Clover Health Investor Presentation Deck

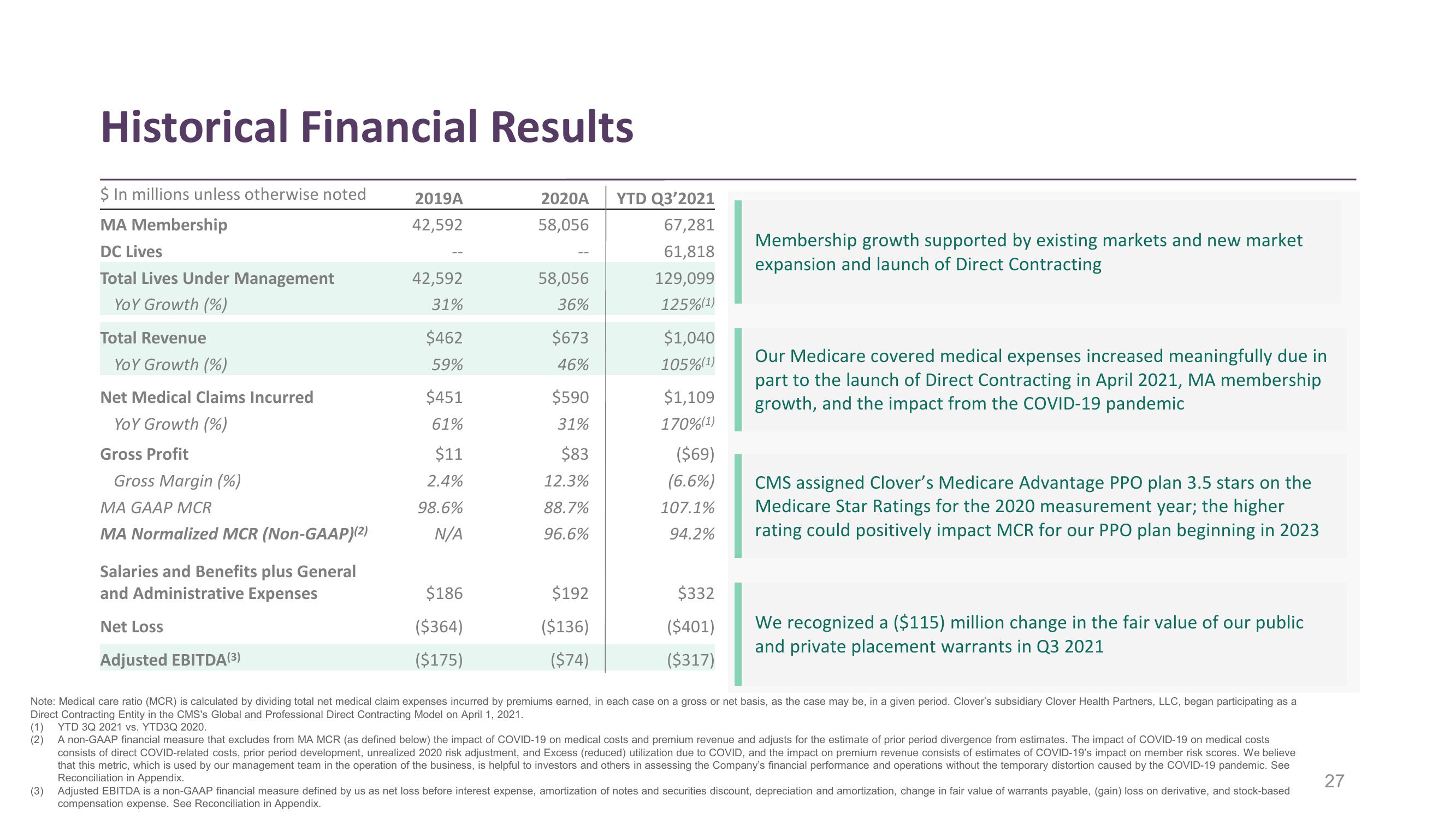

Historical Financial Results

(3)

$ In millions unless otherwise noted

MA Membership

DC Lives

Total Lives Under Management

YOY Growth (%)

Total Revenue

YOY Growth (%)

Net Medical Claims Incurred

YOY Growth (%)

Gross Profit

Gross Margin (%)

MA GAAP MCR

MA Normalized MCR (Non-GAAP)(2)

Salaries and Benefits plus General

and Administrative Expenses

Net Loss

Adjusted EBITDA(3)

2019A

42,592

42,592

31%

$462

59%

$451

61%

$11

2.4%

98.6%

N/A

$186

($364)

($175)

2020A YTD Q3'2021

58,056

67,281

1,818

129,099

125%(¹)

58,056

36%

$673

46%

$590

31%

$83

12.3%

88.7%

96.6%

$192

($136)

($74)

$1,040

105%(1)

$1,109

170%(1)

($69)

(6.6%)

107.1%

94.2%

$332

($401)

($317)

Membership growth supported by existing markets and new market

expansion and launch of Direct Contracting

Our Medicare covered medical expenses increased meaningfully due in

part to the launch of Direct Contracting in April 2021, MA membership

growth, and the impact from the COVID-19 pandemic

CMS assigned Clover's Medicare Advantage PPO plan 3.5 stars on the

Medicare Star Ratings for the 2020 measurement year; the higher

rating could positively impact MCR for our PPO plan beginning in 2023

We recognized a ($115) million change in the fair value of our public

and private placement warrants in Q3 2021

Note: Medical care ratio (MCR) is calculated dividing total net medical claim expenses incurred by premiums earned, in each case on a gross or net basis, as the case ma be, in a given period. Clover's subsidiary Clover Health Partners, LLC, began participating as a

Direct Contracting Entity in the CMS's Global and Professional Direct Contracting Model on April 1, 2021.

(1) YTD 3Q 2021 vs. YTD3Q 2020.

(2)

A non-GAAP financial measure that excludes from MA MCR (as defined below) the impact of COVID-19 on medical costs and premium revenue and adjusts for the estimate of prior period divergence from estimates. The impact of COVID-19 on medical costs

consists of direct COVID-related costs, prior period development, unrealized 2020 risk adjustment, and Excess (reduced) utilization due to COVID, and the impact on premium revenue consists of estimates of COVID-19's impact on member risk scores. We believe

that this metric, which is used by our management team in the operation of the business, is helpful to investors and others in assessing the Company's financial performance and operations without the temporary distortion caused by the COVID-19 pandemic. See

Reconciliation in Appendix.

Adjusted EBITDA is a non-GAAP financial measure defined by us as net loss before interest expense, amortization of notes and securities discount, depreciation and amortization, change in fair value of warrants payable, (gain) loss on derivative, and stock-based

compensation expense. See Reconciliation in Appendix.

27View entire presentation