Deutsche Bank Fixed Income Presentation Deck

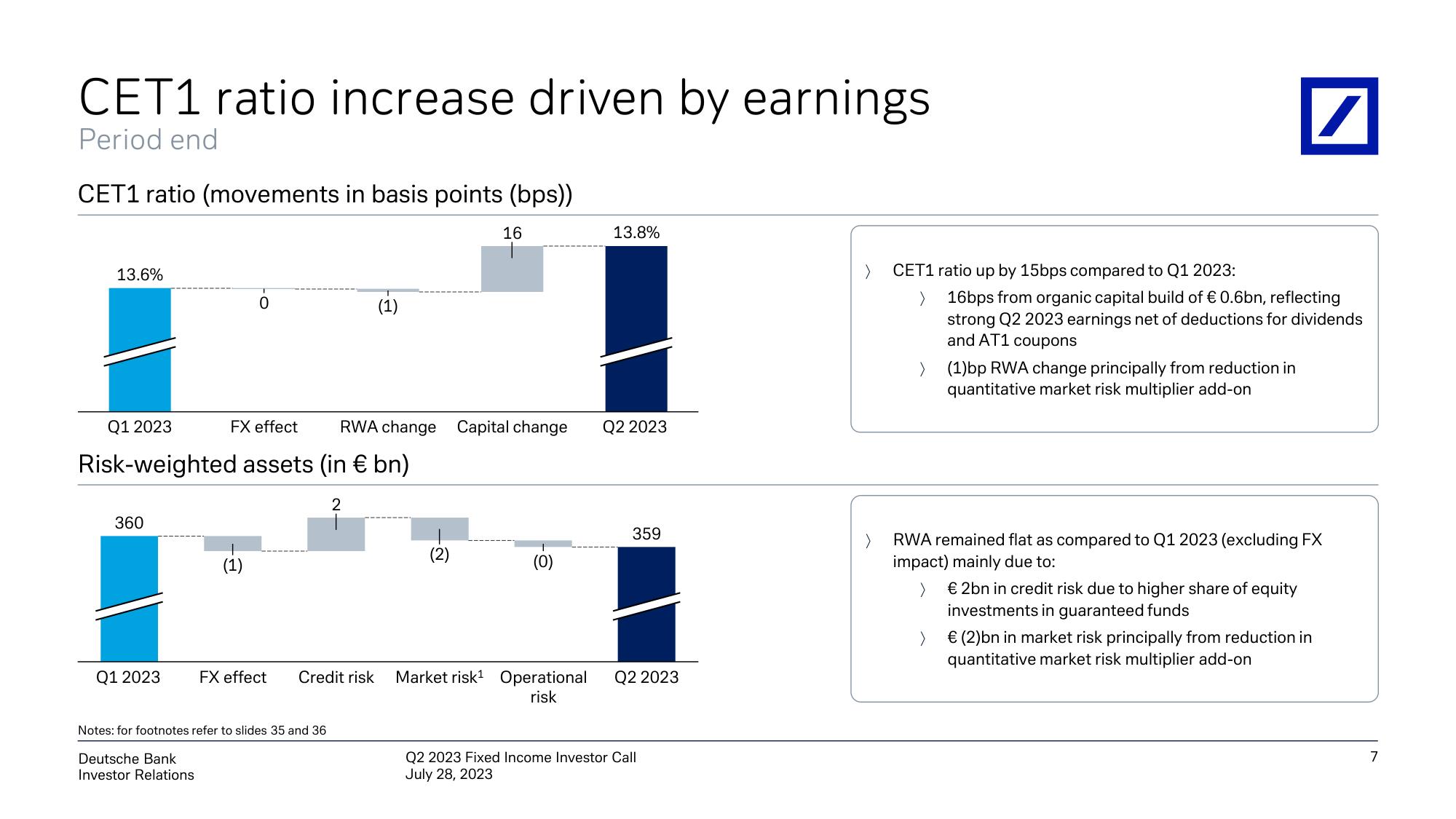

CET1 ratio increase driven by earnings

Period end

CET1 ratio (movements in basis points (bps))

13.6%

360

Q1 2023

Risk-weighted assets (in € bn)

Q1 2023

FX effect RWA change Capital change

(1)

(1)

2

FX effect Credit risk

Notes: for footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

16

-~

13.8%

Q2 2023

359

Market risk¹ Operational Q2 2023

risk

Q2 2023 Fixed Income Investor Call

July 28, 2023

> CET1 ratio up by 15bps compared to Q1 2023:

>

>

16bps from organic capital build of € 0.6bn, reflecting

strong Q2 2023 earnings net of deductions for dividends

and AT1 coupons

(1)bp RWA change principally from reduction in

quantitative market risk multiplier add-on

/

RWA remained flat as compared to Q1 2023 (excluding FX

impact) mainly due to:

>

€ 2bn in credit risk due to higher share of equity

investments in guaranteed funds

>

€ (2)bn in market risk principally from reduction in

quantitative market risk multiplier add-on

7View entire presentation