Atalaya Risk Management Overview

Specialty Finance: Underwriting & Asset Management

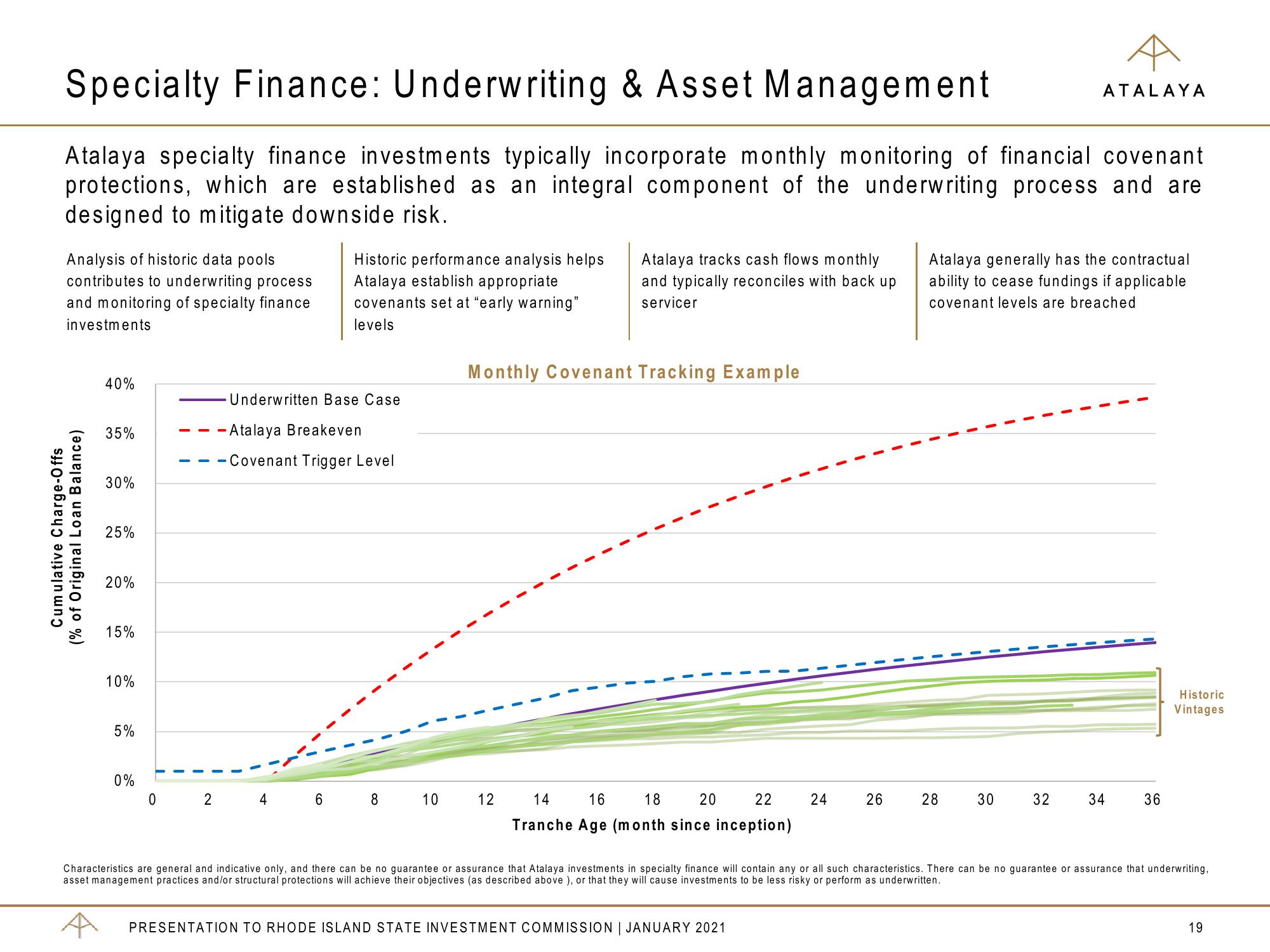

Atalaya specialty finance investments typically incorporate monthly monitoring of financial covenant

protections, which are established as an integral component of the underwriting process and are

designed to mitigate downside risk.

Analysis of historic data pools

contributes to underwriting process

and monitoring of specialty finance

investments

(% of Original Loan Balance)

Cumulative Charge-Offs

40%

35%

30%

25%

20%

15%

10%

5%

0%

0

2

Underwritten Base Case

Historic performance analysis helps

Atalaya establish appropriate

covenants set at "early warning"

levels

-Atalaya Breakeven

- Covenant Trigger Level

4

6

8

10

Atalaya tracks cash flows monthly

and typically reconciles with back up

servicer

Monthly Covenant Tracking Example

12

14 16 18 20 22

Tranche Age (month since inception)

24

PRESENTATION TO RHODE ISLAND STATE INVESTMENT COMMISSION | JANUARY 2021

26

Atalaya generally has the contractual

ability to cease fundings if applicable

covenant levels are breached

28

30

ATALAYA

32

34

36

Historic

Vintages

Characteristics are general and indicative only, and there can be no guarantee or assurance that Atalaya investments in specialty finance will contain any or all such characteristics. There can be no guarantee or assurance that underwriting,

asset management practices and/or structural protections will achieve their objectives (as described above), or that they will cause investments to be less risky or perform as underwritten.

19View entire presentation