Bausch+Lomb Investor Conference Presentation Deck

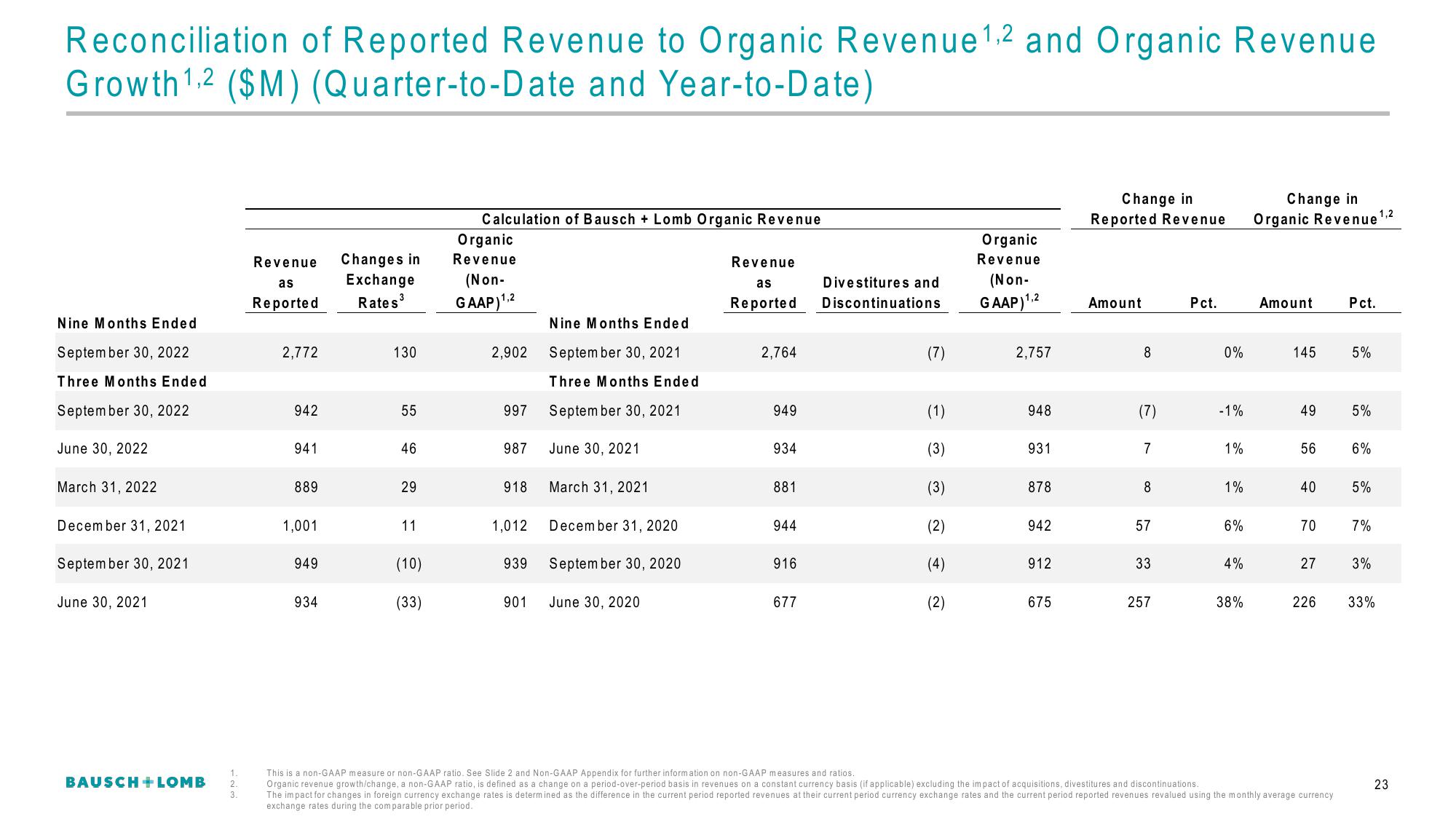

Reconciliation of Reported Revenue to Organic Revenue ¹,2 and Organic Revenue

Growth ¹,2 ($M) (Quarter-to-Date and Year-to-Date)

Nine Months Ended

September 30, 2022

Three Months Ended

September 30, 2022

June 30, 2022

March 31, 2022

December 31, 2021

September 30, 2021

June 30, 2021

BAUSCH + LOMB

1.

2.

3.

Revenue

as

Reported

2,772

942

941

889

1,001

949

934

Changes in

Exchange

Rates ³

130

55

46

29

11

(10)

(33)

Calculation of Bausch + Lomb Organic Revenue

Organic

Revenue

(Non-

GAAP)¹,2

2,902

997

987

Nine Months Ended

September 30, 2021

Three Months Ended

September 30, 2021

June 30, 2021

918 March 31, 2021

1,012 December 31, 2020

901

939 September 30, 2020

June 30, 2020

Revenue

as

Reported

2,764

949

934

881

944

916

677

Divestitures and

Discontinuations

(1)

(3)

(3)

(2)

(4)

(2)

Organic

Revenue

(Non-

GAAP) 1,2

2,757

948

931

878

942

912

675

Change in

Reported Revenue

Amount

8

(7)

7

8

57

33

257

Pct.

0%

-1%

1%

1%

6%

4%

38%

Change in

Organic Revenue ¹,2

Amount

145

49

56

40

70

27

Pct.

This is a non-GAAP measure or non-GAAP ratio. See Slide 2 and Non-GAAP Appendix for further information on non-GAAP measures and ratios.

Organic revenue growth/change, a non-GAAP ratio, is defined as a change on a period-over-period basis in revenues on a constant currency basis (if applicable) excluding the impact of acquisitions, divestitures and discontinuations.

The impact for changes in foreign currency exchange rates is determined as the difference in the current period reported revenues at their current period currency exchange rates and the current period reported revenues revalued using the monthly average currency

exchange rates during the comparable prior period.

5%

5%

6%

5%

7%

3%

226 33%

23View entire presentation