FY 2017 Second Quarter Earnings Call

Non-GAAP reconciliations

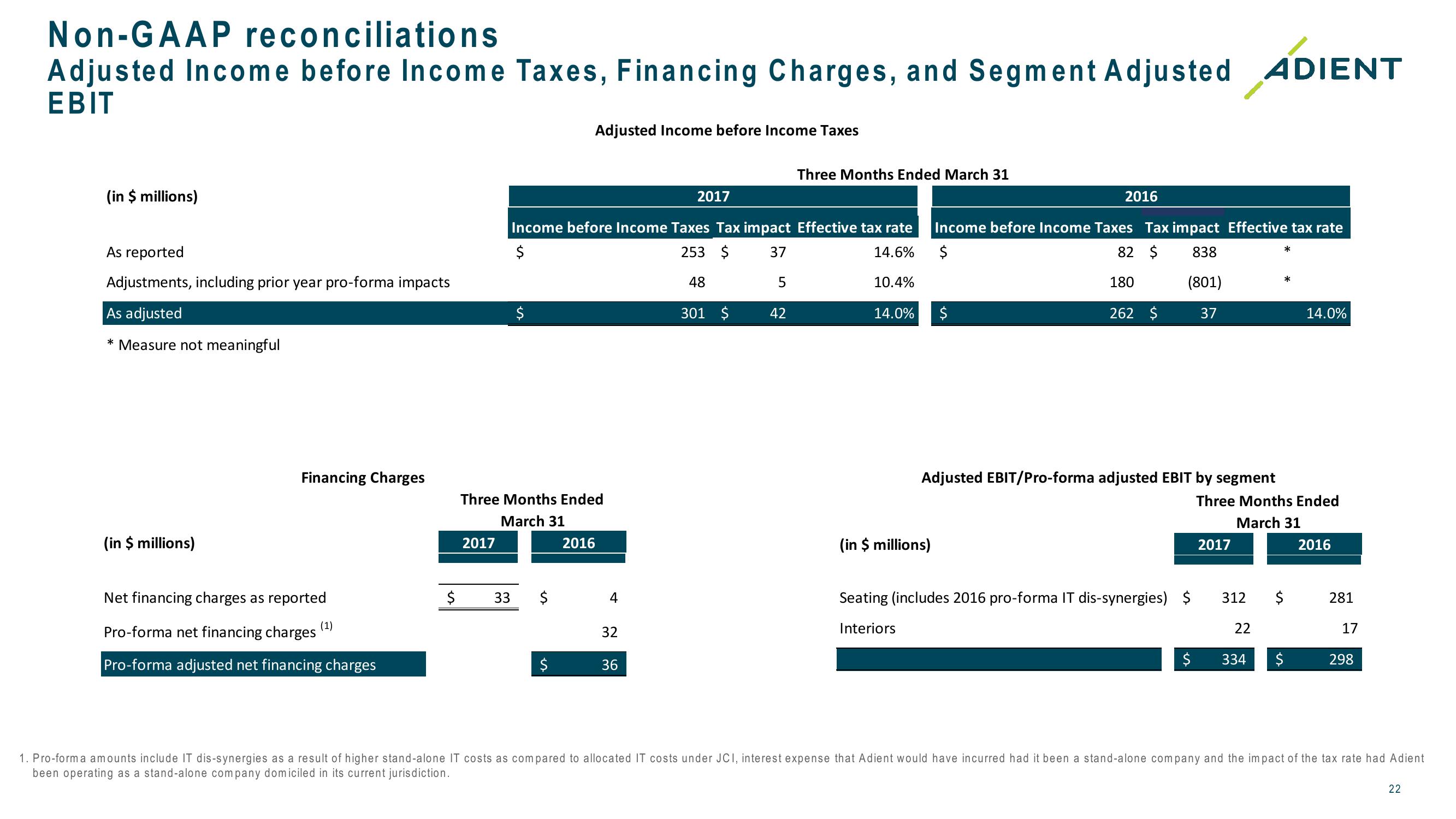

Adjusted Income before Income Taxes, Financing Charges, and Segment Adjusted ADIENT

EBIT

Adjusted Income before Income Taxes

Three Months Ended March 31

(in $ millions)

2017

2016

Income before Income Taxes Tax impact Effective tax rate

Income before Income Taxes Tax impact Effective tax rate

As reported

$

253 $

37

14.6%

$

82 $ 838

*

Adjustments, including prior year pro-forma impacts

48

5

10.4%

180

(801)

*

As adjusted

$

301 $

42

14.0%

$

262 $

37

14.0%

* Measure not meaningful

(in $ millions)

Financing Charges

Three Months Ended

March 31

2017

2016

Adjusted EBIT/Pro-forma adjusted EBIT by segment

Three Months Ended

March 31

2017

2016

(in $ millions)

$

33

$

4

(1)

32

Seating (includes 2016 pro-forma IT dis-synergies) $ 312

Interiors

$

281

22

17

$

334

$

298

36

Net financing charges as reported

Pro-forma net financing charges

Pro-forma adjusted net financing charges

1. Pro-forma amounts include IT dis-synergies as a result of higher stand-alone IT costs as compared to allocated IT costs under JCI, interest expense that Adient would have incurred had it been a stand-alone company and the impact of the tax rate had Adient

been operating as a stand-alone company domiciled in its current jurisdiction.

22View entire presentation