Zegna SPAC Presentation Deck

GLOSSARY

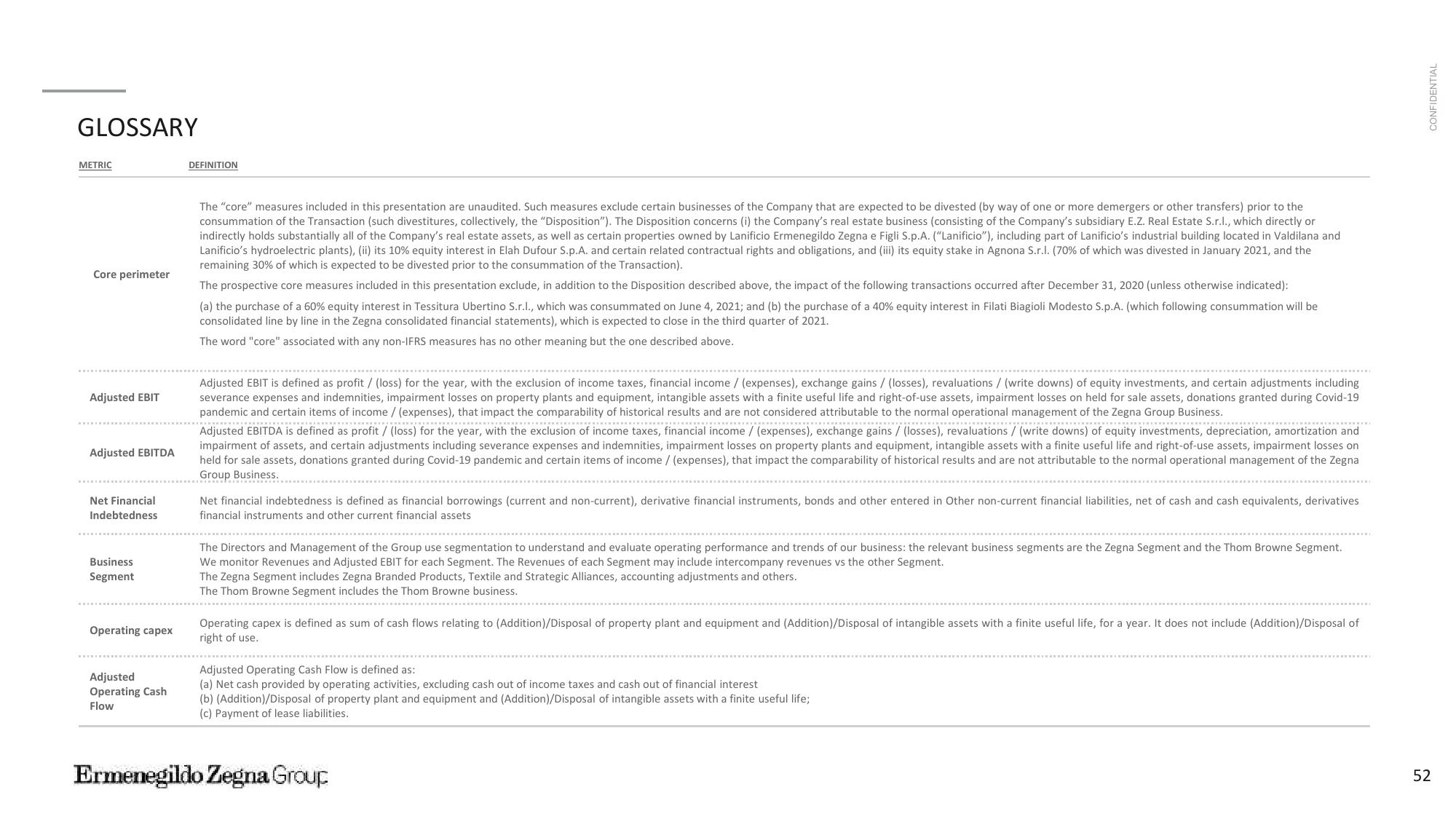

METRIC

Core perimeter

Adjusted EBIT

Adjusted EBITDA

Net Financial

Indebtedness

Business

Segment

Operating capex

Adjusted

Operating Cash

Flow

DEFINITION

The "core" measures included in this presentation are unaudited. Such measures exclude certain businesses of the Company that are expected to be divested (by way of one or more demergers or other transfers) prior to the

consummation of the Transaction (such divestitures, collectively, the "Disposition"). The Disposition concerns (i) the Company's real estate business (consisting of the Company's subsidiary E.Z. Real Estate S.r.l., which directly or

indirectly holds substantially all of the Company's real estate assets, as well as certain properties owned by Lanificio Ermenegildo Zegna e Figli S.p.A. ("Lanificio"), including part of Lanificio's industrial building located in Valdilana and

Lanificio's hydroelectric plants), (ii) its 10% equity interest in Elah Dufour S.p.A. and certain related contractual rights and obligations, and (iii) its equity stake in Agnona S.r.l. (70% of which was divested in January 2021, and the

remaining 30% of which is expected to be divested prior to the consummation of the Transaction).

The prospective core measures included in this presentation exclude, in addition to the Disposition described above, the impact of the following transactions occurred after December 31, 2020 (unless otherwise indicated):

(a) the purchase of a 60% equity interest in Tessitura Ubertino S.r.l., which was consummated on June 4, 2021; and (b) the purchase of a 40% equity interest in Filati Biagioli Modesto S.p.A. (which following consummation will be

consolidated line by line in the Zegna consolidated financial statements), which is expected to close in the third quarter of 2021.

The word "core" associated with any non-IFRS measures has no other meaning but the one described above.

Adjusted EBIT is defined as profit/ (loss) for the year, with the exclusion of income taxes, financial income / (expenses), exchange gains / (losses), revaluations / (write downs) of equity investments, and certain adjustments including

severance expenses and indemnities, impairment losses on property plants and equipment, intangible assets with a finite useful life and right-of-use assets, impairment losses on held for sale assets, donations granted during Covid-19

pandemic and certain items of income / (expenses), that impact the comparability of historical results and are not considered attributable to the normal operational management of the Zegna Group Business.

--------------------------------------------------------------

**************------------------------------……………………………………

**************************

Adjusted EBITDA is defined as profit / (loss) for the year, with the exclusion of income taxes, financial income / (expenses), exchange gains / (losses), revaluations / (write downs) of equity investments, depreciation, amortization and

impairment of assets, and certain adjustments including severance expenses and indemnities, impairment losses on property plants and equipment, intangible assets with a finite useful life and right-of-use assets, impairment losses on

held for sale assets, donations granted during Covid-19 pandemic and certain items of income / (expenses), that impact the comparability of historical results and are not attributable to the normal operational management of the Zegna

Group Business.

Net financial indebtedness is defined as financial borrowings (current and non-current), derivative financial instruments, bonds and other entered in Other non-current financial liabilities, net of cash and cash equivalents, derivatives

financial instruments and other current financial assets

The Directors and Management of the Group use segmentation to understand and evaluate operating performance and trends of our business: the relevant business segments are the Zegna Segment and the Thom Browne Segment.

We monitor Revenues and Adjusted EBIT for each Segment. The Revenues of each Segment may include intercompany revenues vs the other Segment.

The Zegna Segment includes Zegna Branded Products, Textile and Strategic Alliances, accounting adjustments and others.

The Thom Browne Segment includes the Thom Browne business.

Operating capex is defined as sum of cash flows relating to (Addition)/Disposal of property plant and equipment and (Addition)/Disposal of intangible assets with a finite useful life, for a year. It does not include (Addition)/Disposal of

right of use.

Adjusted Operating Cash Flow is defined as:

(a) Net cash provided by operating activities, excluding cash out of income taxes and cash out of financial interest

(b) (Addition)/Disposal of property plant and equipment and (Addition)/Disposal of intangible assets with a finite useful life;

(c) Payment of lease liabilities.

Ermenegildo Zegna Group

CONFIDENTIAL

52View entire presentation