Melrose Results Presentation Deck

Pensions and tax

Melrose

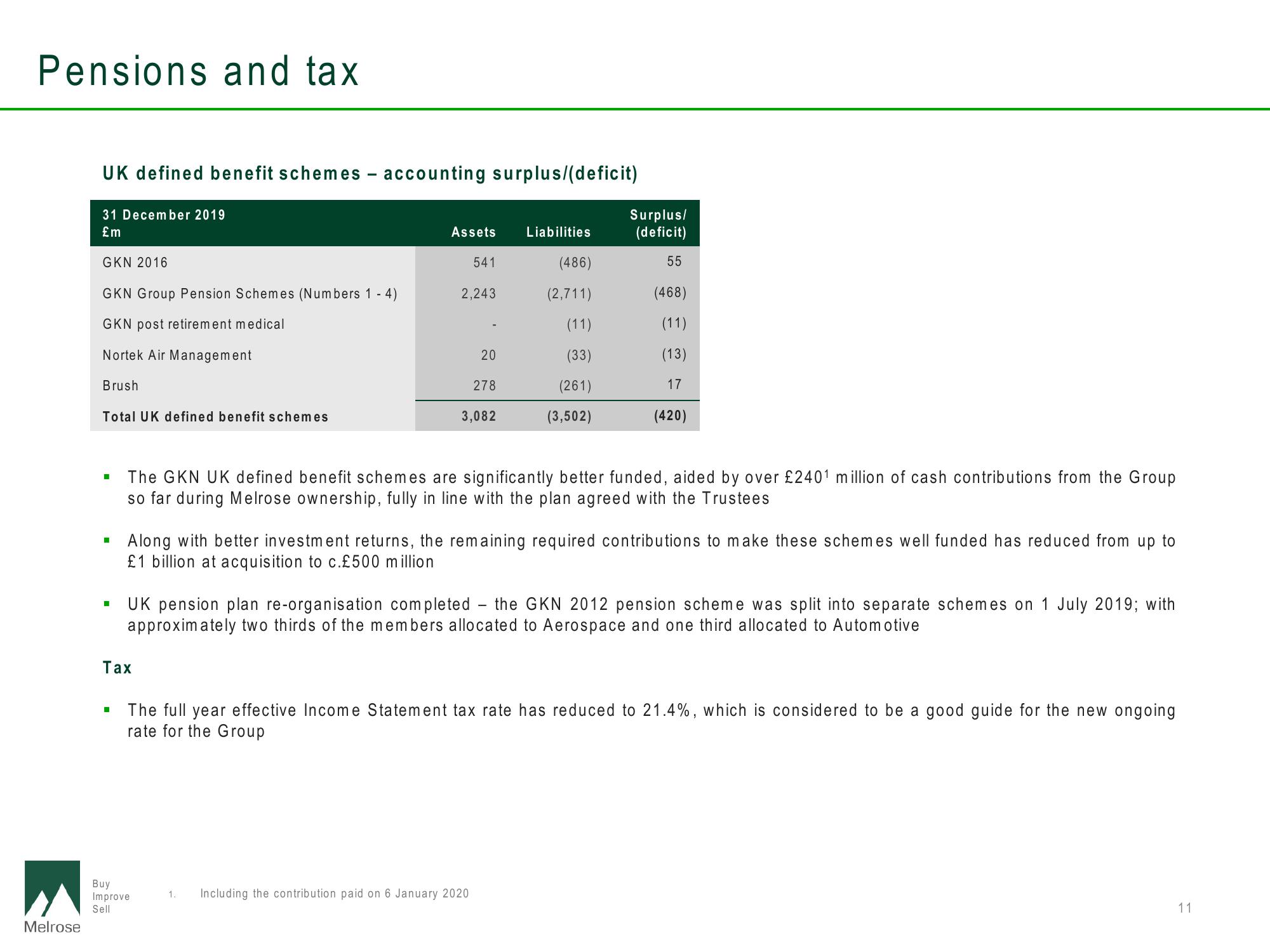

UK defined benefit schemes - accounting surplus/(deficit)

31 December 2019

£m

GKN 2016

GKN Group Pension Sche hes (Numbers 1 - 4)

GKN post retirement medical

Nortek Air Management

Brush

Total UK defined benefit schemes

I

■

I

Assets

Tax

541

2,243

20

Buy

Improve

Sell

278

3,082

Liabilities

(486)

(2,711)

(11)

(33)

(261)

(3,502)

1. Including the contribution paid on 6 January 2020

Surplus/

(deficit)

55

The GKN UK defined benefit schemes are significantly better funded, aided by over £240¹ million of cash contributions from the Group

so far during Melrose ownership, fully in line with the plan agreed with the Trustees

(468)

(11)

(13)

17

Along with better investment returns, the remaining required contributions to make these schemes well funded has reduced from up to

£1 billion at acquisition to c.£500 million

(420)

UK pension plan re-organisation completed the GKN 2012 pension scheme was split into separate schemes on 1 July 2019; with

approximately two thirds of the members allocated to Aerospace and one third allocated to Automotive

The full year effective Income Statement tax rate has reduced to 21.4%, which is considered to be a good guide for the new ongoing

rate for the Group

11View entire presentation