Kinnevik Results Presentation Deck

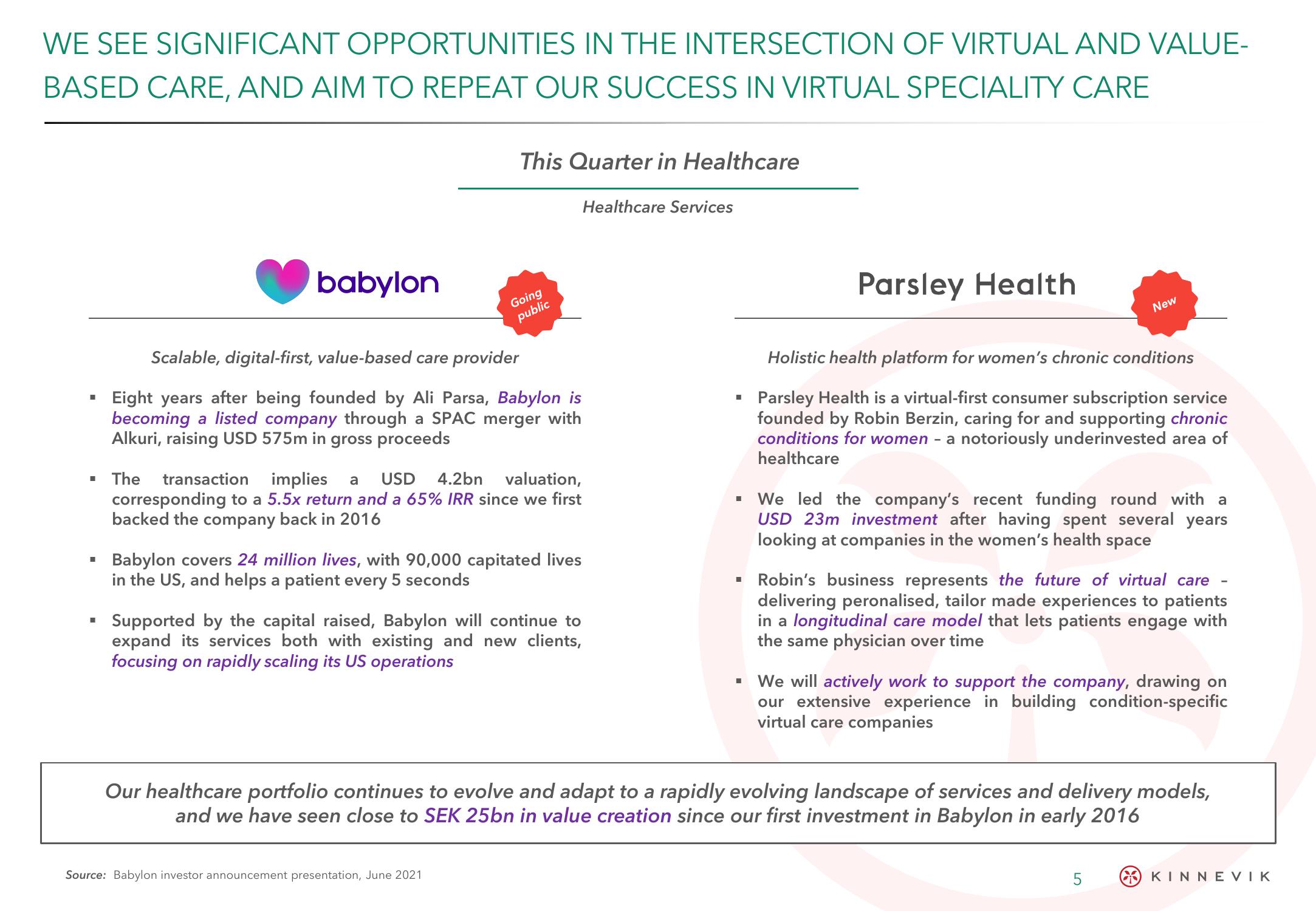

WE SEE SIGNIFICANT OPPORTUNITIES IN THE INTERSECTION OF VIRTUAL AND VALUE-

BASED CARE, AND AIM TO REPEAT OUR SUCCESS IN VIRTUAL SPECIALITY CARE

I

babylon

This Quarter in Healthcare

Going

public

Scalable, digital-first, value-based care provider

Eight years after being founded by Ali Parsa, Babylon is

becoming a listed company through a SPAC merger with

Alkuri, raising USD 575m in gross proceeds

The transaction implies a USD 4.2bn valuation,

corresponding to a 5.5x return and a 65% IRR since we first

backed the company back in 2016

Babylon covers 24 million lives, with 90,000 capitated lives

in the US, and helps a patient every 5 seconds

Source: Babylon investor announcement presentation, June 2021

Healthcare Services

Supported by the capital raised, Babylon will continue to

expand its services both with existing and new clients,

focusing on rapidly scaling its US operations

I

■

■

Parsley Health

New

Holistic health platform for women's chronic conditions

Parsley Health is a virtual-first consumer subscription service

founded by Robin Berzin, caring for and supporting chronic

conditions for women - a notoriously underinvested area of

healthcare

We led the company's recent funding round with a

USD 23m investment after having spent several years

looking at companies in the women's health space

Robin's business represents the future of virtual care

delivering peronalised, tailor made experiences to patients

in a longitudinal care model that lets patients engage with

the same physician over time

We will actively work to support the company, drawing on

our extensive experience in building condition-specific

virtual care companies

Our healthcare portfolio continues to evolve and adapt to a rapidly evolving landscape of services and delivery models,

and we have seen close to SEK 25bn in value creation since our first investment in Babylon in early 2016

5

KINNEVIKView entire presentation