HSBC Investor Day Presentation Deck

Reported and adjusted income statement

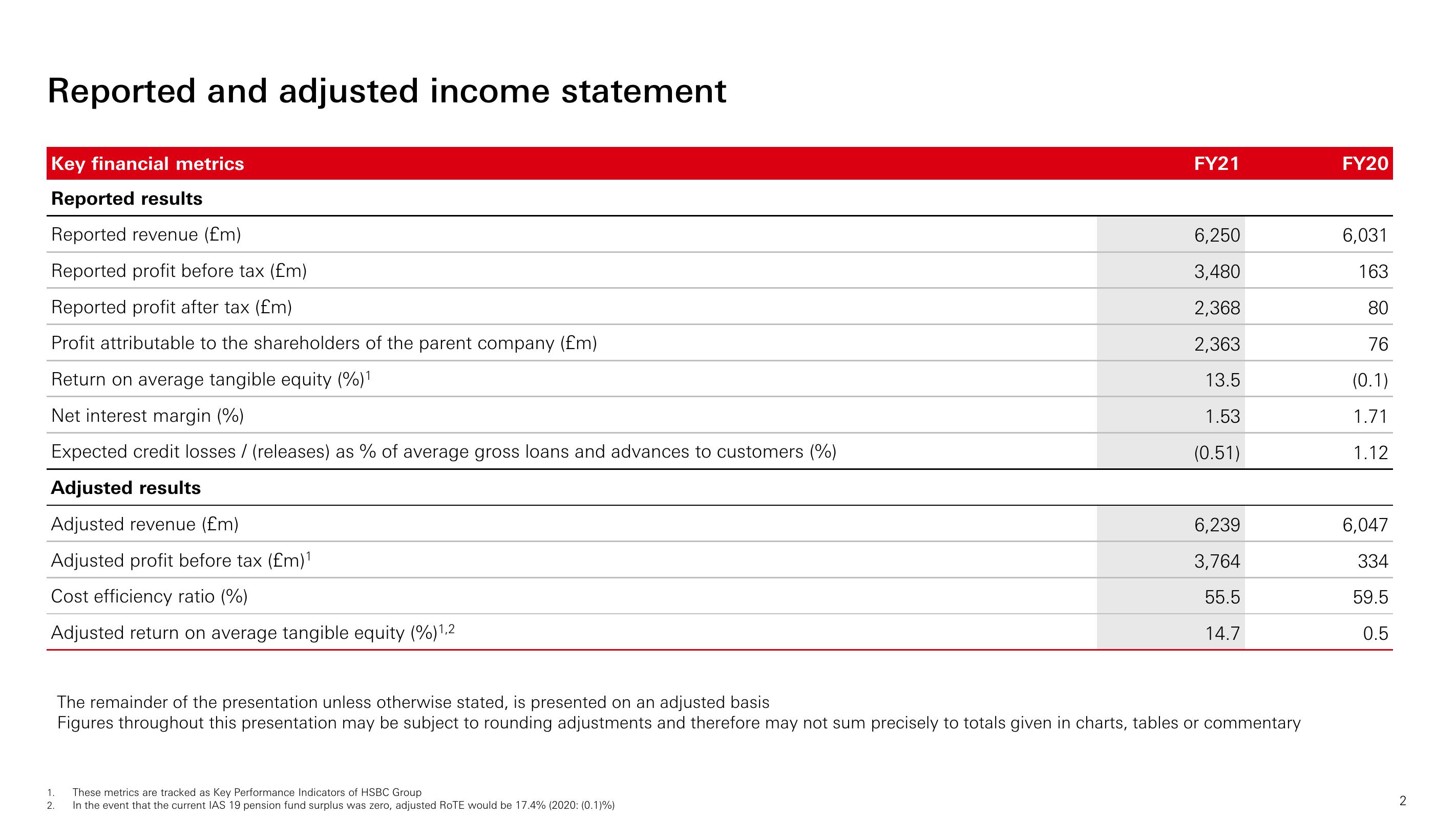

Key financial metrics

Reported results

Reported revenue (£m)

Reported profit before tax (£m)

Reported profit after tax (£m)

Profit attributable to the shareholders of the parent company (£m)

Return on average tangible equity (%)¹

Net interest margin (%)

Expected credit losses / (releases) as % of average gross loans and advances to customers (%)

Adjusted results

Adjusted revenue (£m)

Adjusted profit before tax (£m)¹

Cost efficiency ratio (%)

Adjusted return on average tangible equity (%) 1,2

1.

2.

FY21

These metrics are tracked as Key Performance Indicators of HSBC Group

In the event that the current IAS 19 pension fund surplus was zero, adjusted ROTE would be 17.4% (2020: (0.1)%)

6,250

3,480

2,368

2,363

13.5

1.53

(0.51)

6,239

3,764

55.5

14.7

The remainder of the presentation unless otherwise stated, is presented on an adjusted basis

Figures throughout this presentation may be subject to rounding adjustments and therefore may not sum precisely to totals given in charts, tables or commentary

FY20

6,031

163

80

76

(0.1)

1.71

1.12

6,047

334

59.5

0.5

2View entire presentation