Markforged SPAC Presentation Deck

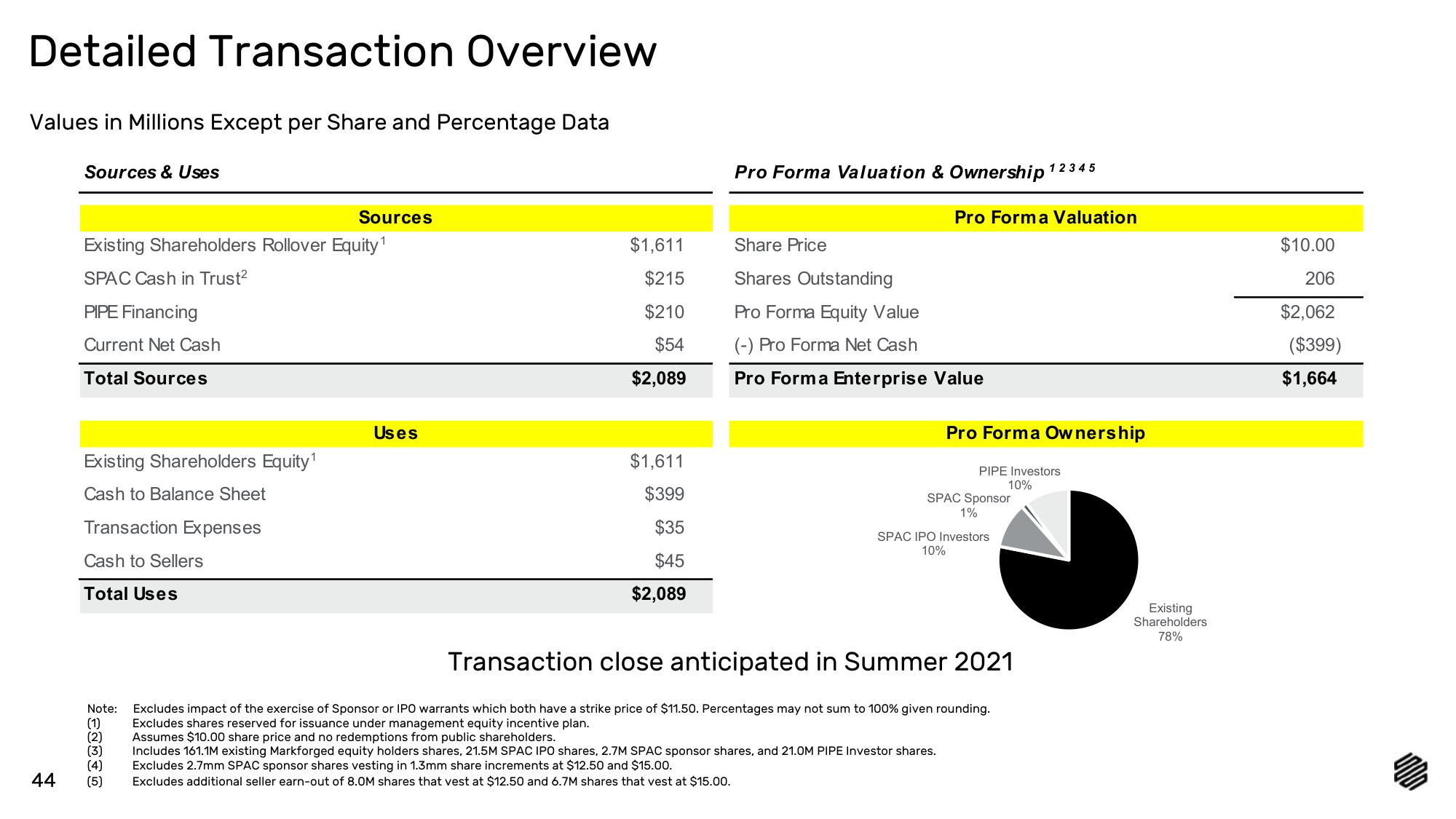

Detailed Transaction Overview

Values in Millions Except per Share and Percentage Data

44

Sources & Uses

Existing Shareholders Rollover Equity¹

SPAC Cash in Trust²

PIPE Financing

Current Net Cash

Total Sources

Existing Shareholders Equity¹

Cash to Balance Sheet

Transaction Expenses

Cash to Sellers

Total Uses

Sources

Note:

(1)

(2)

(3)

(4)

(5)

Us es

$1,611

$215

$210

$54

$2,089

$1,611

$399

$35

$45

$2,089

Pro Forma Valuation & Ownership 12345

Pro Forma Valuation

Share Price

Shares Outstanding

Pro Forma Equity Value

(-) Pro Forma Net Cash

Pro Forma Enterprise Value

Pro Forma Ownership

PIPE Investors

10%

SPAC Sponsor

1%

SPAC IPO Investors

10%

Transaction close anticipated in Summer 2021

Excludes impact of the exercise of Sponsor or IPO warrants which both have a strike price of $11.50. Percentages may not sum to 100% given rounding.

Excludes shares reserved for issuance under management equity incentive plan.

Assumes $10.00 share price and no redemptions from public shareholders.

Includes 161.1M existing Markforged equity holders shares, 21.5M SPAC IPO shares, 2.7M SPAC sponsor shares, and 21.0M PIPE Investor shares.

Excludes 2.7mm SPAC sponsor shares vesting in 1.3mm share increments at $12.50 and $15.00.

Excludes additional seller earn-out of 8.0M shares that vest at $12.50 and 6.7M shares that vest at $15.00.

Existing

Shareholders

789

$10.00

206

$2,062

($399)

$1,664View entire presentation