Investor Insights: Q1 MCR Corp

MCR INVESTMENT STRATEGY: BUY IT. FIX IT. SELL IT.

Step #1) Buy It

●

●

●

●

●

●

●

Single-asset acquisitions and portfolios

Distressed deals (foreclosure auctions, non-performing loans, loan-to-own, etc.)

Limited service and full-service hotels

Step #2) Fix It

●

<15 years old

Fee simple

Always: Run hotels 350 - 400+ bps in margin better than other operators

Sometimes: Lightly renovate (typically spend less than $20K per guestroom)

Rarely: Re-brand (convert from independent or weaker brands like Choice and

InterContinental to stronger brands like Marriott and Hilton)

Step #3) Sell It

●

Strong, growing primary and secondary markets across the US

20%+ discounts to replacement cost

Sell opportunistically

Single-assets or portfolios (depends on what maximizes investor profits)

Potential buyers: Public REIT's, private equity firms, other owner/operators, etc.

Positioned to participate in all stages of the cycle given track record in (i) acquisitions (incl. via

bankruptcy/foreclosure auctions), (ii) development, (iii) non-performing loans and (iv) public equities

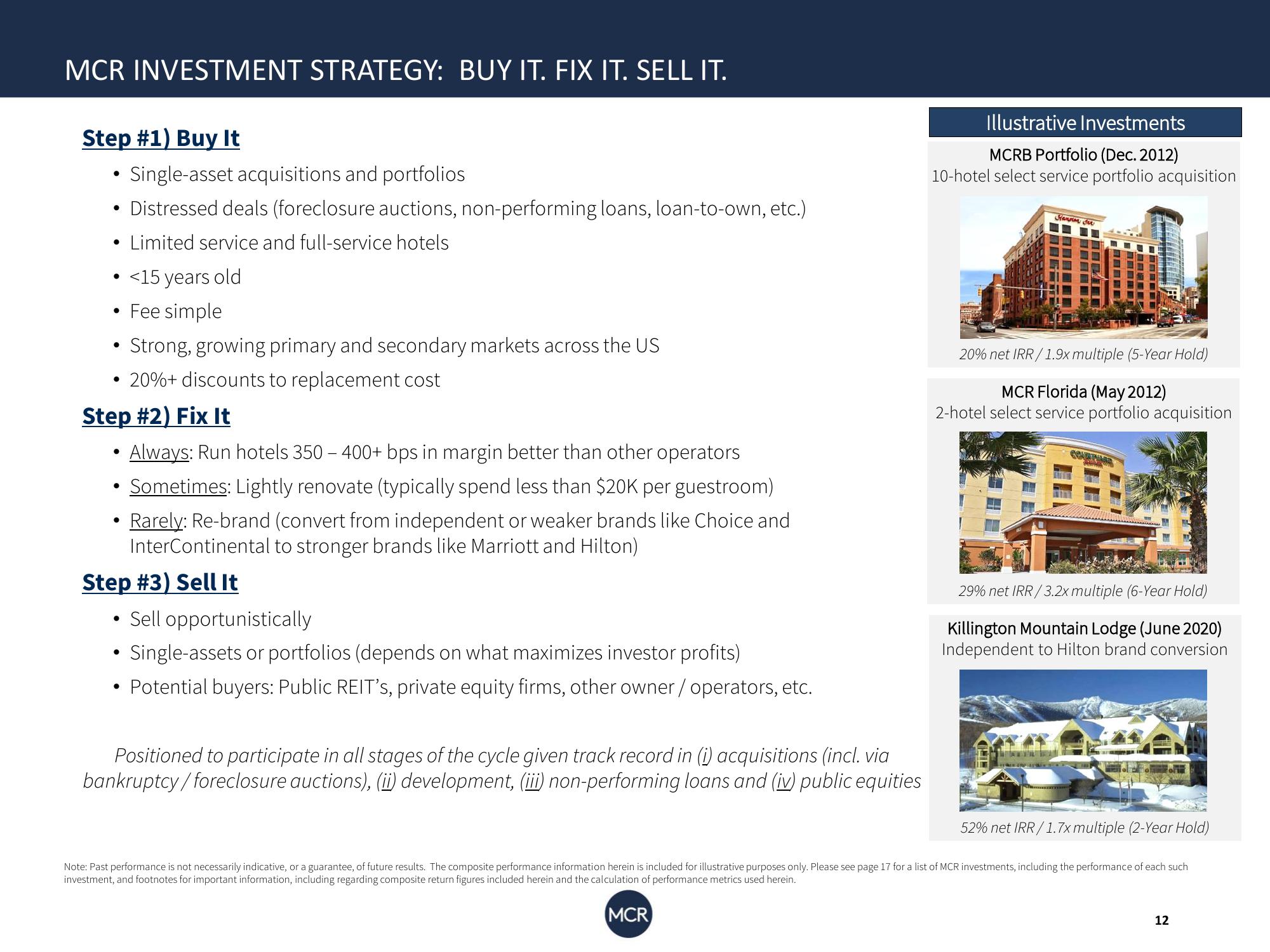

Illustrative Investments

MCRB Portfolio (Dec. 2012)

10-hotel select service portfolio acquisition

Sanna See

20% net IRR/1.9x multiple (5-Year Hold)

MCR Florida (May 2012)

2-hotel select service portfolio acquisition

FATHER

29% net IRR/3.2x multiple (6-Year Hold)

Killington Mountain Lodge (June 2020)

Independent to Hilton brand conversion

52% net IRR/1.7x multiple (2-Year Hold)

Note: Past performance is not necessarily indicative, or a guarantee, of future results. The composite performance information herein is included for illustrative purposes only. Please see page 17 for a list of MCR investments, including the performance of each such

investment, and footnotes for important information, including regarding composite return figures included herein and the calculation of performance metrics used herein.

MCR

12View entire presentation