Credit Suisse Investment Banking Pitch Book

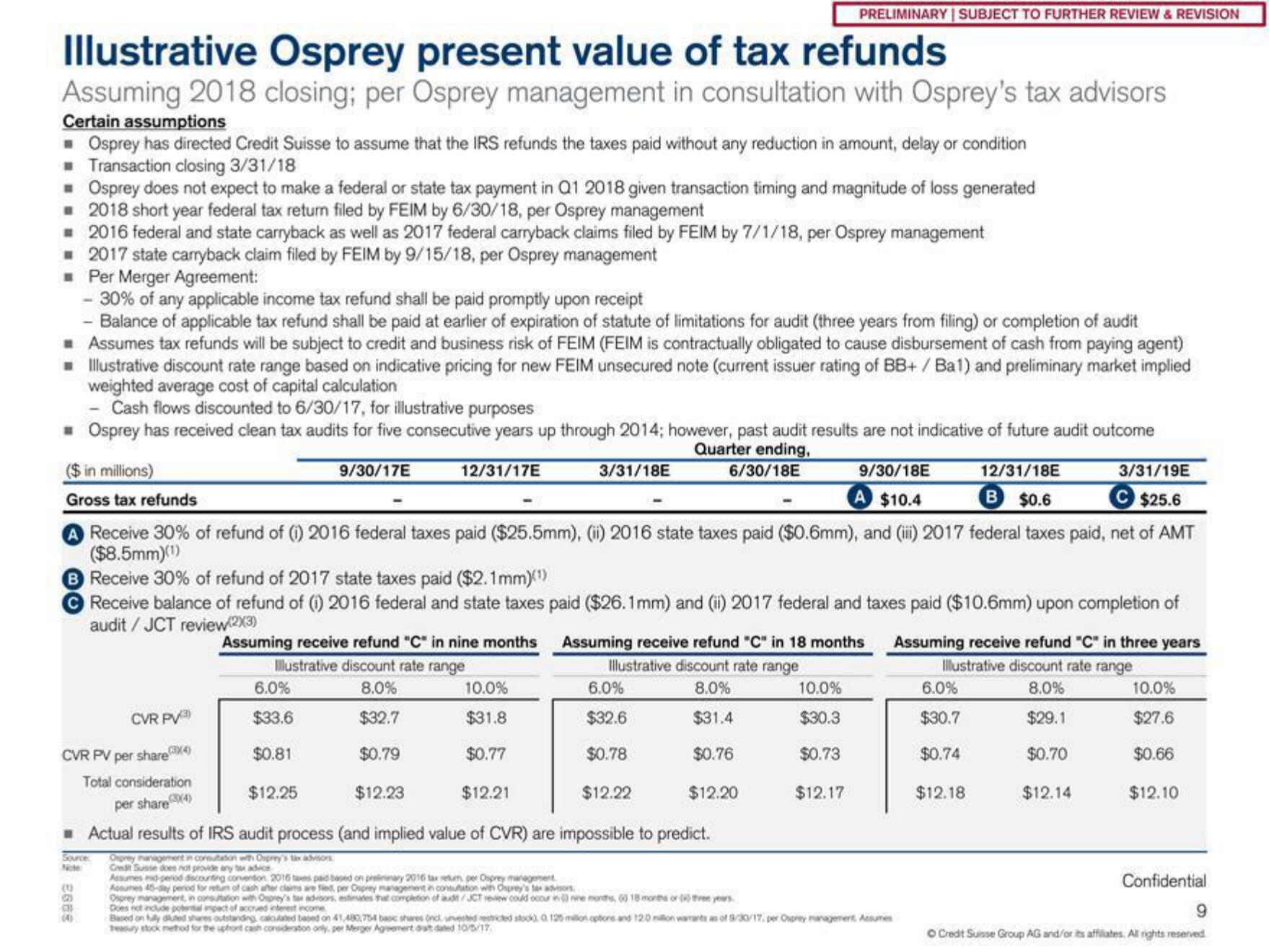

Illustrative Osprey present value of tax refunds

Assuming 2018 closing; per Osprey management in consultation with Osprey's tax advisors

Certain assumptions

■ Osprey has directed Credit Suisse to assume that the IRS refunds the taxes paid without any reduction in amount, delay or condition

■ Transaction closing 3/31/18

■ Osprey does not expect to make a federal or state tax payment in Q1 2018 given transaction timing and magnitude of loss generated

☐ 2018 short year federal tax return filed by FEIM by 6/30/18, per Osprey management

☐ 2016 federal and state carryback as well as 2017 federal carryback claims filed by FEIM by 7/1/18, per Osprey management

■ 2017 state carryback claim filed by FEIM by 9/15/18, per Osprey management

■ Per Merger Agreement:

- 30% of any applicable income tax refund shall be paid promptly upon receipt

- Balance of applicable tax refund shall be paid at earlier of expiration of statute of limitations for audit (three years from filing) or completion of audit

■ Assumes tax refunds will be subject to credit and business risk of FEIM (FEIM is contractually obligated to cause disbursement of cash from paying agent)

■ Illustrative discount rate range based on indicative pricing for new FEIM unsecured note (current issuer rating of BB+ / Ba1) and preliminary market implied

weighted average cost of capital calculation

- Cash flows discounted to 6/30/17, for illustrative purposes

■ Osprey has received clean tax audits for five consecutive years up through 2014; however, past audit results are not indicative of future audit outcome

($ in millions)

Quarter ending,

6/30/18E

9/30/17E

12/31/17E

3/31/18E

9/30/18E

A $10.4

12/31/18E

B $0.6

Gross tax refunds

A Receive 30% of refund of (1) 2016 federal taxes paid ($25.5mm), (ii) 2016 state taxes paid ($0.6mm), and (ii) 2017 federal taxes paid, net of AMT

($8.5mm)(¹)

CVR PV3)

CVR PV per share (3X4)

Total consideration

per shareX(4)

B Receive 30% of refund of 2017 state taxes paid ($2.1mm)(¹)

Receive balance of refund of (1) 2016 federal and state taxes paid ($26.1mm) and (ii) 2017 federal and taxes paid ($10.6mm) upon completion of

audit / JCT review(2X3)

Assuming receive refund "C" in nine months

Illustrative discount rate range

8.0%

$32.7

$0.79

2008

6.0%

$33.6

$0.81

$12.25

10.0%

$31.8

$0.77

$12.23

$12.22

■ Actual results of IRS audit process (and implied value of CVR) are impossible to predict.

Source Osprey management in consultation with Osprey's tax advisors

Credit Susse does not provide any tax advice

$12.21

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Assuming receive refund "C" in 18 months

Illustrative discount rate range

8.0%

$31.4

$0.76

6.0%

$32.6

$0.78

$12.20

Assumes mid-perod discounting convention 2016 taxes paid based on prelunary 2016 tax retum, per Osprey management

Assumes 45-day period for return of cash after claims are fied, per Osprey management in consultation with Osprey's tax advisors

Osprey management, in consultation with Osprey's tax advisors, estimates that completion of audit/JCT review could occur in nine months, 60 18 months or three years

Does not include potential impact of accrued interest income

10.0%

$30.3

$0.73

$12.17

Assuming receive refund "C" in three years

Illustrative discount rate range

8.0%

$29.1

$0.70

$12.14

Based on fully diluted shares outstanding, calculated based on 41,480,754 basic shares ont unvested restricted stock) 0.125 million options and 12.0 million warrants as of 9/30/17, per Osprey management Assumes

treasury stock method for the uptont cash consideration only, per Merger Agreement dat dated 10/5/17,

3/31/19E

$25.6

6.0%

$30.7

$0.74

$12.18

10.0%

$27.6

$0.66

$12.10

Confidential

9

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reservedView entire presentation