Azerion Results Presentation Deck

Financial update

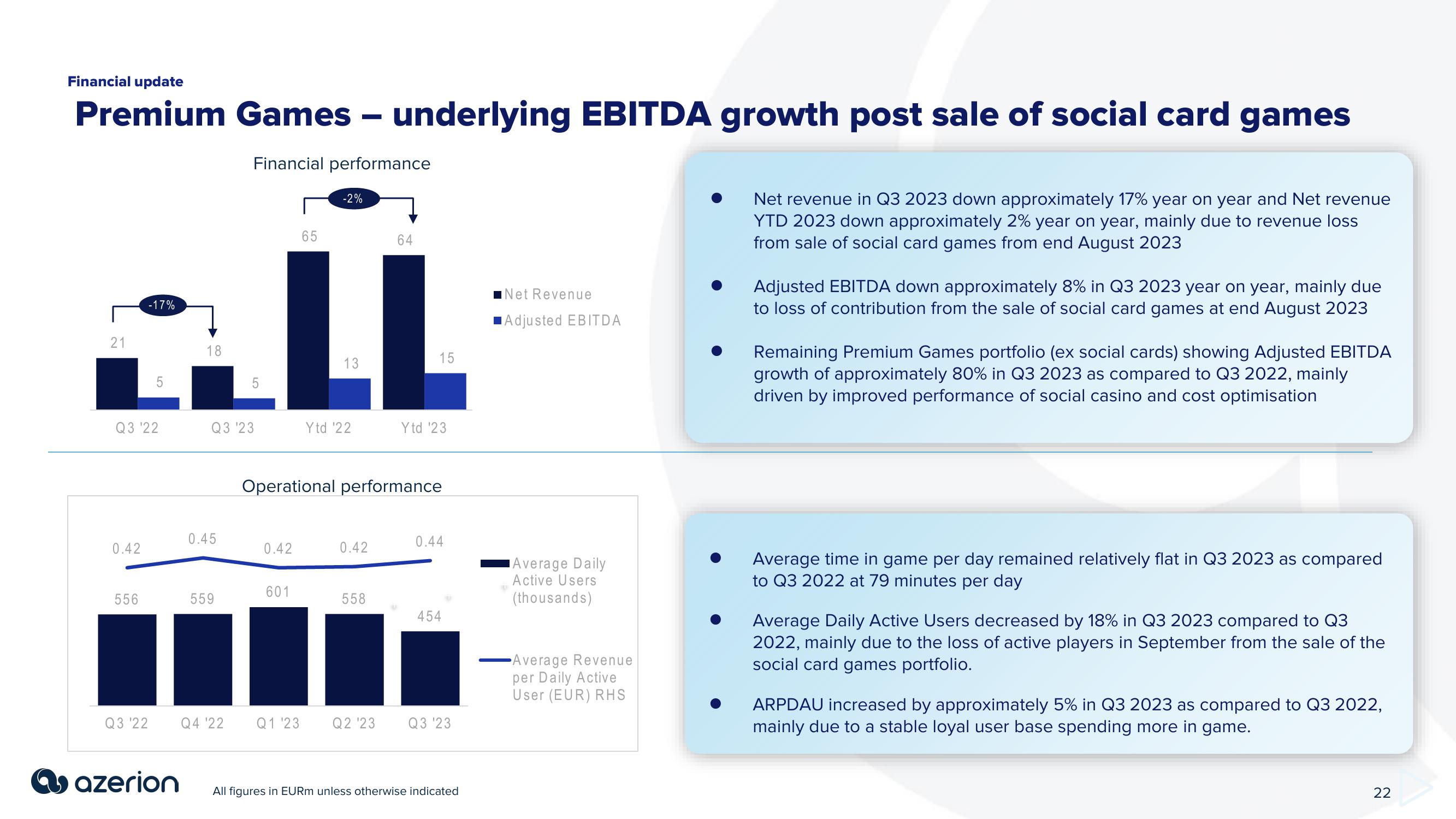

Premium Games underlying EBITDA growth post sale of social card games

Financial performance

65

all

LL

18

15

13

5

21

0.42

-17%

Q3 '22

556

5

Q3 '22

azerion

Q3 '23

0.45

559

-2%

0.42

601

Ytd ¹22

Operational performance

0.42

64

558

Ytd '23

0.44

454

Q4 '22 Q1 '23 Q2 '23 Q3 '23

All figures in EURm unless otherwise indicated

Net Revenue

Adjusted EBITDA

Average Daily

Active Users

(thousands)

Average Revenue

per Daily Active

User (EUR) RHS

Net revenue in Q3 2023 down approximately 17% year on year and Net revenue

YTD 2023 down approximately 2% year on year, mainly due to revenue loss

from sale of social card games from end August 2023

Adjusted EBITDA down approximately 8% in Q3 2023 year on year, mainly due

to loss of contribution from the sale of social card games at end August 2023

Remaining Premium Games portfolio (ex social cards) showing Adjusted EBITDA

growth of approximately 80% in Q3 2023 as compared to Q3 2022, mainly

driven by improved performance of social casino and cost optimisation

Average time in game per day remained relatively flat in Q3 2023 as compared

to Q3 2022 at 79 minutes per day

Average Daily Active Users decreased by 18% in Q3 2023 compared to Q3

2022, mainly due to the loss of active players in September from the sale of the

social card games portfolio.

ARPDAU increased by approximately 5% in Q3 2023 as compared to Q3 2022,

mainly due to a stable loyal user base spending more in game.

22View entire presentation