Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

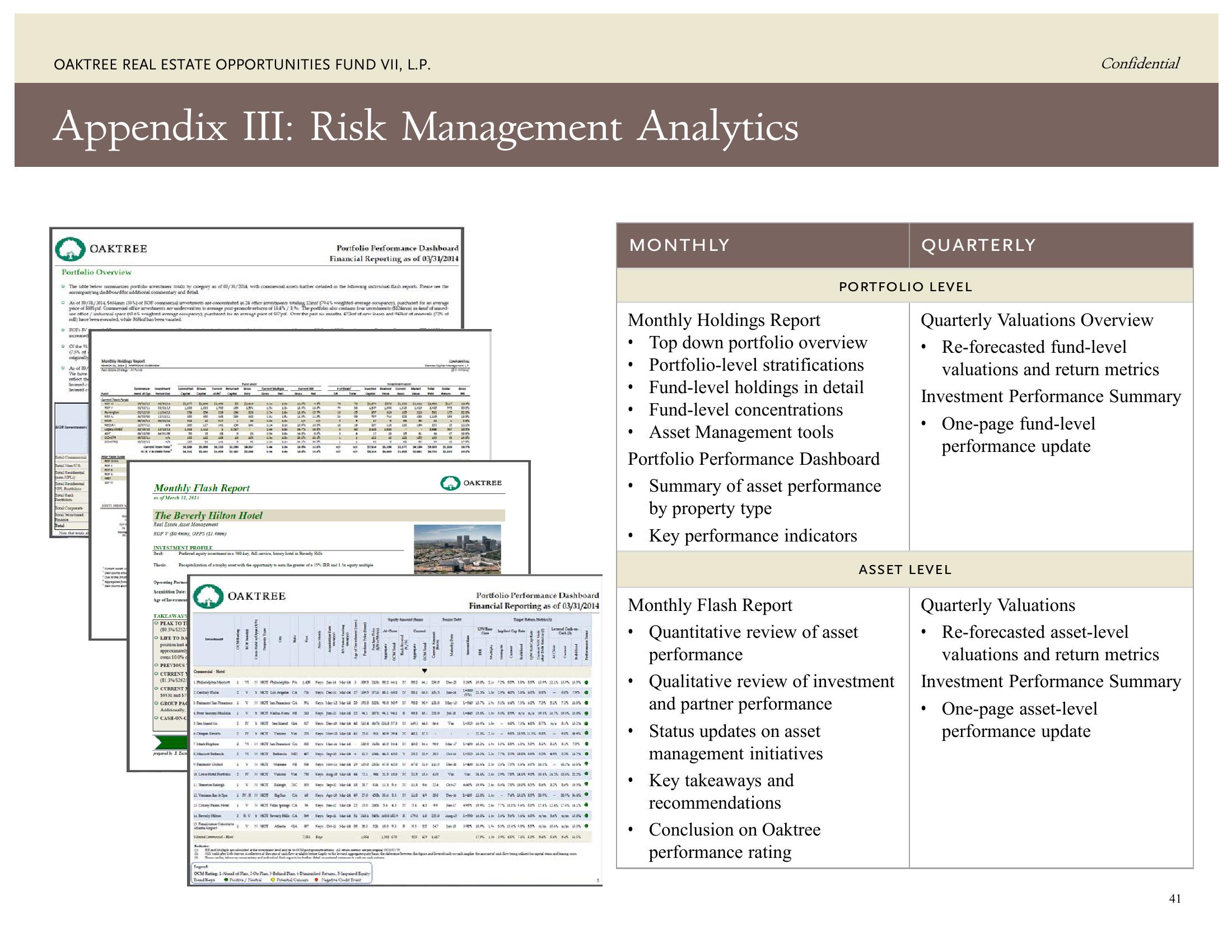

Appendix III: Risk Management Analytics

Portfolio Overview

The table belowe oumeares portolio imestan tods by category as of 08/31/2014 with commence Burther detailed in the following individual flash reports. Pese new the

agam ng da Board for addonal commentary and fetal

POP IV

increased

3/31/2014 $834 (33% ROE sad wetent se concentrated in 24 office est touting 1 794% wwighted-average socupancy's purchased for an average

price al Conservial office amestments ar sideration to evage post promote return of 14/1% The portfolio also contains for its($eren) in dans of wisd

c/ual space fetes, weighed average socuparey purchased to an age pace pt. Over the past six m47nases and of 2% af

dll) have been led, while Jolf has been vasted

23% 0

originally

Hotel

09/

The Dune

WEAT TH

Severed c

leverede

mts

Total Nimes US

Total Real

Total Redena

Potab

Toutebes

Total Comp

total d

OAKTREE

Now this s

Jak

Holding

Regio

Debel

NOW A

My

Da

Due to

"Appretac

Innov

Deadly

www

S

www.

Ever

www

04/04/

wa

www

345-15

HAL

50

ANT

Tom Brodu

Opre

Deal

LI

Theis

238

HE

LHE

Chad

14.0 31

INVESTMENT PROFILE

54

and

Operating Partner

Acquisition Date:

Age of Investmen

A

TAKEAWAYS

PEAK TO T

(80.3%/$252/

LIFE TO DA

position had a

approximately

owns 100%

O PREVIOUS

CURRENT

(81.3% /$262/

M

prepared by B. Earn

F

238

L

1

3318

some S

Monthly Flash Report

as of Merch 31, 2014

The Beverly Hilton Hotel

Real Estate Asset Management

ROF V ($0.4mm), OPPS ($1.4mm)

basket

C-Mod

±cetury Vice

Lad

4 Berly Hi

+40 4.9

14

380

Spe

CH

1

D

1380

cases-

Findi

S

H

7487

CHE

Mug

AM

938 IS

150 14

1.5

UK

***

d

PA

O CURRENT:

CA

$9532 and $7

O GROUP PAC FTV HOT CA 20

Addisonally,

4. Sunt NOT-10 30

O CASH-ON-C

300

w

ada

Ta

Legend

OCM Rating: -dan 2-0

Tod Key ⒸP/N

IM

10

1

14

L

OAKTREE

19 HOT PA

1 VHOT LA

140

Prefered equity investment in a 560.key, full-service, luxury hotel in Bowly Hills

Recapitalization of a trophy asset with the opportunity to earn the greater of a 15% IRR and 1.5m equity multiple

wa

A

with

MA 11.5

Un 115

UA

ILA

IN

ar

SA

BA 202

MOS

un

wa

VIHKOT MD

Vas

HOC ME

H

IN HOT

IVN HOT Fing ORC

VHOT CA

AV THOTH CA

X

C

2010th

IN

IA

16

Portfolio Performance Dashboard

Financial Reporting as of 03/31/2014

33

Tale

LUM

Joke Kaye

F

.

114

3

Mel

4

MY

A

4

STRIA

LAT LAH

PU

H KM-14 30 30

G

LA

PUM

LA

M-34 22 41 30877961061

Jak w

Here

1-Beland Fan+Diled Reta Standa

ⒸPCⒸ Ngaling na

5

1

TH SLAAT June

"

20

Hey

Spy Ap

HUTT F

LOUS AT

N/W

KAM-1421 e

N

Sep 14 37

CIT

***********

175 M 13 30

Inda Ham

11.3.₂ N

C

Del M1425093 605

201

Tote

de in

DM123 2004, 84.3 4.2 y IN 20 3003

45

1422 33 34 3

i kish

35 103 0.3 2

H

AN

135

Ca

ALO

2 wo at m

Am SUR

42208480300 Mard 1-5 15.7% 14 325 45 13% 60% 735 345 705 JUN

0348 238.00-18

DAS HA 4110

123 98224

Mw Sem

BURK

30

85 549

47

V

de

Va

BAN

DEM

on

MY

282Y

Oct-0

www

WITH

OAKTREE

Portfolio Performance Dashboard

Financial Reporting as of 03/31/2014

N

Com

TNS

Song Cg

1345 126 125 124 125

E

12% 4% 10% 805005015 7850

Cal d

13.01 3.35 1983/8/4147525

- in

4005 2.2

- 1-08 120% Lm

100% 100% 15 wan

-

175 185 ton dan kan a

1-30 18:34 13 % 33% GLON CON SIN A DIN 147%

Va NAK 14: 2P% 70% 81% 0% 20.45 14.25 -184

a win

% 70% 80% 85% 8% 325 335

1905 226 77

- Selasa

- 745-2825 335 305 - 31

@

nen an ē

356

1914 IN CONNA 1944 24

17% KEN TAN 42% 945 505 845 PS

yang

MONTHLY

Monthly Holdings Report

Top down portfolio overview

Portfolio-level stratifications

●

●

Asset Management tools

Portfolio Performance Dashboard

●

●

●

●

●

Monthly Flash Report

Quantitative review of asset

performance

Qualitative review of investment

and partner performance

Status updates on asset

management initiatives

●

Fund-level holdings in detail

Fund-level concentrations

●

PORTFOLIO LEVEL

Summary of asset performance

by property type

Key performance indicators

Key takeaways and

recommendations

Conclusion on Oaktree

performance rating

QUARTERLY

Quarterly Valuations Overview

Re-forecasted fund-level

valuations and return metrics

●

Investment Performance Summary

One-page fund-level

performance update

●

ASSET LEVEL

Quarterly Valuations

Confidential

●

●

Re-forecasted asset-level

valuations and return metrics

Investment Performance Summary

One-page asset-level

performance update

41View entire presentation