Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

PERFORMANCE

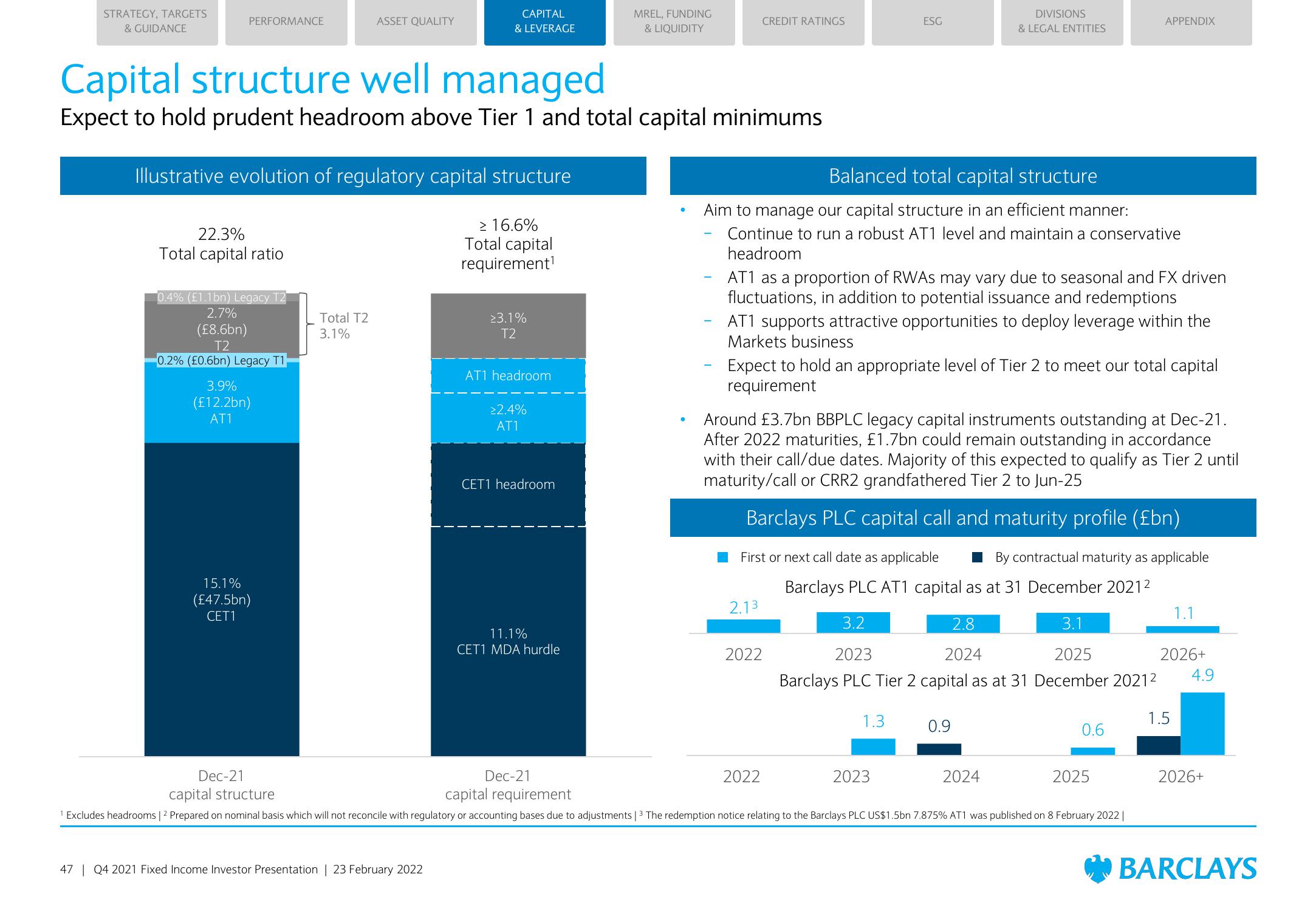

22.3%

Total capital ratio

0.4% (£1.1bn) Legacy T2

2.7%

(£8.6bn)

T2

0.2% (£0.6bn) Legacy T1

3.9%

(£12.2bn)

AT1

Capital structure well managed

Expect to hold prudent headroom above Tier 1 and total capital minimums

Illustrative evolution of regulatory capital structure

≥ 16.6%

Total capital

requirement¹

15.1%

(£47.5bn)

CET1

ASSET QUALITY

Total T2

3.1%

CAPITAL

& LEVERAGE

47 | Q4 2021 Fixed Income Investor Presentation | 23 February 2022

≥3.1%

T2

AT1 headroom

>2.4%

AT1

CET1 headroom

MREL, FUNDING

& LIQUIDITY

11.1%

CET1 MDA hurdle

CREDIT RATINGS

Balanced total capital structure

Aim to manage our capital structure in an efficient manner:

Continue to run a robust AT1 level and maintain a conservative

headroom

2.13

AT1 as a proportion of RWAs may vary due to seasonal and FX driven

fluctuations, in addition to potential issuance and redemptions

AT1 supports attractive opportunities to deploy leverage within the

Markets business

Expect to hold an appropriate level of Tier 2 to meet our total capital

requirement

2022

ESG

Around £3.7bn BBPLC legacy capital instruments outstanding at Dec-21.

After 2022 maturities, £1.7bn could remain outstanding in accordance

with their call/due dates. Majority of this expected to qualify as Tier 2 until

maturity/call or CRR2 grandfathered Tier 2 to Jun-25

Barclays PLC capital call and maturity profile (£bn)

2022

First or next call date as applicable

By contractual maturity as applicable

Barclays PLC AT1 capital as at 31 December 2021²

2.8

3.1

2024

2025

Barclays PLC Tier 2 capital as at 31 December 20212

3.2

2023

1.3

DIVISIONS

& LEGAL ENTITIES

2023

0.9

Dec-21

Dec-21

capital requirement

capital structure

¹ Excludes headrooms | 2 Prepared on nominal basis which will not reconcile with regulatory or accounting bases due to adjustments | 3 The redemption notice relating to the Barclays PLC US$1.5bn 7.875% AT1 was published on 8 February 2022 |

2024

APPENDIX

0.6

2025

1.1

2026+

4.9

1.5

2026+

BARCLAYSView entire presentation