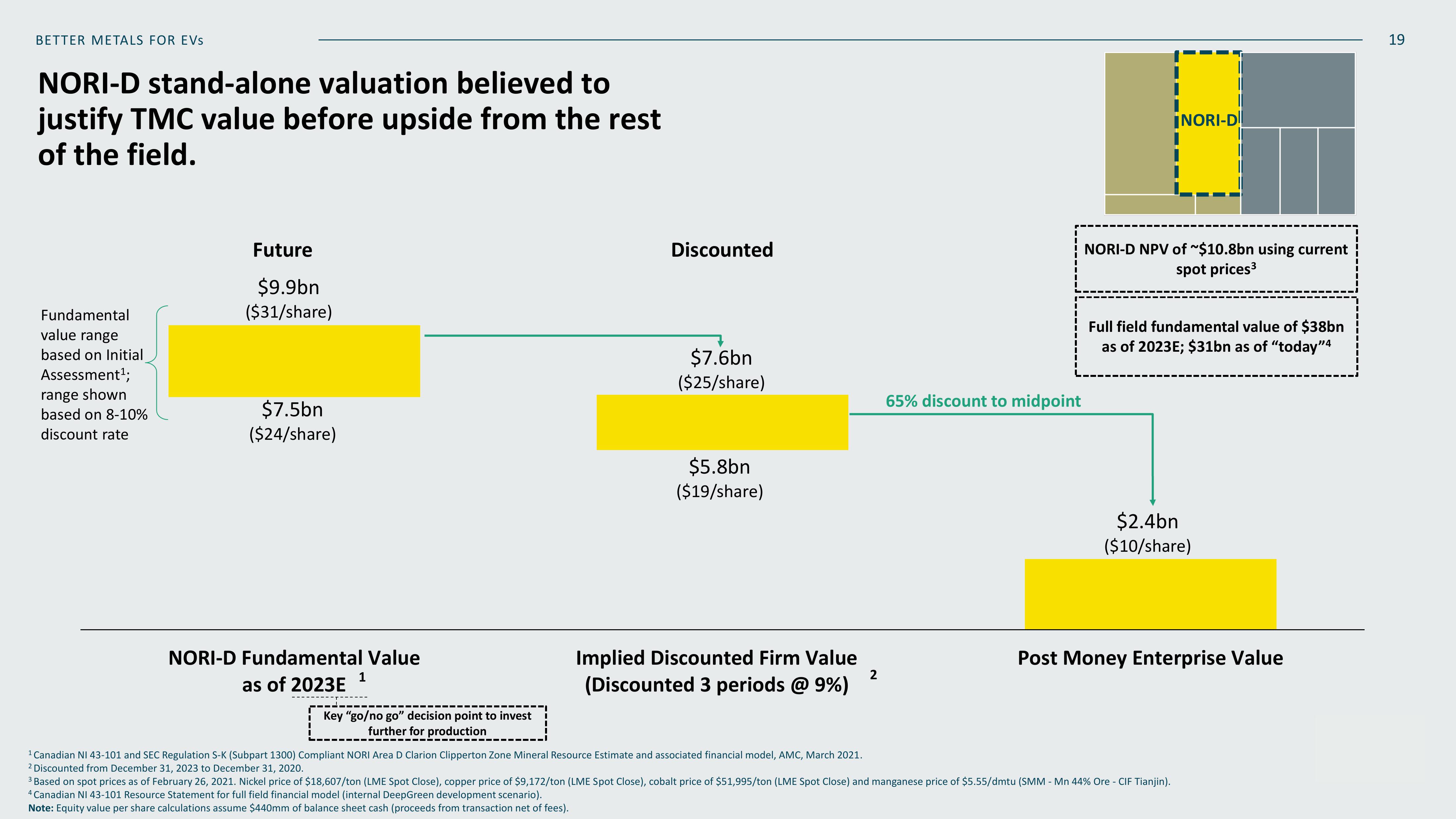

NORI-D stand-alone valuation believed to

justify TMC value before upside from the rest

of the field.

Fundamental

value range

based on Initial

Assessment¹;

range shown

based on 8-10%

discount rate

Future

$9.9bn

($31/share)

$7.5bn

($24/share)

NORI-D Fundamental Value

as of 2023E

1

Key "go/no go" decision point to invest

further for production

Discounted

$7.6bn

($25/share)

$5.8bn

($19/share)

Implied Discounted Firm Value

(Discounted 3 periods @ 9%)

2

65% discount to midpoint

||

INORI-D

NORI-D NPV of ~$10.8bn using current

spot prices³

$2.4bn

($10/share)

|

||

Full field fundamental value of $38bn

as of 2023E; $31bn as of "today"4

¹ Canadian NI 43-101 and SEC Regulation S-K (Subpart 1300) Compliant NORI Area O Clarion Clipperton Zone Mineral Resource Estimate and associated financial model, AMC, March 2021.

2 Discounted from December 31, 2023 to December 31, 2020.

3 Based on spot prices as of February 26, 2021. Nickel price of $18,607/ton (LME Spot Close), copper price of $9,172/ton (LME Spot Close), cobalt price of $51,995/ton (LME Spot Close) and manganese price of $5.55/dmtu (SMM - Mn 44% Ore - CIF Tianjin).

4 Canadian NI 43-101 Resource Statement for full field financial model (internal DeepGreen development scenario).

Note: Equity value per share calculations assume $440mm of balance sheet cash (proceeds from transaction net of fees).

Post Money Enterprise Value

19View entire presentation