Trian Partners Activist Presentation Deck

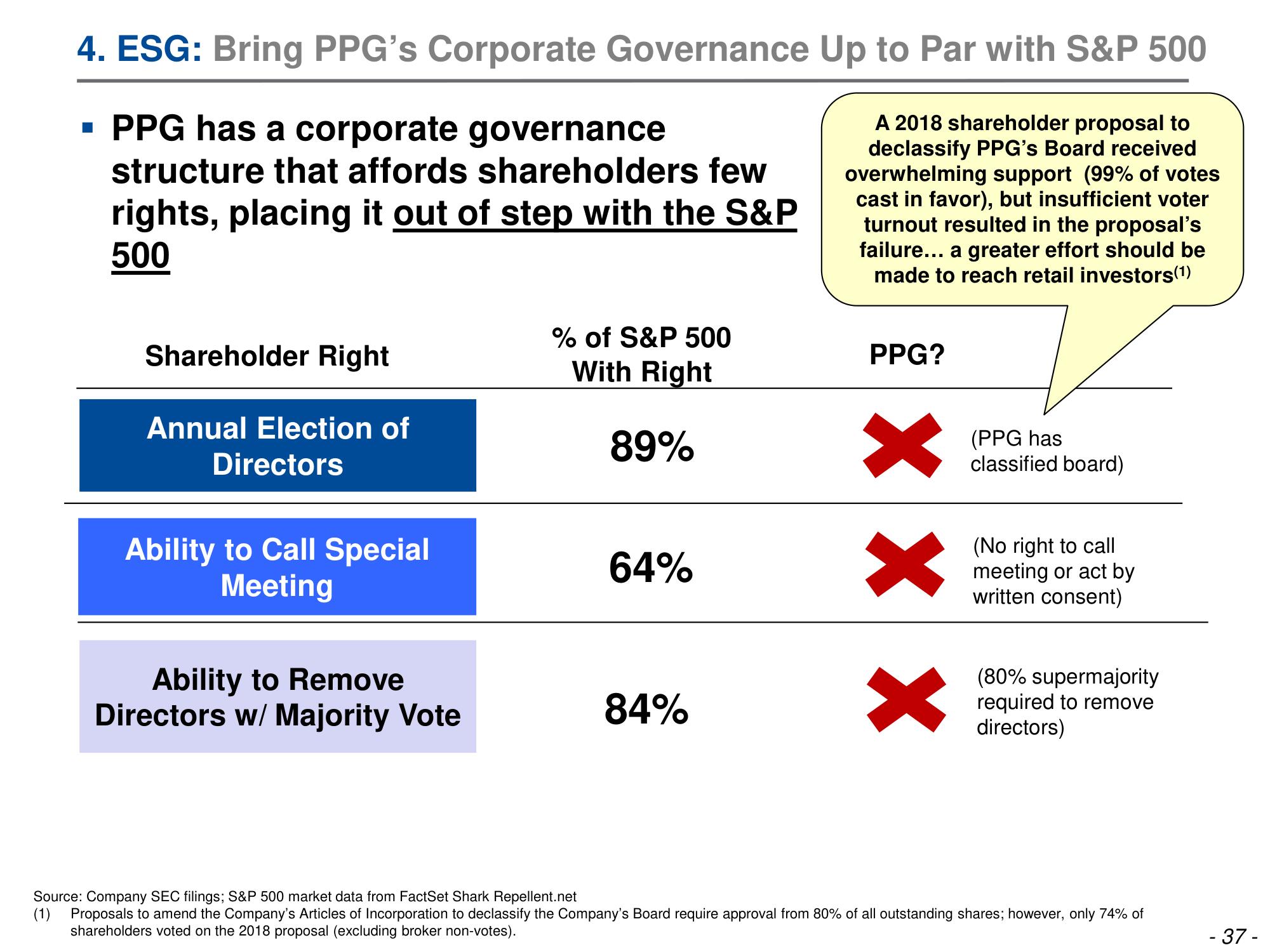

4. ESG: Bring PPG's Corporate Governance Up to Par with S&P 500

I

▪ PPG has a corporate governance

structure that affords shareholders few

rights, placing it out of step with the S&P

500

A 2018 shareholder proposal to

declassify PPG's Board received

overwhelming support (99% of votes

cast in favor), but insufficient voter

turnout resulted in the proposal's

failure... a greater effort should be

made to reach retail investors (1)

Shareholder Right

Annual Election of

Directors

Ability to Call Special

Meeting

Ability to Remove

Directors w/Majority Vote

% of S&P 500

With Right

89%

64%

84%

PPG?

×

X

(PPG has

classified board)

(No right to call

meeting or act by

written consent)

(80% supermajority

required to remove

directors)

Source: Company SEC filings; S&P 500 market data from FactSet Shark Repellent.net

(1) Proposals to amend the Company's Articles of Incorporation to declassify the Company's Board require approval from 80% of all outstanding shares; however, only 74% of

shareholders voted on the 2018 proposal (excluding broker non-votes).

- 37 -View entire presentation