Bird Investor Presentation Deck

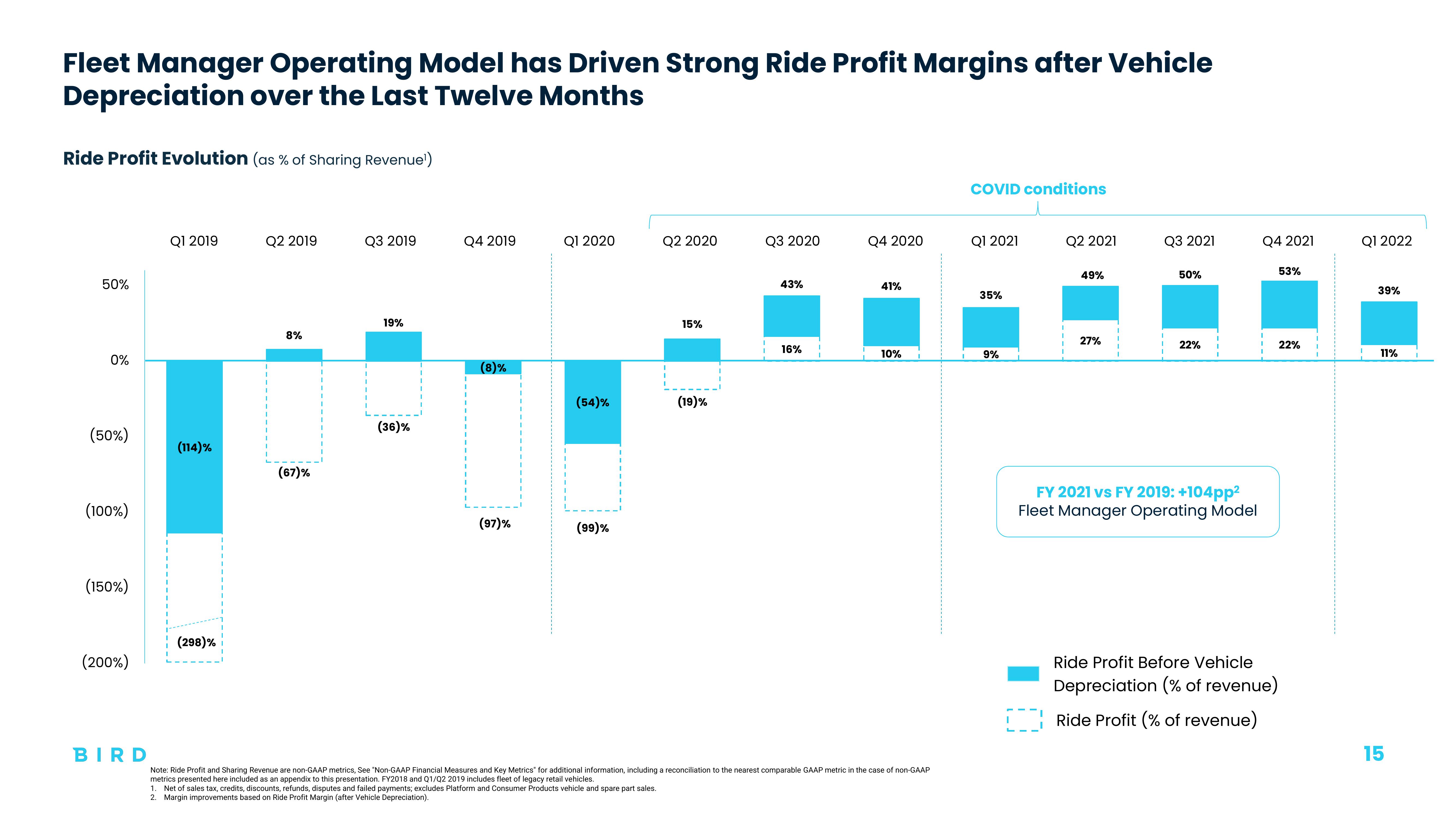

Fleet Manager Operating Model has Driven Strong Ride Profit Margins after Vehicle

Depreciation over the Last Twelve Months

Ride Profit Evolution (as % of Sharing Revenue'¹)

50%

0%

(50%)

(100%)

(150%)

(200%)

BIRD

Q1 2019

(114)%

(298)%

Q2 2019

8%

(67)%

Q3 2019

19%

(36)%

Q4 2019

(8)%

(97)%

Q1 2020

(54)%

(99)%

Q2 2020

15%

(19)%

Q3 2020

43%

16%

Q4 2020

41%

10%

Note: Ride Profit and Sharing Revenue are non-GAAP metrics, See "Non-GAAP Financial Measures and Key Metrics for additional information, including a reconciliation to the nearest comparable GAAP metric in the case of non-GAAP

metrics presented here included as an appendix to this presentation. FY2018 and Q1/Q2 2019 includes fleet of legacy retail vehicles.

1. Net of sales tax, credits, discounts, refunds, disputes and failed payments; excludes Platform and Consumer Products vehicle and spare part sales.

2. Margin improvements based on Ride Profit Margin (after Vehicle Depreciation).

COVID conditions

Q1 2021

35%

9%

Q2 2021

49%

27%

Q3 2021

50%

22%

FY 2021 vs FY 2019: +104pp²

Fleet Manager Operating Model

Q4 2021

Ride Profit Before Vehicle

Depreciation (% of revenue)

Ride Profit (% of revenue)

53%

22%

Q1 2022

39%

11%

15View entire presentation