Blackwells Capital Activist Presentation Deck

BLACKWELLS OFFERED $3.8 BN FOR MONMOUTH REIT IN ALL CASH OFFER

Blackwells' Activism Practice Has Unique Ability to Take Companies Private

In December 2020, Blackwells offered to acquire Monmouth Real Estate Investment Corp (NYSE: MNR) in

a $3.8 billion transaction, representing a 22% premium to its unaffected share price on 12/01/20

•

●

●

●

Largest announced real estate transaction since COVID-19; second largest industrial real estate deal of the

last two years, second only to Colony's industrial portfolio $5.7 billion sale to Blackstone

MNR is an industrial REIT that has significantly underperformed its public peers over the last five years, has

a long history of poor corporate governance, and as structured is not appropriate for the public markets

Blackwells' cash offer provided shareholders immediate liquidity at a 17% premium above consensus net

asset value and the proposed price exceeds the unaffected 1-month, 3-month, and 6-month VWAPs by

19.3%, 23.8%, and 24.8%, respectively

MNR acquisition is part of Blackwells' industrial real estate consolidation strategy to build a 100mm square

feet industrial real estate platform over the next few years, which would be one of the top five platforms in

North America

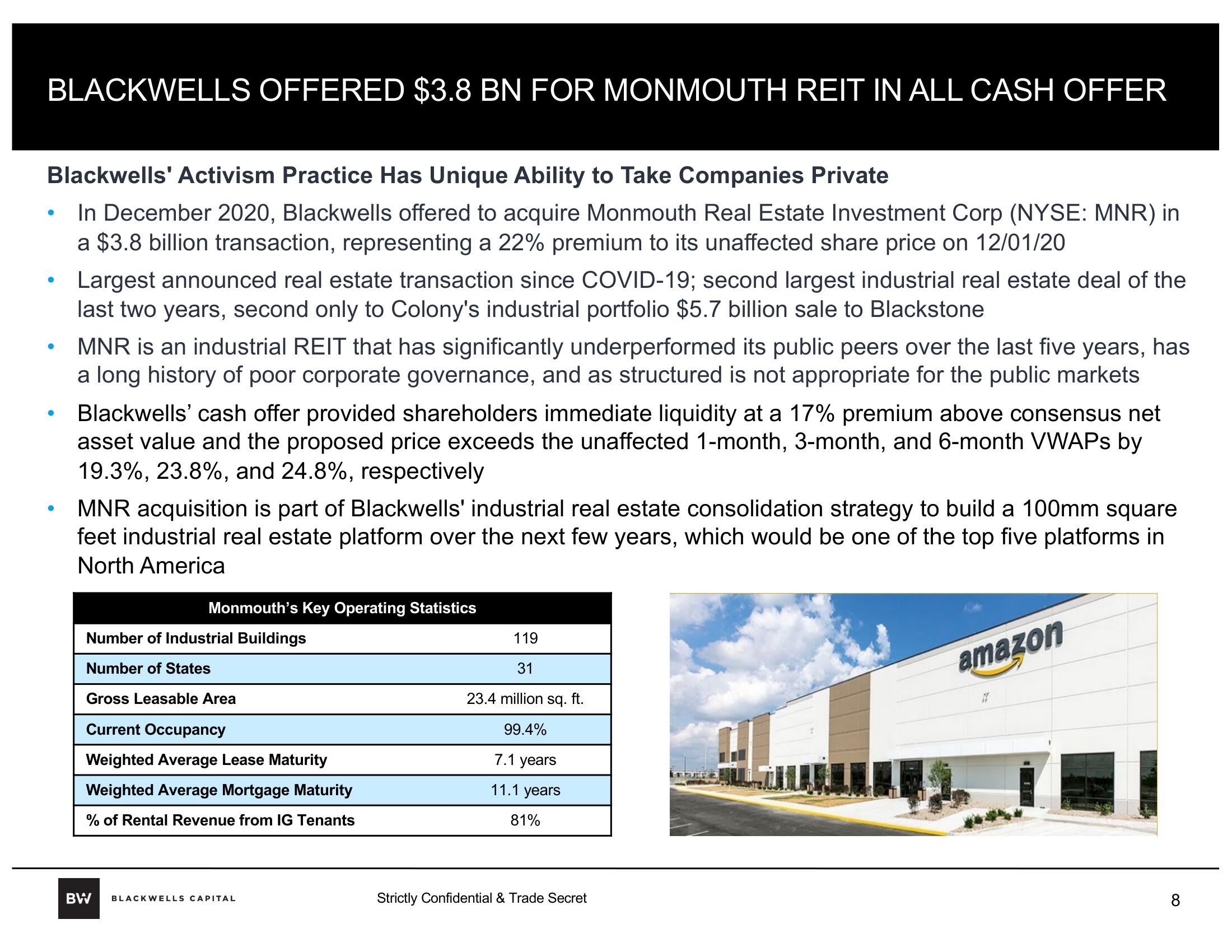

Monmouth's Key Operating Statistics

Number of Industrial Buildings

Number of States

Gross Leasable Area

Current Occupancy

Weighted Average Lease Maturity

Weighted Average Mortgage Maturity

% of Rental Revenue from IG Tenants

BW

BLACKWELLS CAPITAL

119

31

23.4 million sq. ft.

99.4%

7.1 years

11.1 years

81%

Strictly Confidential & Trade Secret

amazon

#

8View entire presentation