Ford Investor Conference Presentation Deck

Ford Credit

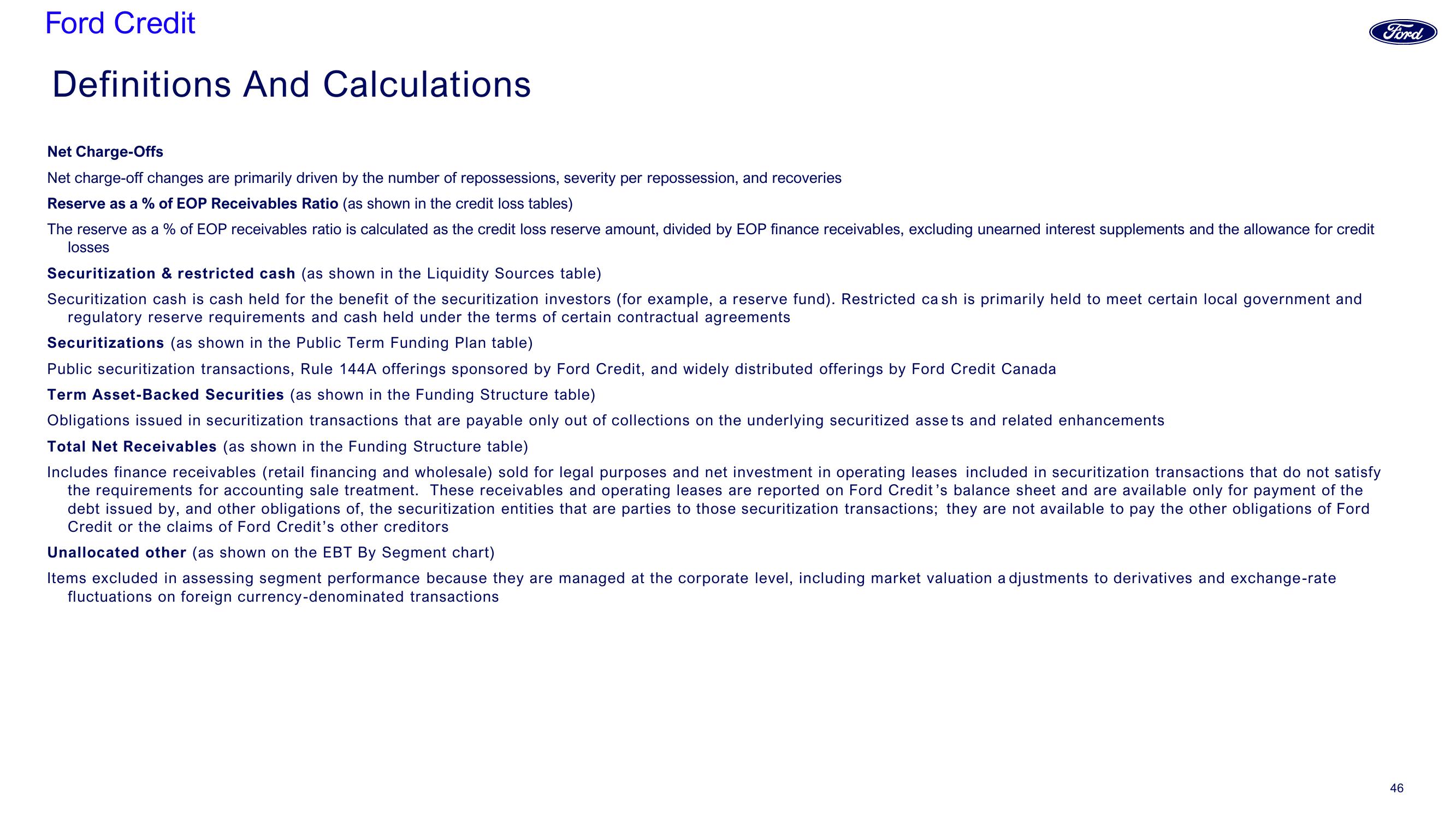

Definitions And Calculations

Net Charge-Offs

Net charge-off changes are primarily driven by the number of repossessions, severity per repossession, and recoveries

Reserve as a % of EOP Receivables Ratio (as shown in the credit loss tables)

The reserve as a % of EOP receivables ratio is calculated as the credit loss reserve amount, divided by EOP finance receivables, excluding unearned interest supplements and the allowance for credit

losses

Securitization & restricted cash (as shown in the Liquidity Sources table)

Securitization cash is cash held for the benefit of the securitization investors (for example, a reserve fund). Restricted cash is primarily held to meet certain local government and

regulatory reserve requirements and cash held under the terms of certain contractual agreements

Securitizations (as shown in the Public Term Funding Plan table)

Public securitization transactions, Rule 144A offerings sponsored by Ford Credit, and widely distributed offerings by Ford Credit Canada

Term Asset-Backed Securities (as shown in the Funding Structure table)

Obligations issued in securitization transactions that are payable only out of collections on the underlying securitized assets and related enhancements

Total Net Receivables (as shown in the Funding Structure table)

Includes finance receivables (retail financing and wholesale) sold for legal purposes and net investment in operating leases included in securitization transactions that do not satisfy

the requirements for accounting sale treatment. These receivables and operating leases are reported on Ford Credit's balance sheet and are available only for payment of the

debt issued by, and other obligations of, the securitization entities that are parties to those securitization transactions; they are not available to pay the other obligations of Ford

Credit or the claims of Ford Credit's other creditors

Unallocated other (as shown on the EBT By Segment chart)

Items excluded in assessing segment performance because they are managed at the corporate level, including market valuation a djustments to derivatives and exchange-rate

fluctuations on foreign currency-denominated transactions

Ford

46View entire presentation