Azek Investor Presentation Deck

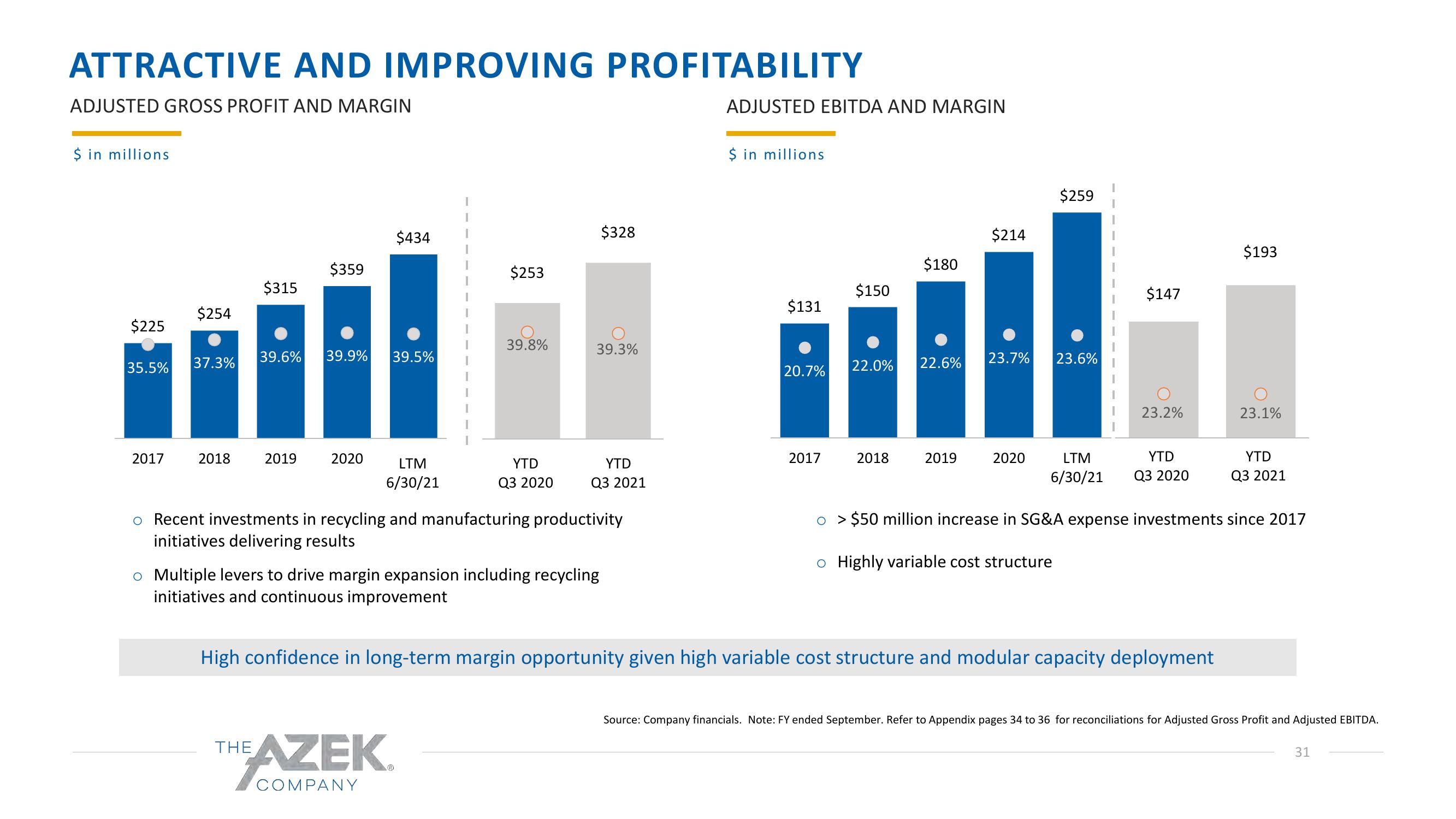

ATTRACTIVE AND IMPROVING PROFITABILITY

ADJUSTED GROSS PROFIT AND MARGIN

$ in millions

$225

35.5%

2017

$254

37.3%

2018

$315

$359

2019

39.6% 39.9% 39.5%

2020

$434

LTM

6/30/21

$253

39.8%

THE AZEK.

COMPANY

YTD

Q3 2020

$328

39.3%

YTD

Q3 2021

o Recent investments in recycling and manufacturing productivity

initiatives delivering results

o Multiple levers to drive margin expansion including recycling

initiatives and continuous improvement

ADJUSTED EBITDA AND MARGIN

$ in millions

$131

20.7%

2017

$150

22.0%

2018

$180

22.6%

2019

$214

23.7%

2020

$259

23.6%

LTM

6/30/21

$147

23.2%

YTD

Q3 2020

High confidence in long-term margin opportunity given high variable cost structure and modular capacity deployment

$193

23.1%

YTD

Q3 2021

> $50 million increase in SG&A expense investments since 2017

o Highly variable cost structure

Source: Company financials. Note: FY ended September. Refer to Appendix pages 34 to 36 for reconciliations for Adjusted Gross Profit and Adjusted EBITDA.

31View entire presentation