BMO Capital Markets Investment Banking Pitch Book

BMO Capital Markets

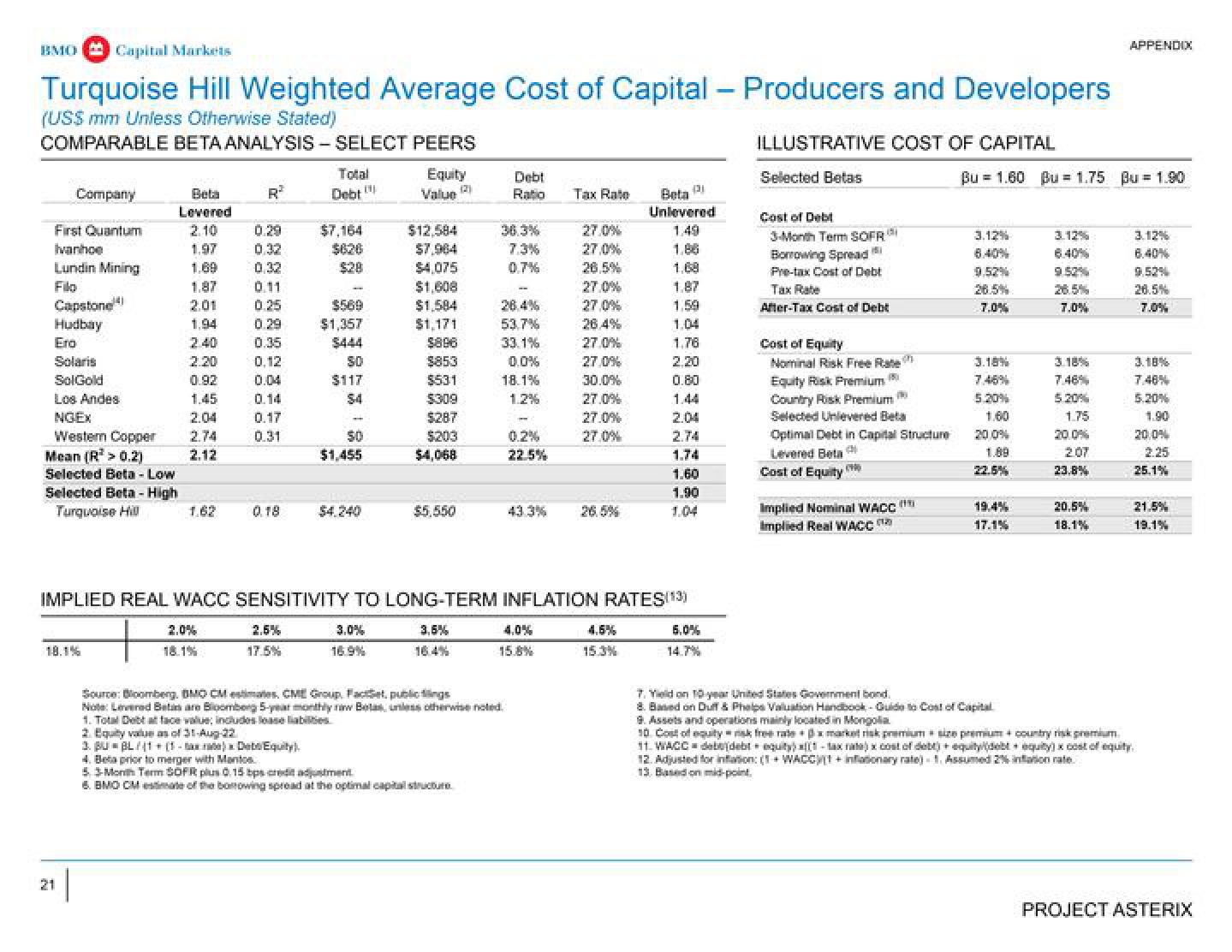

Turquoise Hill Weighted Average Cost of Capital - Producers and Developers

(USS mm Unless Otherwise Stated)

COMPARABLE BETA ANALYSIS SELECT PEERS

Company

First Quantum

Ivanhoe

Lundin Mining

Filo

Capstone

Hudbay

Ero

Solaris

SolGold

Los Andes

NGEX

Western Copper

Mean (R² > 0.2)

Selected Beta - Low

Selected Beta - High

Turquoise Hill

18.1%

21

Beta

Levered

2.10

1.97

1.69

1.87

2.01

1,94

2.40

2.20

0.92

1.45

2.04

2.12

1.62

R²

2.0%

18.1%

0.29

0.32

0.32

0.11

0.25

0.29

0.35

0.12

0.04

0.14

0.17

0.31

0.18

Total

Debt

2.5%

17.5%

$7,164

$626

$28

$569

$1,357

$117

$4

50

$1,455

$4.240

Equity

Value (2)

16.9%

$12,584

$7.964

$4,075

$1,608

$1,584

$1,171

$896

$853

$531

$309

$287

$203

$4,068

$5.550

Debt

Ratio

36.3%

7.3%

0.7%

26.4%

53.7%

33.1%

0.0%

18.1%

1.2%

0.2%

22.5%

Source: Bloomberg, BMO CM estimates, CME Group. Facet, publicis

Note: Levered Bets are Bloomberg 5-year monthly raw Botas, unless otherwise noted.

selbs

1. Total Debatface value; includes

2. Equity value as of 31-Aug-22

3. Bu=BL/(1+(1-x)Dete Equity

4. Bet prior to merger with Mantos

53-Month Term SOFR plus 0.15 bps credit adjustment

6. BMC CMate of the borrowing spread at the optimal capital structure

15.8%

Tax Rate

27.0%

27,0%

26,5%

IMPLIED REAL WACC SENSITIVITY TO LONG-TERM INFLATION RATES(13)

3.5%

27.0%

27,0%

26.4%

27.0%

27,0%

30.0%

27.0%

27.0%

27.0%

pi

Beta

Unlevered

4.6%

15.3%

1.86

1,68

1.87

1.59

1.04

1.76

2.20

0.80

1.44

2.04

2.74

1.74

1.60

1.90

1.04

5.0%

ILLUSTRATIVE COST OF CAPITAL

Selected Betas

Cost of Debt

3-Month Term SOFR

Borrowing Spread

Pre-tax Cost of Debt

Tax Rate

After-Tax Cost of Debt

Cost of Equity

Nominal Risk Free Rate

Equity Risk Premium

Country Risk Premium

Selected Unlevered Beta

Optimal Debt in Capital Structure

Levered Beta

Cost of Equity

Implied Nominal WACC

Implied Real WACC

Bu = 1.60 Bu = 1.75 Bu = 1.90

3.12%

6.40%

9.52%

7.0%

3.18%

7.46%

5.20%

1.60

20 0%

1.89

22.5%

17.1%

7. Yield on 10 year United States Government bond

8. Based on Duff & Phelps Valuation Handbook-Quide to Cost of Capital

3.12%

6.40%

9.52%

26.5%

7.0%

3.18%

7.46%

5.20%

1.75

20.0%

2.07

23.8%

APPENDIX

20.5%

18.1%

3.12%

9.52%

26.5%

3.18%

7.48%

5.20%

20,0%

2.25

25.1%

21.5%

19.1%

9. Assets and operations mainly located in Mongolia

10 Cost of equity nsk free ratexmarket risk premium size premium + country risk premium

11. WACC= debujdebt equity)(1-tax rata) x cost of debt)equity(debt equity) x cost of equity.

12. Adjusted for inflation: (+WACC)(1+inflationary rate) 1. Assumed 2% inflation rate.

13. Based on mid-point.

PROJECT ASTERIXView entire presentation