Pershing Square Activist Presentation Deck

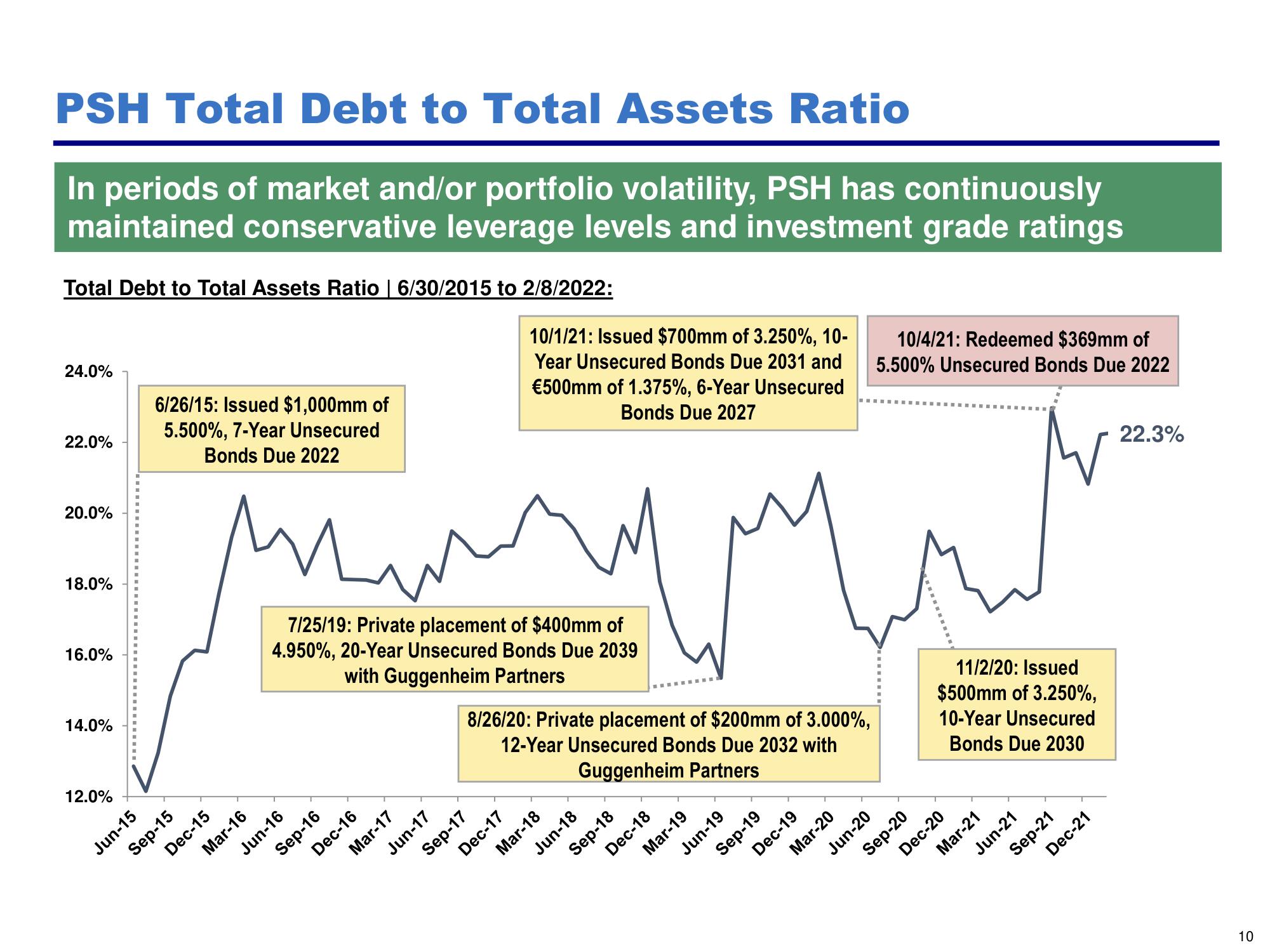

PSH Total Debt to Total Assets Ratio

In periods of market and/or portfolio volatility, PSH has continuously

maintained conservative leverage levels and investment grade ratings

Total Debt to Total Assets Ratio | 6/30/2015 to 2/8/2022:

24.0%

22.0%

20.0%

18.0%

16.0%

14.0%

12.0%

Jun-15

6/26/15: Issued $1,000mm of

5.500%, 7-Year Unsecured

Bonds Due 2022

Sep-15

Dec-15

Mar-16

Jun-16

7/25/19: Private placement of $400mm of

4.950%, 20-Year Unsecured Bonds Due 2039

with Guggenheim Partners

Sep-16

Mar-17

Dec-16

Jun-17

10/1/21: Issued $700mm of 3.250%, 10-

Year Unsecured Bonds Due 2031 and

€500mm of 1.375%, 6-Year Unsecured

Bonds Due 2027

8/26/20: Private placement of $200mm of 3.000%,

12-Year Unsecured Bonds Due 2032

with

Guggenheim

Partners

Sep-17

Dec-17

Mar-18

Jun-18

Sep-18

Dec-18

Mar-19

Jun-19

Sep-19

Dec-19

Mar-20

10/4/21: Redeemed $369mm of

5.500% Unsecured Bonds Due 2022

Jun-20

Sep-20

11/2/20: Issued

$500mm of 3.250%,

10-Year Unsecured

Bonds

Due 2030

Mar-21

Dec-20

Jun-21

Sep-21

Dec-21

22.3%

10View entire presentation