Oatly Results Presentation Deck

Sales

volume(1)

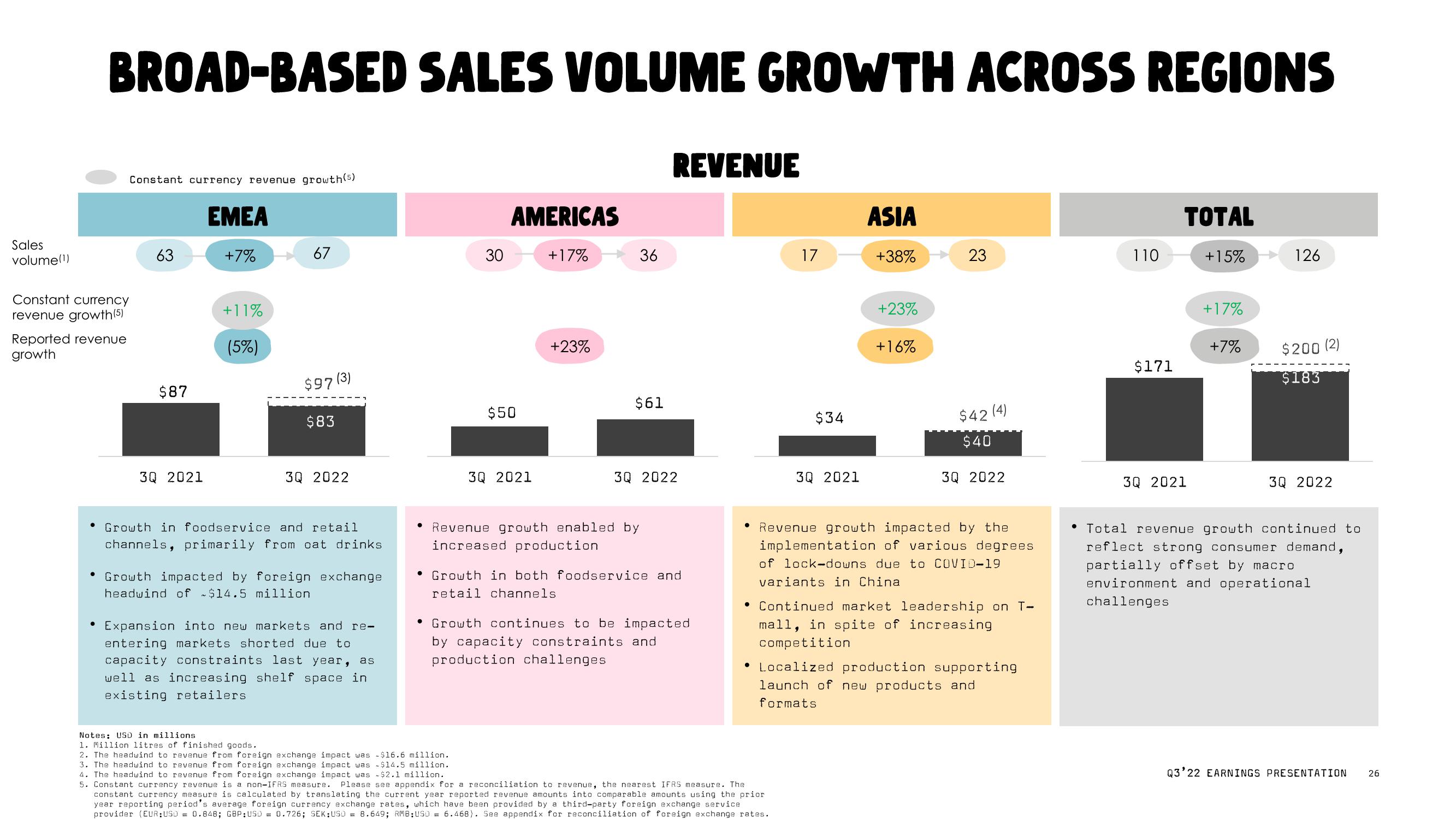

BROAD-BASED SALES VOLUME GROWTH ACROSS REGIONS

Constant currency

revenue growth (5)

Reported revenue

growth

Constant currency revenue growth (5)

●

63

$87

3Q 2021

EMEA

+7%

+11%

(5%)

67

$97

$83

2022

• Growth in foodservice and retail

channels, primarily from oat drinks

• Growth impacted by foreign exchange

headwind of $14.5 million

Expansion into new markets and re-

entering markets shorted due to

capacity constraints last year, as

well as increasing shelf space in

existing retailers.

30

AMERICAS

+17%

$50

3Q 2021

$16.6 million.

$14.5 million.

$2.1 million.

+23%

36

$61

• Revenue growth enabled by

increased production

REVENUE

30 022

Growth in both foodservice and

retail channels

Growth continues to be impacted

by capacity constraints and

production challenges

17

$34

Notes: USD in millions.

1. Million litres of finished goods.

2. The headwind to revenue from foreign exchange impact was

3. The headwind to revenue from foreign exchange impact was

4. The headwind to revenue from foreign exchange impact was

5. Constant currency revenue is a non-IFRS measure. Please see appendix for a reconciliation to revenue, the nearest IFRS measure. The

constant currency measure is calculated by translating the current year reported revenue amounts into comparable amounts using the prior

year reporting period's average foreign currency exchange rates, which have been provided by a third-party foreign exchange service

provider (EUR:USD = 0.848; GBP:USD = 0.726; SEK:USD = 8.649; RMB:USD = 6.468). See appendix for reconciliation of foreign exchange rates.

2021

ASIA

+38%

+23%

+16%

23

$42 (4)

$40

2022

• Revenue growth impacted by the

implementation of various degrees.

of lock-downs due to COVID-19

variants in China

Continued market leadership on T-

mall, in spite of increasing

competition

Localized production supporting

launch of new products and

formats

110

$171

TOTAL

3Q 2021

+15%

+17%

+7%

126

$200 (2)

$183

3Q 2022

Total revenue growth continued to

reflect strong consumer demand,

partially offset by macro

environment and operational

challenges

Q3'22 EARNINGS PRESENTATION

26View entire presentation